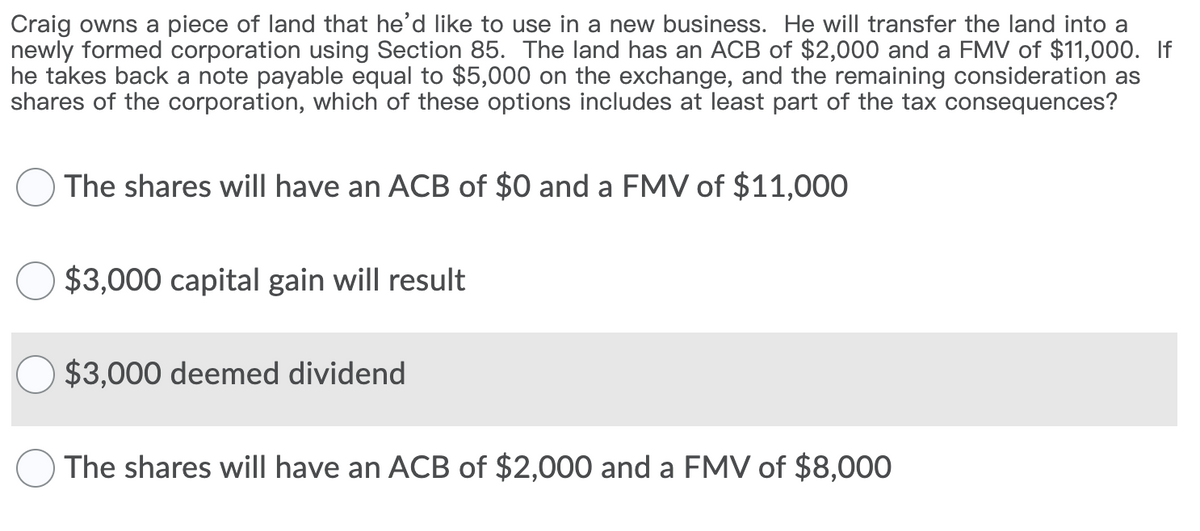

Craig owns a piece of land that he'd like to use in a new business. He will transfer the land into a newly formed corporation using Section 85. The land has an ACB of $2,000 and a FMV of $11,000. If he takes back a note payable equal to $5,000 on the exchange, and the remaining consideration as shares of the corporation, which of these options includes at least part of the tax consequences? The shares will have an ACB of $0 and a FMV of $11,000 $3,000 capital gain will result $3,000 deemed dividend

Craig owns a piece of land that he'd like to use in a new business. He will transfer the land into a newly formed corporation using Section 85. The land has an ACB of $2,000 and a FMV of $11,000. If he takes back a note payable equal to $5,000 on the exchange, and the remaining consideration as shares of the corporation, which of these options includes at least part of the tax consequences? The shares will have an ACB of $0 and a FMV of $11,000 $3,000 capital gain will result $3,000 deemed dividend

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 30P

Related questions

Question

100%

Transcribed Image Text:Craig owns a piece of land that he'd like to use in a new business. He will transfer the land into a

newly formed corporation using Section 85. The land has an ACB of $2,000 and a FMV of $11,000. If

he takes back a note payable equal to $5,000 on the exchange, and the remaining consideration as

shares of the corporation, which of these options includes at least part of the tax consequences?

OThe shares will have an ACB of $0 and a FMV of $11,000

$3,000 capital gain will result

$3,000 deemed dividend

OThe shares will have an ACB of $2,000 and a FMV of $8,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT