Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 31CE

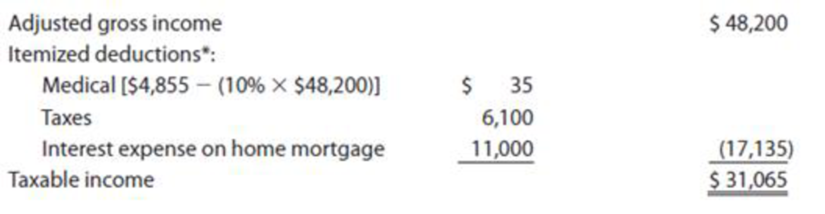

Emily, who is single, sustains an NOL of $7,800 in 2019. The loss is carried forward to 2020. For 2020, Emily’s income tax information before taking into account the 2019 NOL is as follows:

*The 2019 single standard deduction is $12,200; Emily’s itemized deductions will exceed the 2020 single standard deduction (after adjustment for Inflation). The medical expense AGI floor is 10% In 2019.

How much of the NOL carryforward can Emily use in 2020, and what is her adjusted gross income and her taxable income?

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 7 Solutions

Individual Income Taxes

Ch. 7 - Prob. 1DQCh. 7 - Prob. 2DQCh. 7 - Prob. 3DQCh. 7 - Prob. 4DQCh. 7 - Many years ago, Jack purchased 400shares of Canary...Ch. 7 - Scan is in the business of buying and selling...Ch. 7 - Prob. 7DQCh. 7 - Prob. 8DQCh. 7 - Prob. 9DQCh. 7 - Prob. 10DQ

Ch. 7 - Prob. 11DQCh. 7 - Prob. 12DQCh. 7 - Prob. 13DQCh. 7 - Prob. 14DQCh. 7 - Prob. 15DQCh. 7 - Prob. 16DQCh. 7 - Prob. 17DQCh. 7 - Prob. 18DQCh. 7 - Prob. 19DQCh. 7 - Prob. 20DQCh. 7 - Last year Aleshia identified 15,000 as a...Ch. 7 - Prob. 22CECh. 7 - Prob. 23CECh. 7 - Prob. 24CECh. 7 - Prob. 25CECh. 7 - Belinda was involved in a boating accident in...Ch. 7 - Prob. 27CECh. 7 - Prob. 28CECh. 7 - Prob. 29CECh. 7 - Phillis and Trey are married and file a joint tax...Ch. 7 - Emily, who is single, sustains an NOL of 7,800 in...Ch. 7 - Prob. 32PCh. 7 - Monty loaned his friend Ned 20,000 three years...Ch. 7 - Sally is in the business of purchasing accounts...Ch. 7 - Prob. 35PCh. 7 - Prob. 36PCh. 7 - Olaf lives in the state of Minnesota. In 2019, a...Ch. 7 - Prob. 38PCh. 7 - On July 24 of the current year, Sam Smith was...Ch. 7 - Prob. 40PCh. 7 - During 2019, Leisel, a single taxpayer, operates a...Ch. 7 - Prob. 42PCh. 7 - Prob. 43PCh. 7 - Xinran, who is married and files a joint return,...Ch. 7 - During 2019, Rick and his wife, Sara, had the...Ch. 7 - Soong, single and age 32, had the following items...Ch. 7 - Prob. 47PCh. 7 - Prob. 48PCh. 7 - Assume that in addition to the information in...Ch. 7 - Jed, age 55, is married with no children. During...Ch. 7 - Prob. 51CPCh. 7 - Mason Phillips, age 45, and his wife, Ruth, live...Ch. 7 - During 2019, John was the chief executive officer...Ch. 7 - Prob. 2RP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the 2019 tax year, Brian, a single taxpayer, received $ 7,400 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he received $ 30,000 in tax-exempt interest income and has no for-AGI deductions, Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2019. SIMPIFIED TAXABLE SOCIAL SECURITY WORKSHEET (FOR MOST PEOPLE) 1. Enter the total amount of Social Security income. 2. Enter one-half of line 1 3. Enter the total of taxable income items on Form 1040 except Social Security income. 4. Enter the amount of tax-exempt interest income. 5. Add lines 2,3, and 4 6. Enter all adjustments for AGl except for student loan interest, the domestic production activities deduction, and the tuition and fees deduction. 7. Subtract line 6 from line 5 . If zero or less, stop here, none of the Social Security benefits are taxable. 8. Enter $ 25,0001 $ 32,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 9. Subtract line 8 from line 7 . If zero or less, enter -0 - Note: If line 9 is zero or less, stop here; none of your benefits are faxable. Otherwise, go on to line 10 10. Enter $ 9,0001 $12,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 11. Subtract line 10 from line 9. If zero or less, enter -0 -. 12. Enter the smaller of line 9 or line 10 . 13. Enter one-half of line 12 14. Enter the smaller of line 2 or line 13 . 15. Multiply line 11 by 85 (. 85 ). If line 11 is zero, enter -0 -. 16. Add lines 14 and 15 17. Multiply line 1 by 85(.85) 18. Taxable benefits. Enter the smaller of line 16 or line 17 . 1.____________ 2.____________ 3.____________ 4.____________ 5.____________ 6.____________ 7.____________ 8.____________ 9.____________ 10.____________ 11.____________ 12.____________ 13.____________ 14.____________ 15.____________ 16.____________ 17.____________ 18.____________arrow_forwardArthur Wesson, an unmarried individual who is age 68, reports taxable income of 510,000 in 2019. He records positive AMT adjustments of 80,000 and preferences of 35,000. Arthur itemizes his deductions, and his regular tax liability in 2019 is 153,694. a. What is Arthurs AMT? b. What is the total amount of Arthurs tax liability? c. Draft a letter to Arthur explaining why he must pay more than the regular income tax liability. Arthurs address is 100 Colonels Way, Conway, SC 29526.arrow_forward

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License