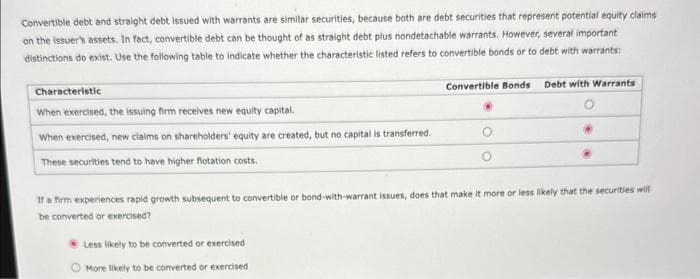

Convertible debt and straight debt issued with warrants are similar securities, because both are debt securities that represent potential equity claims on the issuer's assets. In fact, convertible debt can be thought of as straight debt plus nondetachable warrants. However, several important distinctions do exist. Use the following table to indicate whether the characteristic listed refers to convertible bonds or to debt with warrants: Characteristic When exercised, the issuing firm receives new equity capital. When exercised, new claims on shareholders' equity are created, but no capital is transferred. These securities tend to have higher flotation costs. Convertible Bonds Debt with Warrants If a firm experiences rapid growth subsequent to convertible or bond-with-warrant issues, does that make it more or less likely that the securities will be converted or exercised? Less likely to be converted or exercised More likely to be converted or exercised

Convertible debt and straight debt issued with warrants are similar securities, because both are debt securities that represent potential equity claims on the issuer's assets. In fact, convertible debt can be thought of as straight debt plus nondetachable warrants. However, several important distinctions do exist. Use the following table to indicate whether the characteristic listed refers to convertible bonds or to debt with warrants: Characteristic When exercised, the issuing firm receives new equity capital. When exercised, new claims on shareholders' equity are created, but no capital is transferred. These securities tend to have higher flotation costs. Convertible Bonds Debt with Warrants If a firm experiences rapid growth subsequent to convertible or bond-with-warrant issues, does that make it more or less likely that the securities will be converted or exercised? Less likely to be converted or exercised More likely to be converted or exercised

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 3BIC

Related questions

Question

Transcribed Image Text:Convertible debt and straight debt issued with warrants are similar securities, because both are debt securities that represent potential equity claims

on the issuer's assets. In fact, convertible debt can be thought of as straight debt plus nondetachable warrants. However, several important

distinctions do exist. Use the following table to indicate whether the characteristic listed refers to convertible bonds or to debt with warrants:

Characteristic

When exercised, the issuing firm receives new equity capital.

When exercised, new claims on shareholders' equity are created, but no capital is transferred.

These securities tend to have higher flotation costs.

Convertible Bonds Debt with Warrants

If a firm experiences rapid growth subsequent to convertible or bond-with-warrant issues, does that make it more or less likely that the securities will

be converted or exercised?

Less likely to be converted or exercised

O More likely to

be converted or exercised

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning