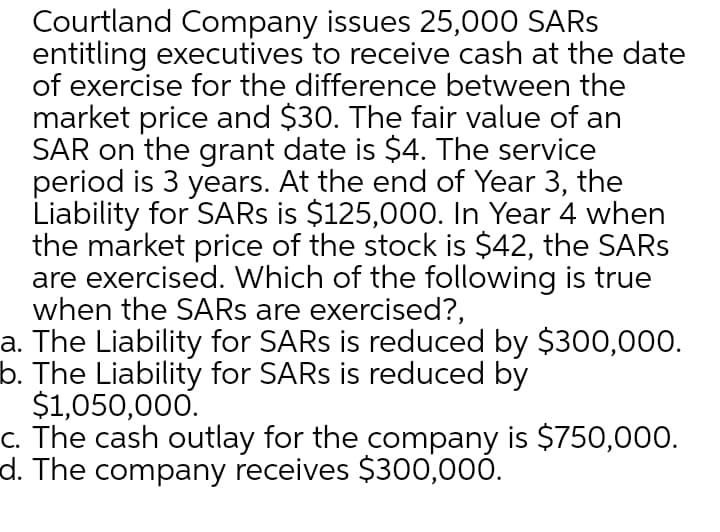

Courtland Company issues 25,000 SARS entitling executives to receive cash at the date of exercise for the difference between the market price and $30. The fair value of an SAR on the grant date is $4. The service period is 3 years. At the end of Year 3, the Liability for SARS is $125,000. In Year 4 when the market price of the stock is $42, the SARS are exercised. Which of the following is true when the SARS are exercised?.

Courtland Company issues 25,000 SARS entitling executives to receive cash at the date of exercise for the difference between the market price and $30. The fair value of an SAR on the grant date is $4. The service period is 3 years. At the end of Year 3, the Liability for SARS is $125,000. In Year 4 when the market price of the stock is $42, the SARS are exercised. Which of the following is true when the SARS are exercised?.

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 42P

Related questions

Question

Transcribed Image Text:Courtland Company issues 25,000 SARS

entitling executives to receive cash at the date

of exercise for the difference between the

market price and $30. The fair value of an

SAR on the grant date is $4. The service

period is 3 years. At the end of Year 3, the

Liability for SARS is $125,000. In Year 4 when

the market price of the stock is $42, the SARS

are exercised. Which of the following is true

when the SARS are exercised?,

a. The Liability for SARS is reduced by $300,000.

b. The Liability for SARS is reduced by

$1,050,000.

c. The cash outlay for the company is $750,000.

d. The company receives $300,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you