(Continuation of problem 1) Assuming 0.5 common stock, 0.4 debt, and 0.1 preferred stock, the after-tax WACC of the firm is ____________________. A zero-tax investor holding the proportion of securities given in (a) would earn ___________________

(Continuation of problem 1) Assuming 0.5 common stock, 0.4 debt, and 0.1 preferred stock, the after-tax WACC of the firm is ____________________. A zero-tax investor holding the proportion of securities given in (a) would earn ___________________

Chapter8: Budgets And Bank Reconciliations

Section: Chapter Questions

Problem 3.3C

Related questions

Question

chapter 9 #2

- (Continuation of problem 1)

- Assuming 0.5 common stock, 0.4 debt, and 0.1

preferred stock , the after-tax WACC of the firm is ____________________. - A zero-tax investor holding the proportion of securities given in (a) would earn ____________________.

- Assuming 0.5 common stock, 0.4 debt, and 0.1

Transcribed Image Text:A Week 5 Assignment

A. Bookshelf - The Capital Budgetin X

d VitalSource Bookshelf: The Capita X

b My Questions | bartleby

A online.vitalsource.com/#/books/9781135656232/cfi/6/34!/4/274@0:77.2

amounts of debt compared to common stock.

Finally, if we consider personal taxes as well as corporate taxes, we are led to conclude that the optimum amount of debt is not clearly defined.

There are tax advantages to common stock (tax deferral and capital gains) that may outweigh the advantages to the corporation of the tax

deductibility of interest. But, remember, a different investor group (clientele) may be buying the debt.

Business managers quite properly want to know how different capital structures affect the cost of obtaining capital to reduce the cost of using the

firm's present capital or to reduce the cost to the firm of obtaining new capital. Although some managers may also want to use the weighted average

cost of capital as the discount rate (the hurdle rate) in evaluating all investments, we are not enthusiastic about this usage. If the risk of the asset

being considered is different from the risk of the firm's other assets, or if the timing of the cash flows is different, using the one risk-adjusted

discount rate (the cost of capital) to evaluate all of the firm's investments is not likely to lead to correct decisions.

A <9. The Cost of Capita...

Go to 9. The Cost of Capital and

Capital Structure

A constant WACC (no taxes)

A constant value

Levering a firm

Problems

Таxes

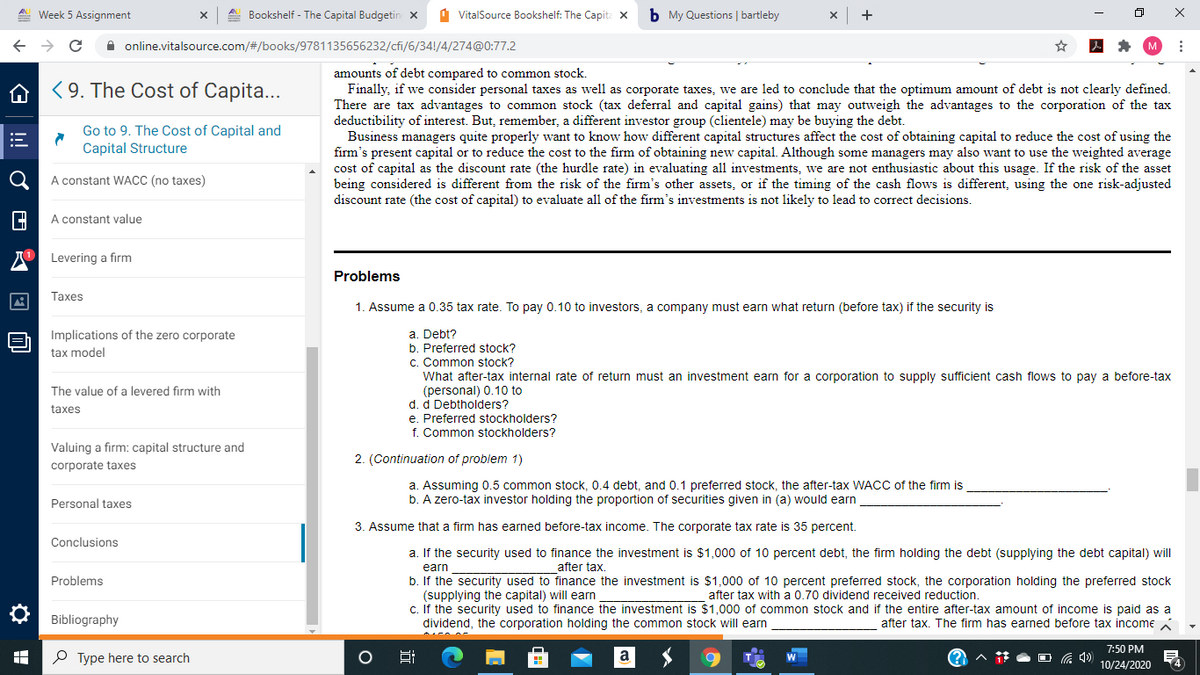

1. Assume a 0.35 tax rate. To pay 0.10 to investors, a company must earn what return (before tax) if the security is

a. Debt?

b. Preferred stock?

c. Common stock?

What after-tax internal rate of return must an investment earn for a corporation to supply sufficient cash flows to pay a before-tax

(personal) 0.10 to

d. d Debtholders?

Preferred stockholders?

f. Common stockholders?

Implications of the zero corporate

tax model

The value of a levered firm with

taxes

Valuing a firm: capital structure and

2. (Continuation of problem 1)

corporate taxes

a. Assuming 0.5 common stock, 0.4 debt, and 0.1 preferred stock, the after-tax WACC of the firm is

b. A zero-tax investor holding the proportion of securities given in (a) would earn

Personal taxes

3. Assume that a firm has earned before-tax income. The corporate tax rate is 35 percent.

Conclusions

a. If the security used to finance the investment is $1,000 of 10 percent debt, the firm holding the debt (supplying the debt capital) will

earn

b. If the security used to finance the investment is $1,000 of 10 percent preferred stock, the corporation holding the preferred stock

(supplying the capital) will earn

c. If the security used to finance the investment is $1,000 of common stock and if the entire after-tax amount of income is paid as a

dividend, the corporation holding the common stock will earn

after tax.

Problems

after tax with a 0.70 dividend received reduction.

Bibliography

after tax. The firm has earned before tax income a

7:50 PM

P Type here to search

Hi

10/24/2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning