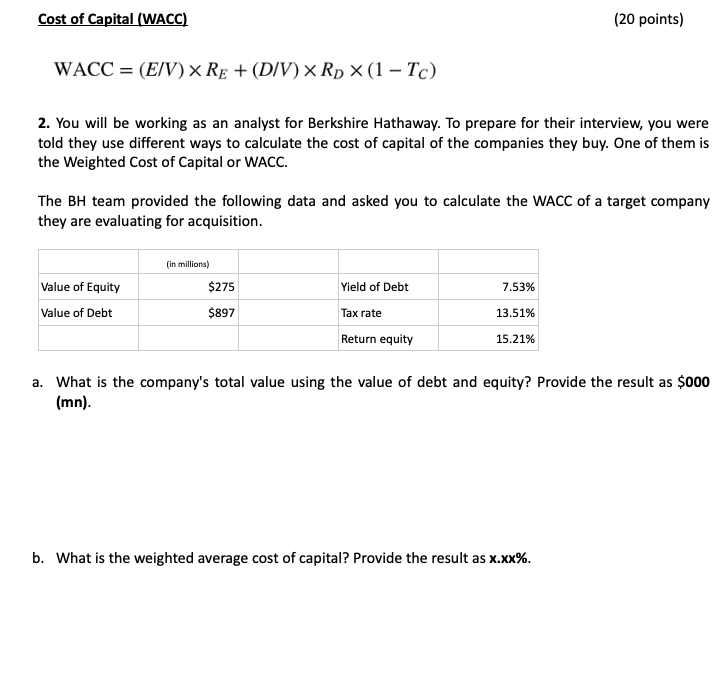

Cost of Capital (WACC) WACC = (E/V) × RE+ (D/V) × RD × (1 - Tc) (20 points) 2. You will be working as an analyst for Berkshire Hathaway. To prepare for their interview, you were told they use different ways to calculate the cost of capital of the companies they buy. One of them is the Weighted Cost of Capital or WACC. The BH team provided the following data and asked you to calculate the WACC of a target company they are evaluating for acquisition. (in millions) Value of Equity $275 Yield of Debt 7.53% Value of Debt $897 Tax rate 13.51% Return equity 15.21% a. What is the company's total value using the value of debt and equity? Provide the result as $000 (mn). b. What is the weighted average cost of capital? Provide the result as x.xx%.

Cost of Capital (WACC) WACC = (E/V) × RE+ (D/V) × RD × (1 - Tc) (20 points) 2. You will be working as an analyst for Berkshire Hathaway. To prepare for their interview, you were told they use different ways to calculate the cost of capital of the companies they buy. One of them is the Weighted Cost of Capital or WACC. The BH team provided the following data and asked you to calculate the WACC of a target company they are evaluating for acquisition. (in millions) Value of Equity $275 Yield of Debt 7.53% Value of Debt $897 Tax rate 13.51% Return equity 15.21% a. What is the company's total value using the value of debt and equity? Provide the result as $000 (mn). b. What is the weighted average cost of capital? Provide the result as x.xx%.

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter10: The Cost Of Capital

Section: Chapter Questions

Problem 2TCL

Question

Transcribed Image Text:Cost of Capital (WACC)

WACC = (E/V) × RE+ (D/V) × RD × (1 - Tc)

(20 points)

2. You will be working as an analyst for Berkshire Hathaway. To prepare for their interview, you were

told they use different ways to calculate the cost of capital of the companies they buy. One of them is

the Weighted Cost of Capital or WACC.

The BH team provided the following data and asked you to calculate the WACC of a target company

they are evaluating for acquisition.

(in millions)

Value of Equity

$275

Yield of Debt

7.53%

Value of Debt

$897

Tax rate

13.51%

Return equity

15.21%

a. What is the company's total value using the value of debt and equity? Provide the result as $000

(mn).

b. What is the weighted average cost of capital? Provide the result as x.xx%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning