covered by insurance, becomes due and payable in April 10. Mahogany Shoe Factory has negotiated with a tenant to rent storage space to him beginning April 1. The rental negotiated is $780,000 per annum. The first month's rent along with one month's safety deposit will be collected from the tenant on April 1. Thereafter, the monthly rental is expected to be received at the beginning of each month. 11. The cash balance on March 31 2016 is expected to be an overdraft of $165,000 Required: a) Prepare a schedule of budgeted cash collections for sales on account for each of the 3 months April to June. b) Prepare a schedule of expected cash disbursements for purchases for the quarter to June 30 2016 c) Prepare a cash budget, with a total column, for the quarter ending June 30, 2016, showing receipts and payments for each month d) Mahogany currently has a loan and one of the covenants is to maintain a minimum cash balance of $150,000 each month. Based on the budget prepared, will the business be meeting this covenant? Suggest four possible steps (other than borrowing) that may be taken by management to improve the cash flow.

covered by insurance, becomes due and payable in April 10. Mahogany Shoe Factory has negotiated with a tenant to rent storage space to him beginning April 1. The rental negotiated is $780,000 per annum. The first month's rent along with one month's safety deposit will be collected from the tenant on April 1. Thereafter, the monthly rental is expected to be received at the beginning of each month. 11. The cash balance on March 31 2016 is expected to be an overdraft of $165,000 Required: a) Prepare a schedule of budgeted cash collections for sales on account for each of the 3 months April to June. b) Prepare a schedule of expected cash disbursements for purchases for the quarter to June 30 2016 c) Prepare a cash budget, with a total column, for the quarter ending June 30, 2016, showing receipts and payments for each month d) Mahogany currently has a loan and one of the covenants is to maintain a minimum cash balance of $150,000 each month. Based on the budget prepared, will the business be meeting this covenant? Suggest four possible steps (other than borrowing) that may be taken by management to improve the cash flow.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter9: Profit Planning And Flexible Budgets

Section: Chapter Questions

Problem 45BEB: Pilsner Inc. purchases raw materials on account for use in production. The direct materials...

Related questions

Question

C and d

need answer

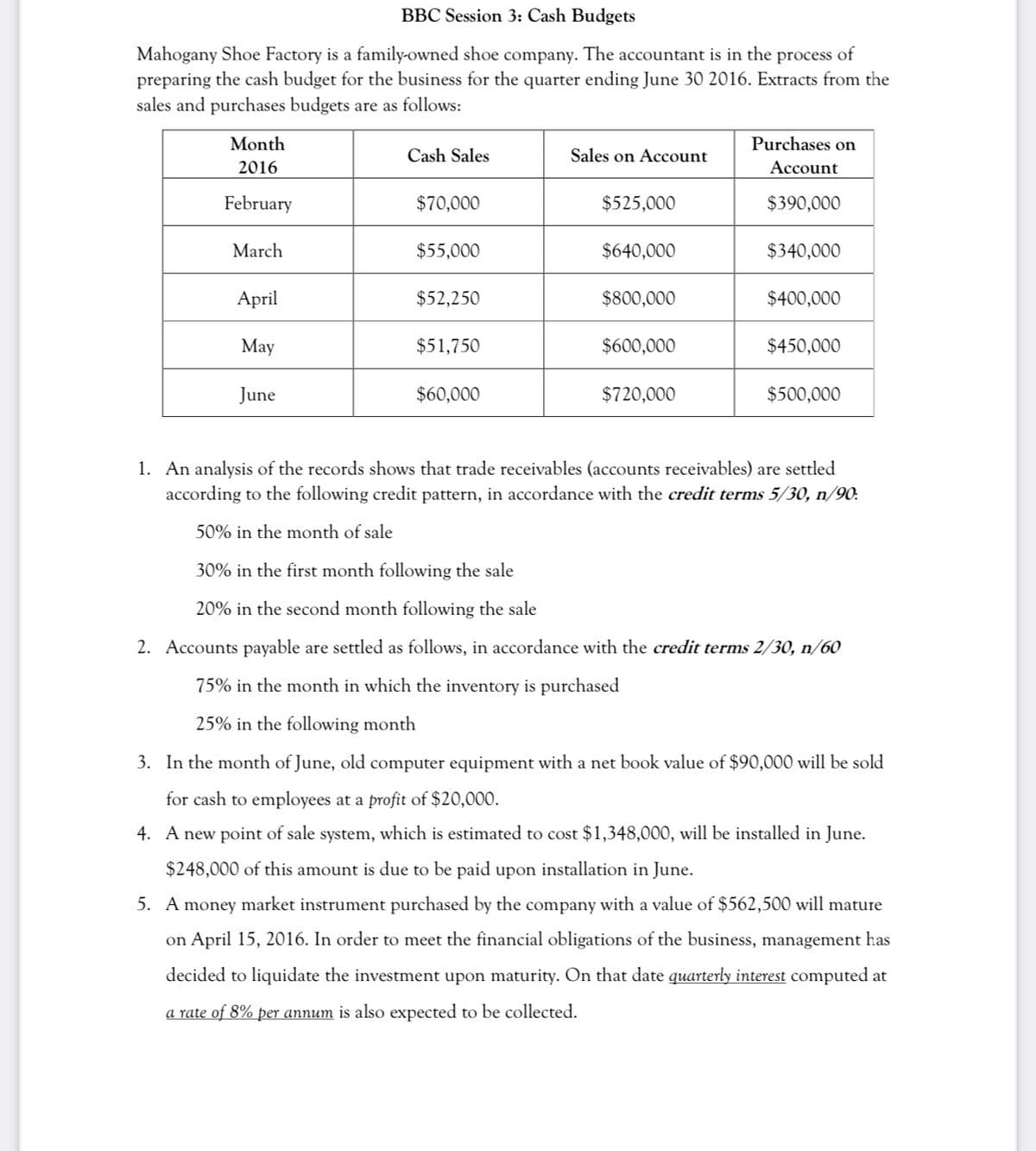

Transcribed Image Text:BBC Session 3: Cash Budgets

Mahogany Shoe Factory is a family-owned shoe company. The accountant is in the process of

preparing the cash budget for the business for the quarter ending June 30 2016. Extracts from the

sales and purchases budgets are as follows:

Month

Purchases on

Cash Sales

Sales on Account

2016

Account

February

$70,000

$525,000

$390,000

March

$55,000

$640,000

$340,000

April

$52,250

$800,000

$400,000

May

$51,750

$600,000

$450,000

June

$60,000

$720,000

$500,000

1. An analysis of the records shows that trade receivables (accounts receivables) are settled

according to the following credit pattern, in accordance with the credit terms 5/30, n/90:

50% in the month of sale

30% in the first month following the sale

20% in the second month following the sale

2. Accounts payable are settled as follows, in accordance with the credit terms 2/30, n/60

75% in the month in which the inventory is purchased

25% in the following month

3. In the month of June, old computer equipment with a net book value of $90,000 will be sold

for cash to employees at a profit of $20,000.

4. A new point of sale system, which is estimated to cost $1,348,000, will be installed in June.

$248,000 of this amount is due to be paid upon installation in June.

5. A money market instrument purchased by the company with a value of $562,500 will mature

on April 15, 2016. In order to meet the financial obligations of the business, management has

decided to liquidate the investment upon maturity. On that date quarterly interest computed at

a rate of 8% per annum is also expected to be collected.

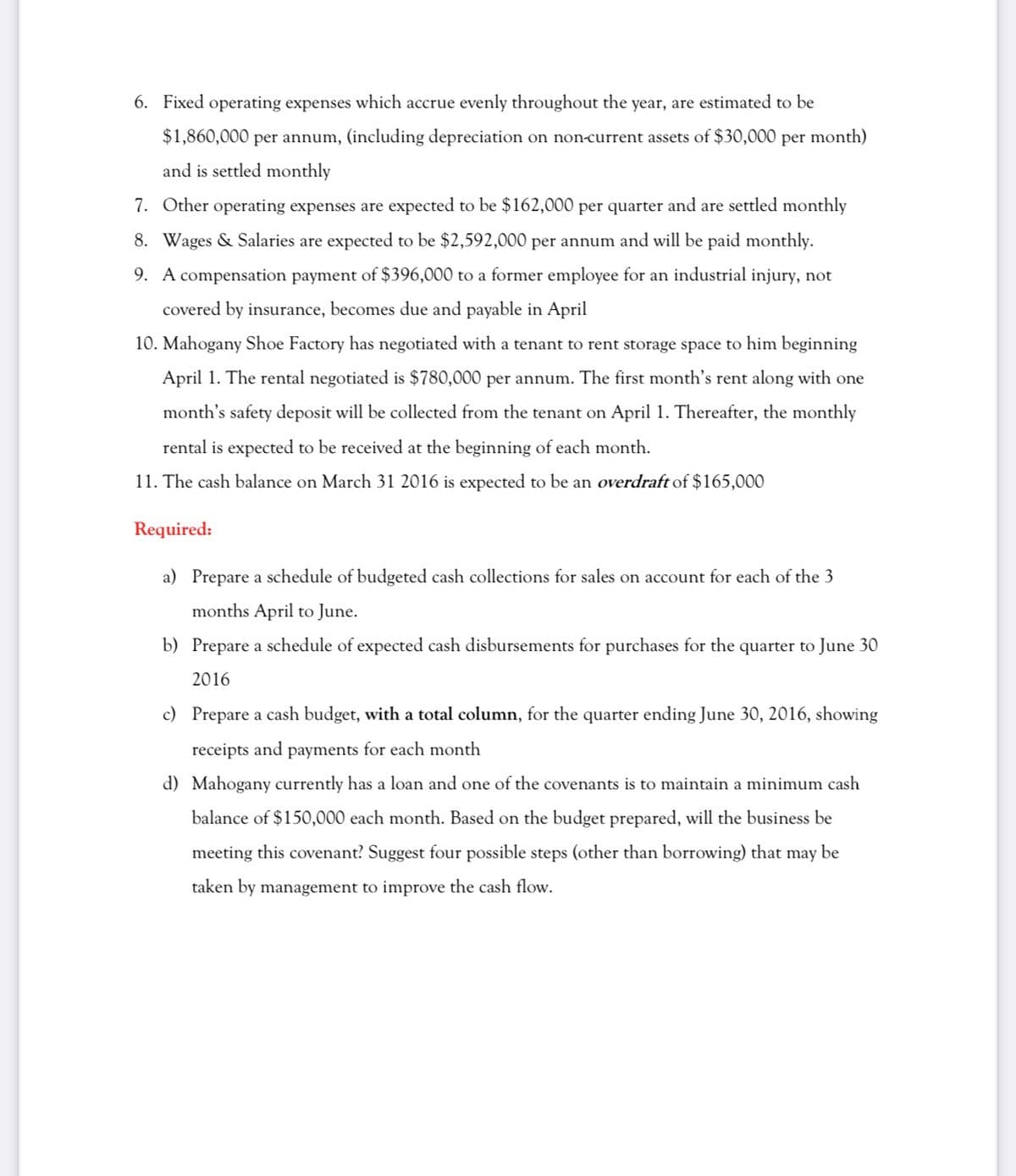

Transcribed Image Text:6. Fixed operating expenses which accrue evenly throughout the year, are estimated to be

$1,860,000 per annum, (including depreciation on non-current assets of $30,000 per month)

and is settled monthly

7. Other operating expenses are expected to be $162,000 per quarter and are settled monthly

8. Wages & Salaries are expected to be $2,592,000 per annum and will be paid monthly.

9. A compensation payment of $396,000 to a former employee for an industrial injury, not

covered by insurance, becomes due and payable in April

10. Mahogany Shoe Factory has negotiated with a tenant to rent storage space to him beginning

April 1. The rental negotiated

80,000 per annum. The first month's rent alo

with one

month's safety deposit will be collected from the tenant on April 1. Thereafter, the monthly

rental is expected to be received at the beginning of each month.

11. The cash balance on March 31 2016 is expected to be an overdraft of $165,000

Required:

a) Prepare a schedule of budgeted cash collections for sales on account for each of the 3

months April to June.

b) Prepare a schedule of expected cash disbursements for purchases for the quarter to June 30

2016

c)

Prepa

a cash budget, with a total column, for the quarter ending June 30, 2016, showing

receipts and payments for each month

d) Mahogany currently has a loan and one of the covenants is to maintain a minimum cash

balance of $150,000 each month. Based on the budget prepared, will the business be

meeting this covenant? Suggest four possible steps (other than borrowing) that may be

taken by management to improve the cash flow.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College