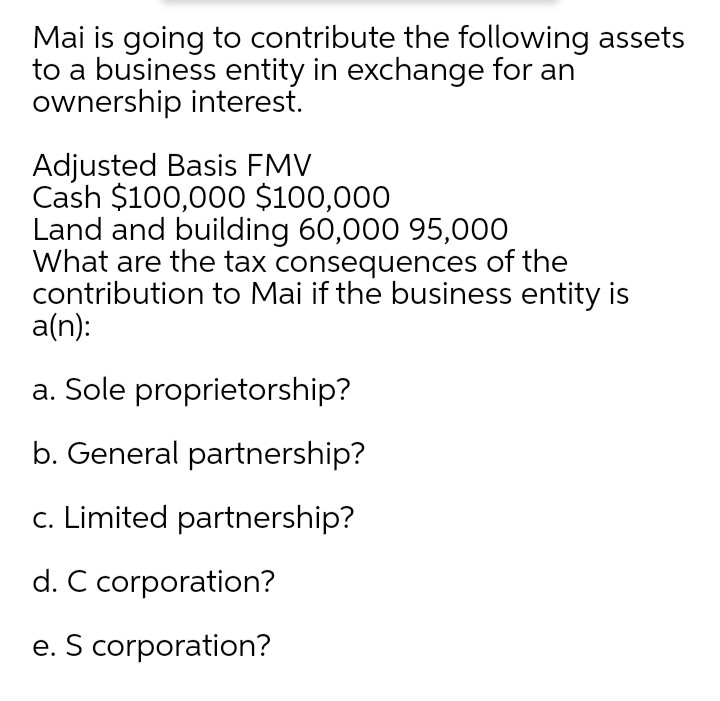

Mai is going to contribute the following assets to a business entity in exchange for an ownership interest. Adjusted Basis FMV Cash $100,000 $100,000 Land and building 60,000 95,000 What are the tax consequences of the contribution to Mai if the business entity is a(n): a. Sole proprietorship? b. General partnership? c. Limited partnership? d. C corporation? e. S corporation?

Mai is going to contribute the following assets to a business entity in exchange for an ownership interest. Adjusted Basis FMV Cash $100,000 $100,000 Land and building 60,000 95,000 What are the tax consequences of the contribution to Mai if the business entity is a(n): a. Sole proprietorship? b. General partnership? c. Limited partnership? d. C corporation? e. S corporation?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 24P

Related questions

Question

100%

Transcribed Image Text:Mai is going to contribute the following assets

to a business entity in exchange for an

ownership interest.

Adjusted Basis FMV

Cash $100,000 $100,000

Land and building 60,000 95,000

What are the tax consequences of the

contribution to Mai if the business entity is

a(n):

a. Sole proprietorship?

b. General partnership?

c. Limited partnership?

d. C corporation?

e. S corporation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you