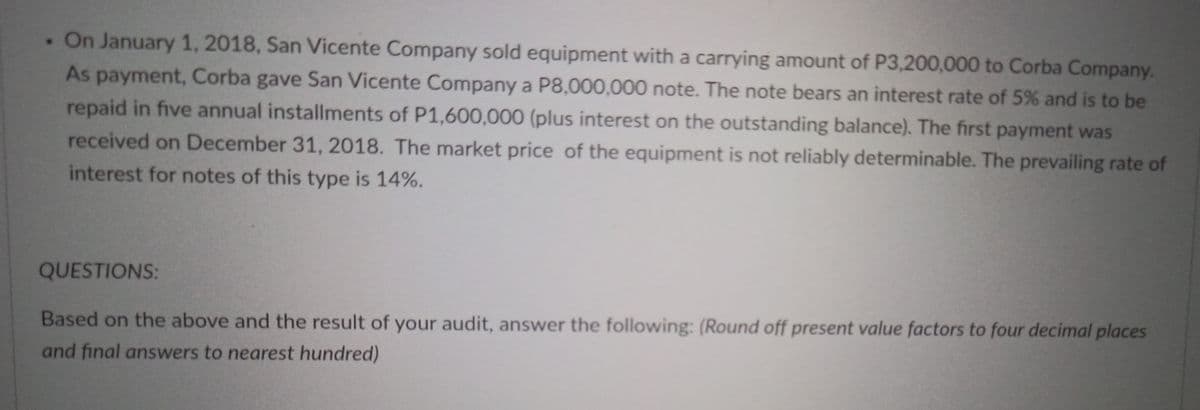

• On January 1, 2018, San Vicente Company sold equipment with a carrying amount of P3,200,000 to Corba Company. As payment, Corba gave San Vicente Company a P8,000,000 note. The note bears an interest rate of 5% and is to be repaid in five annual installments of P1,600,000 (plus interest on the outstanding balance). The first payment was received on December 31, 2018. The market price of the equipment is not reliably determinable. The prevailing rate of interest for notes of this type is 14%.

• On January 1, 2018, San Vicente Company sold equipment with a carrying amount of P3,200,000 to Corba Company. As payment, Corba gave San Vicente Company a P8,000,000 note. The note bears an interest rate of 5% and is to be repaid in five annual installments of P1,600,000 (plus interest on the outstanding balance). The first payment was received on December 31, 2018. The market price of the equipment is not reliably determinable. The prevailing rate of interest for notes of this type is 14%.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 15P: Comprehensive Receivables Problem Blackmon Corporations December 31, 2018, balance sheet disclosed...

Related questions

Question

The current portion of long-term notes receivable as of December 31, 2018 is

Transcribed Image Text:. On January 1, 2018, San Vicente Company sold equipment with a carrying amount of P3,200,000 to Corba Company.

As payment, Corba gave San Vicente Company a P8,000,000 note. The note bears an interest rate of 5% and is to be

repaid in five annual installments of P1,600,000 (plus interest on the outstanding balance). The first payment was

received on December 31, 2018. The market price of the equipment is not reliably determinable. The prevailing rate of

interest for notes of this type is 14%.

QUESTIONS:

Based on the above and the result of your audit, answer the following: (Round off present value factors to four decimal places

and final answers to nearest hundred)

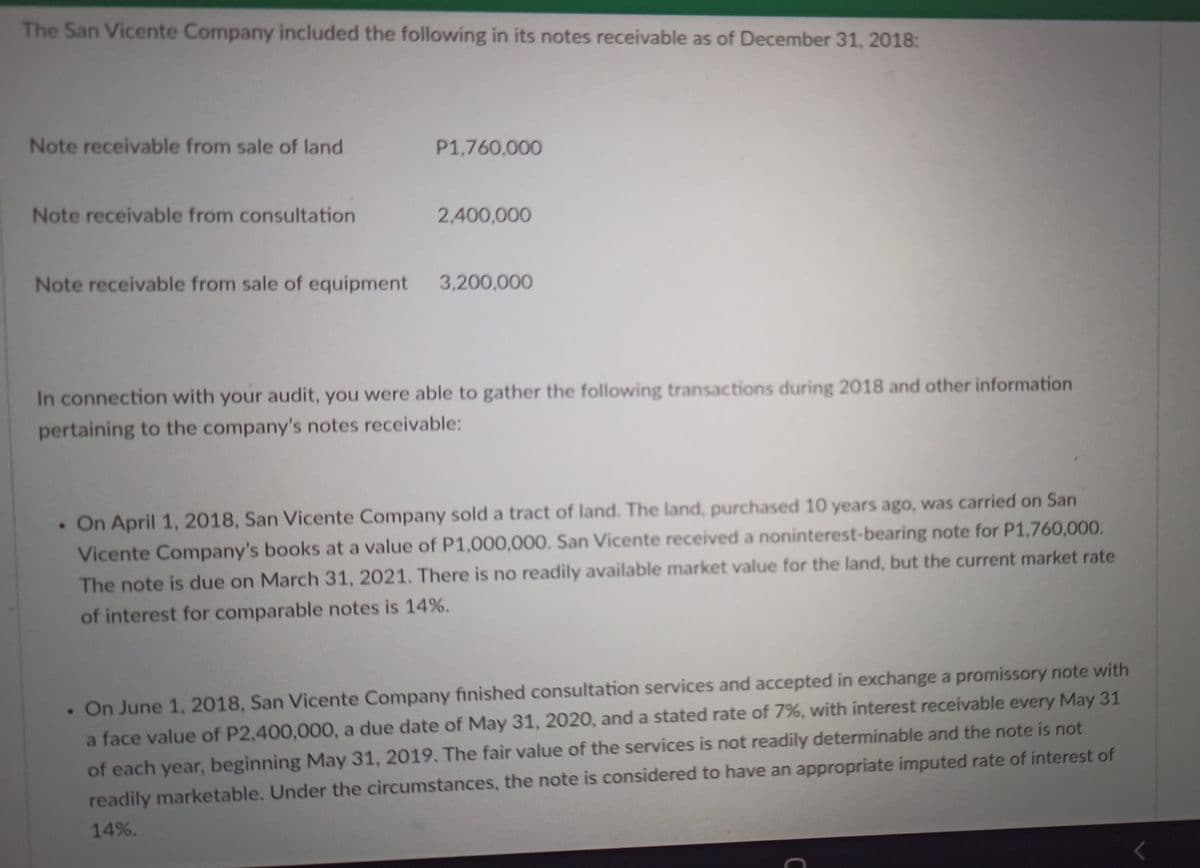

Transcribed Image Text:The San Vicente Company included the following in its notes receivable as of December 31, 2018:

Note receivable from sale of land

P1,760,000

Note receivable from consultation

2,400,000

Note receivable from sale of equipment

3,200,000

In connection with your audit, you were able to gather the following transactions during 2018 and other information

pertaining to the company's notes receivable:

• On April 1, 2018, San Vicente Company sold a tract of land. The land, purchased 10 years ago, was carried on San

Vicente Company's books at a value of P1,000,000. San Vicente received a noninterest-bearing note for P1,760,000.

The note is due on March 31, 2021. There is no readily available market value for the land, but the current market rate

of interest for comparable notes is 14%.

• On June 1, 2018, San Vicente Company finished consultation services and accepted in exchange a promissory note with

a face value of P2,400,000, a due date of May 31, 2020, and a stated rate of 7%, with interest receivable every May 31

of each year, beginning May 31, 2019. The fair value of the services is not readily determinable and the note is not

readily marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of interest of

14%.

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,