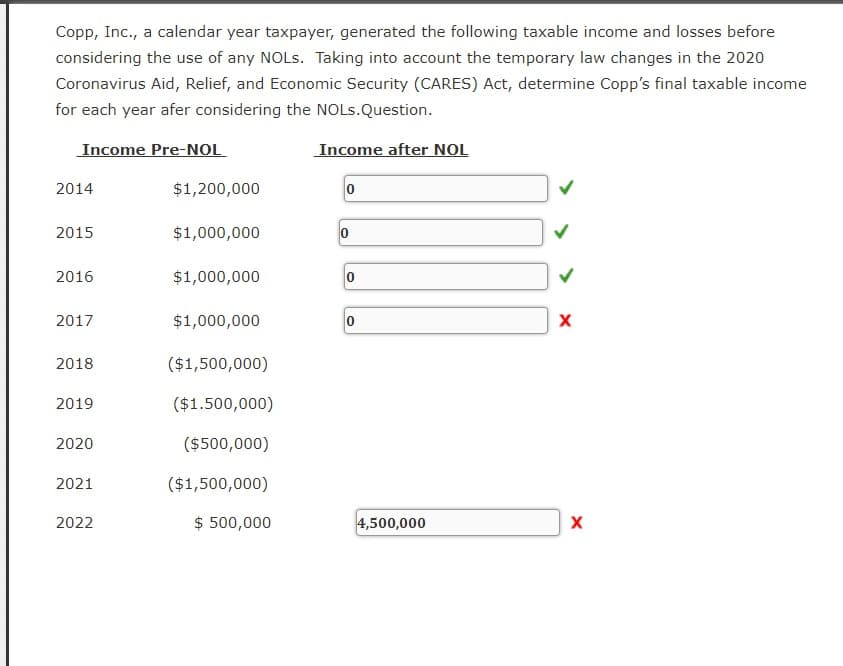

Copp, Inc., a calendar year taxpayer, generated the following taxable income and losses before considering the use of any NOLs. Taking into account the temporary law changes in the 2020 Coronavirus Aid, Relief, and Economic Security (CARES) Act, determine Copp's final taxable income for each year afer considering the NOLS.Question. Income Pre-NOL 2014 2015 2016 2017 2018 2019 2020 2021 2022 $1,200,000 $1,000,000 $1,000,000 $1,000,000 ($1,500,000) ($1.500,000) ($500,000) ($1,500,000) $ 500,000 Income after NOL 0 0 0 0 4,500,000 X X

Copp, Inc., a calendar year taxpayer, generated the following taxable income and losses before considering the use of any NOLs. Taking into account the temporary law changes in the 2020 Coronavirus Aid, Relief, and Economic Security (CARES) Act, determine Copp's final taxable income for each year afer considering the NOLS.Question. Income Pre-NOL 2014 2015 2016 2017 2018 2019 2020 2021 2022 $1,200,000 $1,000,000 $1,000,000 $1,000,000 ($1,500,000) ($1.500,000) ($500,000) ($1,500,000) $ 500,000 Income after NOL 0 0 0 0 4,500,000 X X

Chapter3: Tax Formula And Tax Determination : An Overview Of Property Transactions

Section: Chapter Questions

Problem 49P: During 2019, Inez (a single taxpayer) had the following transactions involving capital assets: a. If...

Related questions

Question

Dog

Transcribed Image Text:Copp, Inc., a calendar year taxpayer, generated the following taxable income and losses before

considering the use of any NOLs. Taking into account the temporary law changes in the 2020

Coronavirus Aid, Relief, and Economic Security (CARES) Act, determine Copp's final taxable income

for each year afer considering the NOLs.Question.

Income Pre-NOL

2014

2015

2016

2017

2018

2019

2020

2021

2022

$1,200,000

$1,000,000

$1,000,000

$1,000,000

($1,500,000)

($1.500,000)

($500,000)

($1,500,000)

$ 500,000

Income after NOL

0

0

0

0

4,500,000

X

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT