COST-BENEFIT ANALYSIS Listed in the diagram for Problem 7 are some probability estimates of the costs and benefits associated with two competing projects. a. Compute the net present value of each alternative. Round the cost projections to the nearest month. b. Repeat step (a) for the payback method. c. Which method do you think provides the best source of information? Why? PROBLEM 7: CosT-BENEFIT AMALYSIS COST OF CAPITAL = .14 Probability Amount Probability Amount Project completion time 0.5 0.3 0.2 12 months 18 months 24 months 4 years 5 years 6 years $200,000 250,000 300,000 $ 75,000 95,000 105,000 0.6 12 months 0.2 18 months 0.1 24 months 4 years 5 years 6 years $210,000 250,000 260,000 $ 85,000 100,000 110,000 Expected useful ife 0.6 0.5 0.25 0.3 0.2 0.15 0.35 One-time costs 0.2 0.4 0.55 0.25 0.25 Recurring costs 0.1 0.4 0.55 0.35 0.4 0.2 Annual tangible benefits starting with weighted average completion date 0.3 0.5 0.2 $220,000 233,000 240,000 0.25 0.5 0.25 $215,000 225,000 235,000

COST-BENEFIT ANALYSIS Listed in the diagram for Problem 7 are some probability estimates of the costs and benefits associated with two competing projects. a. Compute the net present value of each alternative. Round the cost projections to the nearest month. b. Repeat step (a) for the payback method. c. Which method do you think provides the best source of information? Why? PROBLEM 7: CosT-BENEFIT AMALYSIS COST OF CAPITAL = .14 Probability Amount Probability Amount Project completion time 0.5 0.3 0.2 12 months 18 months 24 months 4 years 5 years 6 years $200,000 250,000 300,000 $ 75,000 95,000 105,000 0.6 12 months 0.2 18 months 0.1 24 months 4 years 5 years 6 years $210,000 250,000 260,000 $ 85,000 100,000 110,000 Expected useful ife 0.6 0.5 0.25 0.3 0.2 0.15 0.35 One-time costs 0.2 0.4 0.55 0.25 0.25 Recurring costs 0.1 0.4 0.55 0.35 0.4 0.2 Annual tangible benefits starting with weighted average completion date 0.3 0.5 0.2 $220,000 233,000 240,000 0.25 0.5 0.25 $215,000 225,000 235,000

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter7: Corporate Valuation And Stock Valuation

Section: Chapter Questions

Problem 26SP

Related questions

Question

100%

Hello! Happy Sunday! Can you please help me with this problem? Me and my friends are having difficulties answering this problem.Thank you so much!

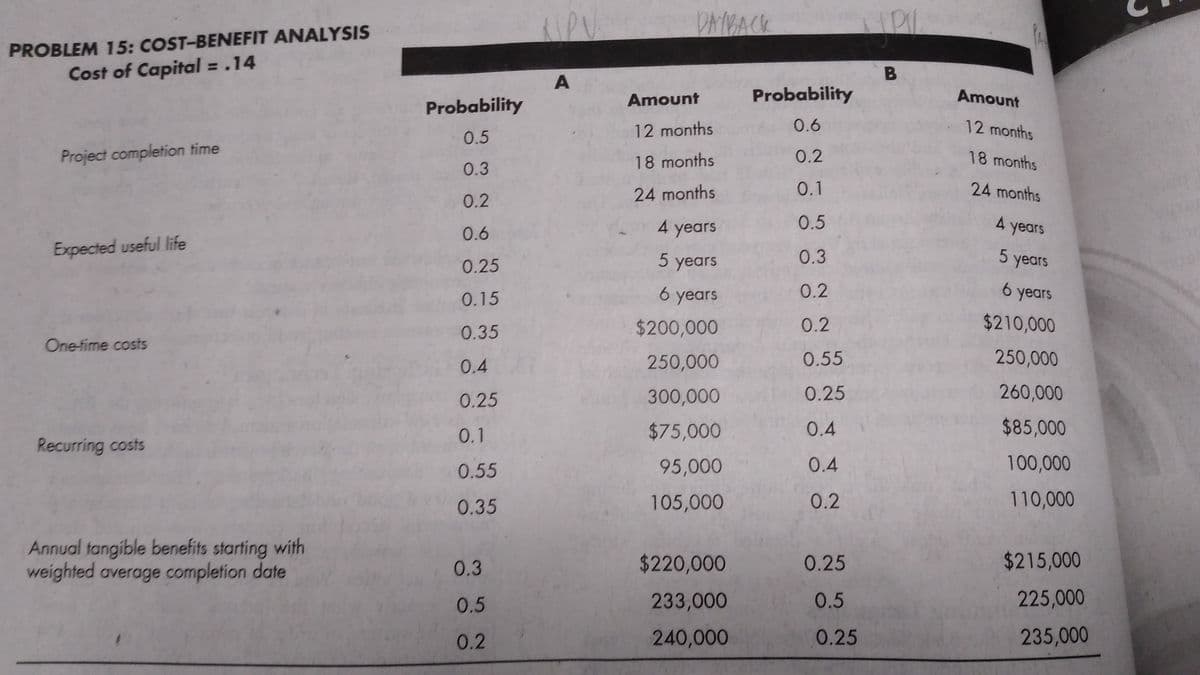

*COST-BENEFIT ANALYSIS

Listed in the diagram are some probability estimates of the costs and benefits associated with two competing projects.

a. Compute the

b. Repeat step (a) for the payback method. c. Which method do you think provides the best source of information? Why?

Transcribed Image Text:DAYBACK

PROBLEM 15: COST-BENEFIT ANALYSIS

%3D

Cost of Capital = .14

B

Amount

Probability

Amount

Probability

12 months

0.6

12 months

0.5

Project completion time

0.2

18 months

18 months

0.3

24 months

0.1

24 months

0.2

0.6

4 years

0.5

4

4 years

Expected useful life

5 years

0.25

5 years

0.3

0.15

6 years

0.2

6.

6 years

$200,000

0.2

$210,000

0.35

One-fime costs

0.4

250,000

0.55

250,000

0.25

300,000

0.25

260,000

0.1

$75,000

0.4

$85,000

Recurring costs

0.55

95,000

0.4

100,000

0.35

105,000

0.2

110,000

Annual tangible benefits starting with

weighted average completion date

0.3

$220,000

0.25

$215,000

0.5

233,000

0.5

225,000

0.2

240,000

0.25

235,000

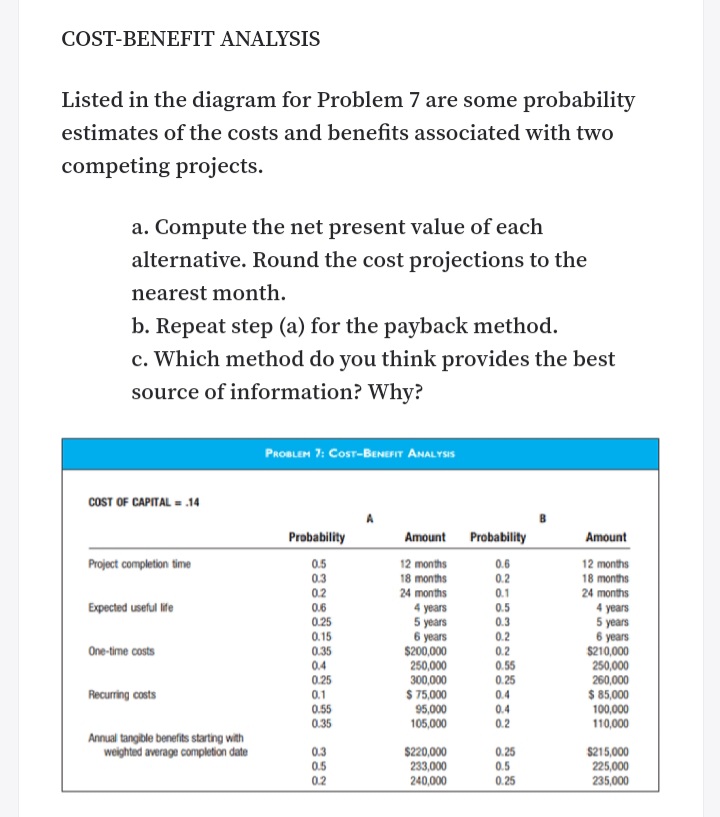

Transcribed Image Text:COST-BENEFIT ANALYSIS

Listed in the diagram for Problem 7 are some probability

estimates of the costs and benefits associated with two

competing projects.

a. Compute the net present value of each

alternative. Round the cost projections to the

nearest month.

b. Repeat step (a) for the payback method.

c. Which method do you think provides the best

source of information? Why?

PROBLEM 7: Cosr-BENEFIT ANALYSIS

COST OF CAPITAL = .14

Probability

Amount Probability

Amount

0.5

0.3

0.2

0.6

12 months

18 months

24 months

4 years

5 years

6 years

$210,000

250,000

260,000

$ 85,000

100,000

110,000

Project completion time

12 months

18 months

0.2

24 months

4 years

5 years

6 years

$200,000

250,000

300,000

$ 75,000

95,000

105,000

0.1

Expected useful ife

0.6

0.5

0.25

0.15

0.35

0.3

0.2

0.2

0.55

0.25

0.4

0.4

0.2

One-time costs

04

0.25

Recurring costs

0.1

0.55

0.35

Annual tangible benefits starting with

weighted average completion date

0.3

0.5

0.2

$220,000

233,000

240,000

0.25

0.5

0.25

$215,000

225,000

235,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you