Coronado Landscaping Limited has determined that its lawn maintenance division is a cash-generating unit under IFRS. The carrying amounts of the division’s assets at December 31, 2020, are as follows: Land $26,000 Building 58,000 Equipment 34,000 Vehicles 16,000 $134,000 The lawn maintenance division has been assessed for impairment and it is determined that the division’s value in use is $120,600, fair value less costs to sell is $89,000, and undiscounted future net cash flows are $158,000.

Coronado Landscaping Limited has determined that its lawn maintenance division is a cash-generating unit under IFRS. The carrying amounts of the division’s assets at December 31, 2020, are as follows: Land $26,000 Building 58,000 Equipment 34,000 Vehicles 16,000 $134,000 The lawn maintenance division has been assessed for impairment and it is determined that the division’s value in use is $120,600, fair value less costs to sell is $89,000, and undiscounted future net cash flows are $158,000.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 15E: The following are independent errors: a. In January 2019, repair costs of 9,000 were debited to the...

Related questions

Question

Coronado Landscaping Limited has determined that its lawn maintenance division is a cash-generating unit under IFRS. The carrying amounts of the division’s assets at December 31, 2020, are as follows:

| Land | $26,000 | |

| Building | 58,000 | |

| Equipment | 34,000 | |

| Vehicles | 16,000 | |

| $134,000 |

The lawn maintenance division has been assessed for impairment and it is determined that the division’s value in use is $120,600, fair value less costs to sell is $89,000, and undiscounted future net cash flows are $158,000.

B

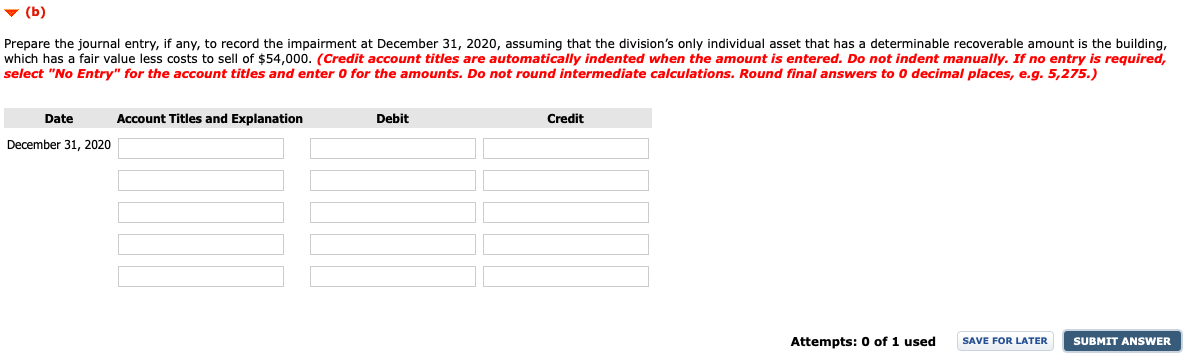

Transcribed Image Text:v (b)

Prepare the journal entry, if any, to record the impairment at December 31, 2020, assuming that the division's only individual asset that has a determinable recoverable amount is the building,

which has a fair value less costs to sell of $54,000. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required,

select "No Entry" for the account titles and enter 0 for the amounts. Do not round intermediate calculations. Round final answers to 0 decimal places, e.g. 5,275.)

Date

Account Titles and Explanation

Debit

Credit

December 31, 2020

Attempts: 0 of 1 used

SAVE FOR LATER

SUBMIT ANSWER

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College