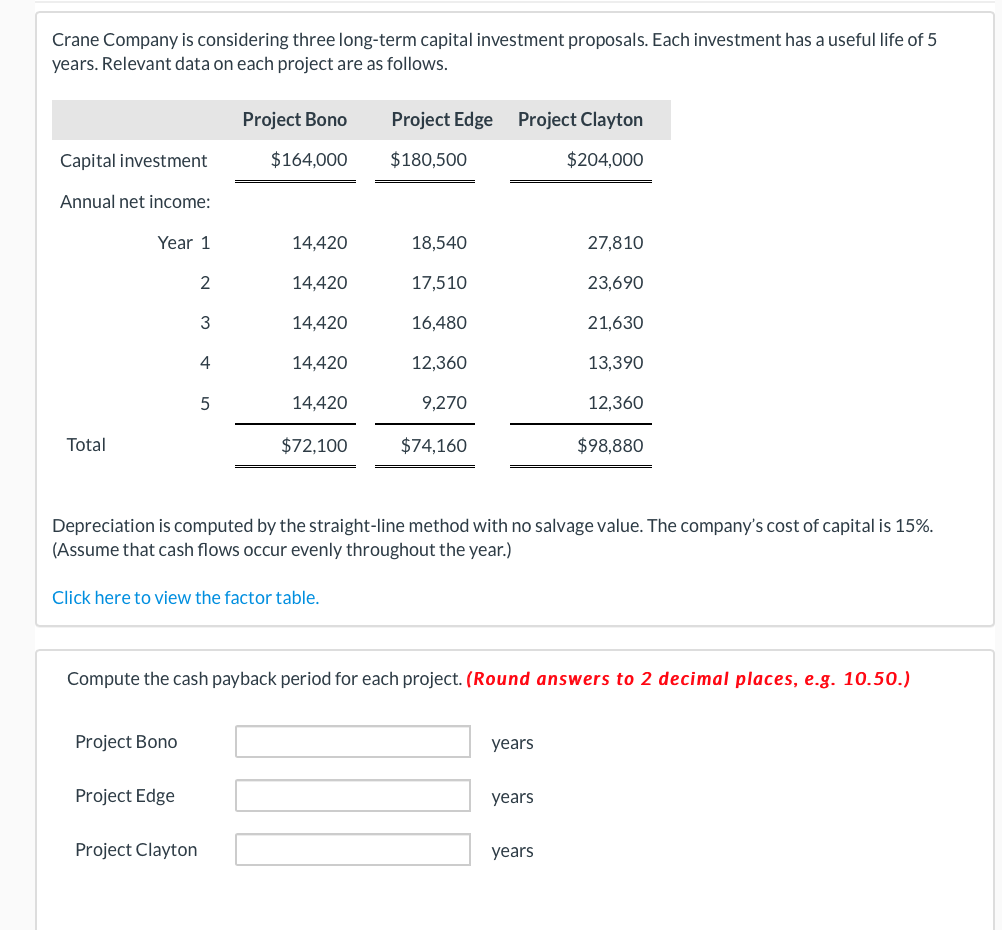

Crane Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Bono Project Edge Project Clayton Capital investment $164,000 $180,500 $204,000 Annual net income: Year 1 14,420 18,540 27,810 14,420 17,510 23,690 14,420 16,480 21,630 4 14,420 12,360 13,390 14,420 9,270 12,360 Total $72,100 $74,160 $98,880 Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view the factor table. Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50.) Project Bono years Project Edge years Project Clayton years

Crane Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Bono Project Edge Project Clayton Capital investment $164,000 $180,500 $204,000 Annual net income: Year 1 14,420 18,540 27,810 14,420 17,510 23,690 14,420 16,480 21,630 4 14,420 12,360 13,390 14,420 9,270 12,360 Total $72,100 $74,160 $98,880 Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view the factor table. Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50.) Project Bono years Project Edge years Project Clayton years

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 8P: Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley...

Related questions

Question

Transcribed Image Text:Crane Company is considering three long-term capital investment proposals. Each investment has a useful life of 5

years. Relevant data on each project are as follows.

Project Bono

Project Edge Project Clayton

Capital investment

$164,000

$180,500

$204,000

Annual net income:

Year 1

14,420

18,540

27,810

2

14,420

17,510

23,690

14,420

16,480

21,630

4

14,420

12,360

13,390

14,420

9,270

12,360

Total

$72,100

$74,160

$98,880

Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%.

(Assume that cash flows occur evenly throughout the year.)

Click here to view the factor table.

Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50.)

Project Bono

years

Project Edge

years

Project Clayton

years

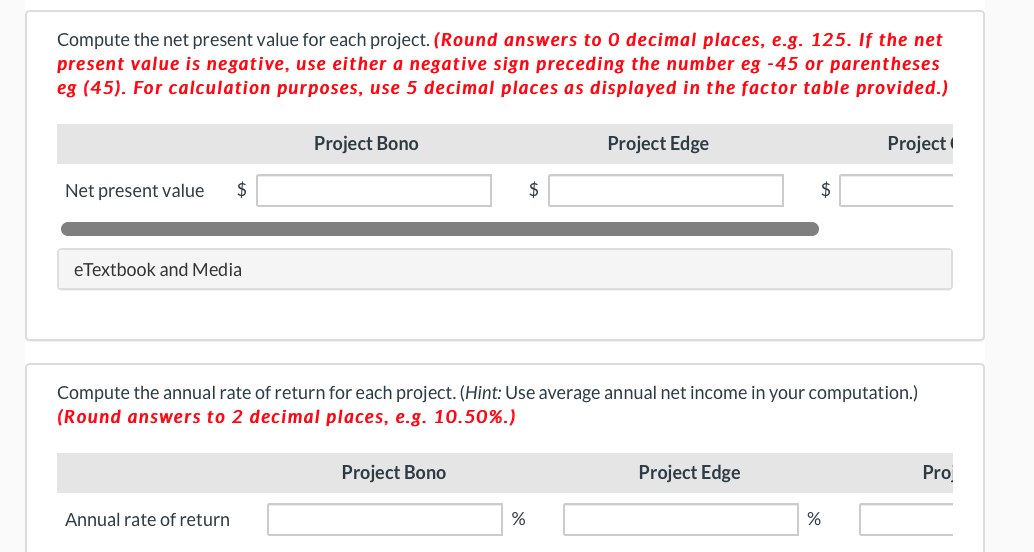

Transcribed Image Text:Compute the net present value for each project. (Round answers to 0 decimal places, e.g. 125. If the net

present value is negative, use either a negative sign preceding the number eg -45 or parentheses

eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

Project Bono

Project Edge

Project

Net present value

2$

$

2$

eTextbook and Media

Compute the annual rate of return for each project. (Hint: Use average annual net income in your computation.)

(Round answers to 2 decimal places, e.g. 10.50%.)

Project Bono

Project Edge

Pro

Annual rate of return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

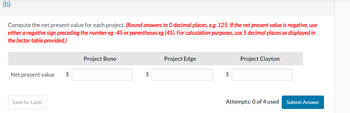

Transcribed Image Text:(b)

Compute the net present value for each project. (Round answers to O decimal places, e.g. 125. If the net present value is negative, use

either a negative sign preceding the number eg -45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in

the factor table provided.)

Net present value

Save for Later

$

Project Bono

$

Project Edge

$

Project Clayton

Attempts: 0 of 4 used

Submit Answer

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub