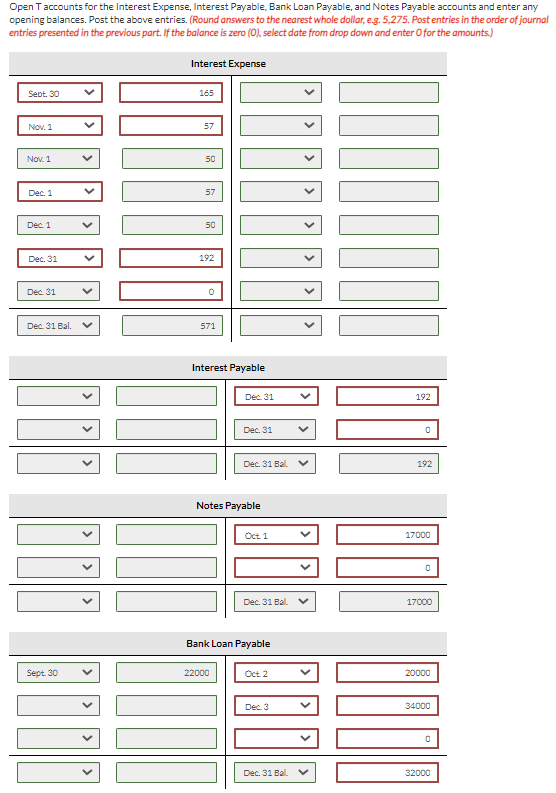

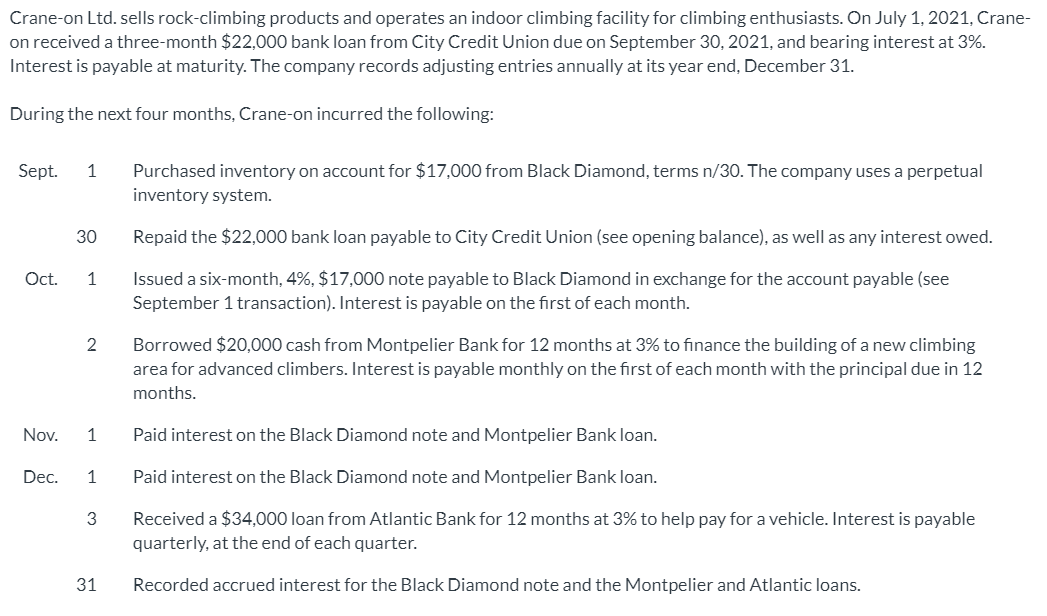

Crane-on Ltd. sells rock-climbing products and operates an indoor climbing facility for climbing enthusiasts. On July 1, 2021, Crane- on received a three-month $22,000 bank loan from City Credit Union due on September 30, 2021, and bearing interest at 3%. Interest is payable at maturity. The company records adjusting entries annually at its year end, December 31. During the next four months, Crane-on incurred the following: Purchased inventory on account for $17,000 from Black Diamond, terms n/30. The company uses a perpetual inventory system. Sept. 1 30 Repaid the $22,000 bank loan payable to City Credit Union (see opening balance), as well as any interest owed. Issued a six-month, 4%, $17,000 note payable to Black Diamond in exchange for the account payable (see September 1 transaction). Interest is payable on the first of each month. Oct. 1 2 Borrowed $20,000 cash from Montpelier Bank for 12 months at 3% to finance the building of a new climbing area for advanced climbers. Interest is payable monthly on the first of each month with the principal due in 12 months. Nov. 1 Paid interest on the Black Diamond note and Montpelier Bank loan. Dec. 1 Paid interest on the Black Diamond note and Montpelier Bank loan. Received a $34,000 loan from Atlantic Bank for 12 months at 3% to help pay for a vehicle. Interest is payable quarterly, at the end of each quarter. 31 Recorded accrued interest for the Black Diamond note and the Montpelier and Atlantic loans.

Crane-on Ltd. sells rock-climbing products and operates an indoor climbing facility for climbing enthusiasts. On July 1, 2021, Crane-on received a three-month $22,000 bank loan from City Credit Union due on September 30, 2021, and bearing interest at 3%. Interest is payable at maturity. The company records

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images