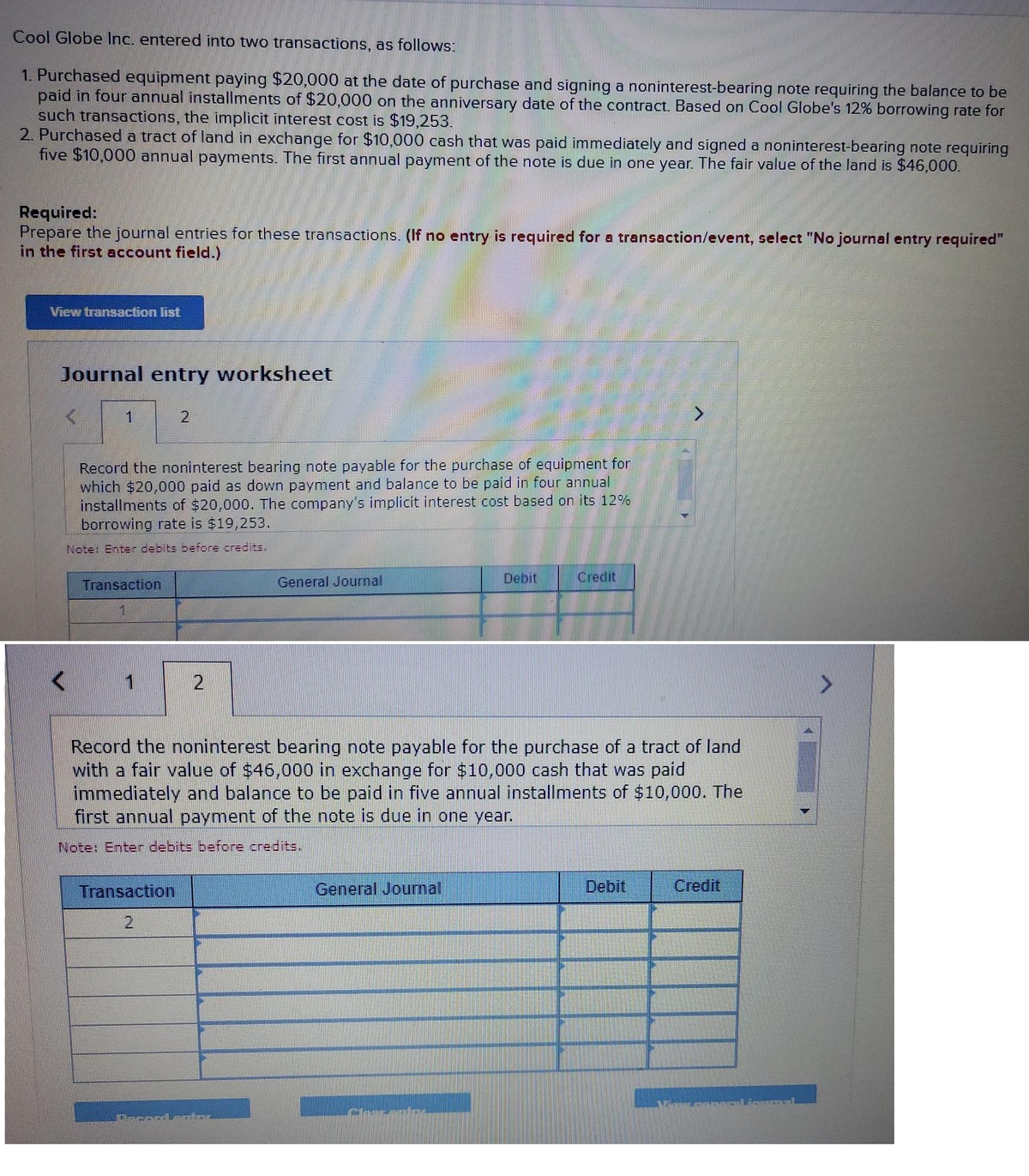

Cool Globe Inc. entered into two transactions, as follows: 1. Purchased equipment paying $20,000 at the date of purchase and signing a noninterest-bearing note requiring the balance to be paid in four annual installments of $20,000 on the anniversary date of the contract. Based on Cool Globe's 12% borrowing rate for such transactions, the implicit interest cost is $19,253. 2. Purchased a tract of land in exchange for $10,000 cash that was paid immediately and signed a noninterest-bearing note requiring five $10,000 annual payments. The first annual payment of the note is due in one year. The fair value of the land is $46,000. Required: Prepare the journal entries for these transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Cool Globe Inc. entered into two transactions, as follows: 1. Purchased equipment paying $20,000 at the date of purchase and signing a noninterest-bearing note requiring the balance to be paid in four annual installments of $20,000 on the anniversary date of the contract. Based on Cool Globe's 12% borrowing rate for such transactions, the implicit interest cost is $19,253. 2. Purchased a tract of land in exchange for $10,000 cash that was paid immediately and signed a noninterest-bearing note requiring five $10,000 annual payments. The first annual payment of the note is due in one year. The fair value of the land is $46,000. Required: Prepare the journal entries for these transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 6E: Fixed asset purchases with note On June 30, Collins Management Company purchased land for 400,000...

Related questions

Question

Transcribed Image Text:Cool Globe Inc. entered into two transactions, as follows:

1. Purchased equipment paying $20,000 at the date of purchase and signing a noninterest-bearing note requiring the balance to be

paid in four annual installments of $20,000 on the anniversary date of the contract. Based on Cool Globe's 12% borrowing rate for

such transactions, the implicit interest cost is $19,253.

2. Purchased a tract of land in exchange for $10,000 cash that was paid immediately and signed a noninterest-bearing note requiring

five $10,000 annual payments. The first annual payment of the note is due in one year. The fair value of the land is $46,000.

Required:

Prepare the journal entries for these transactions. (If no entry is required for a transaction/event, select "No journal entry required"

in the first account field.)

View transaction list

Journal entry worksheet

2.

Record the noninterest bearing note payable for the purchase of equipment for

which $20,000 paid as down payment and balance to be paid in four annual

installments of $20,000. The company's implicit interest cost based on its 12%

borrowing rate is $19,253.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

Record the noninterest bearing note payable for the purchase of a tract of land

with a fair value of $46,000 in exchange for $10,000 cash that was paid

immediately and balance to be paid in five annual installments of $10,000. The

first annual payment of the note is due in one year.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College