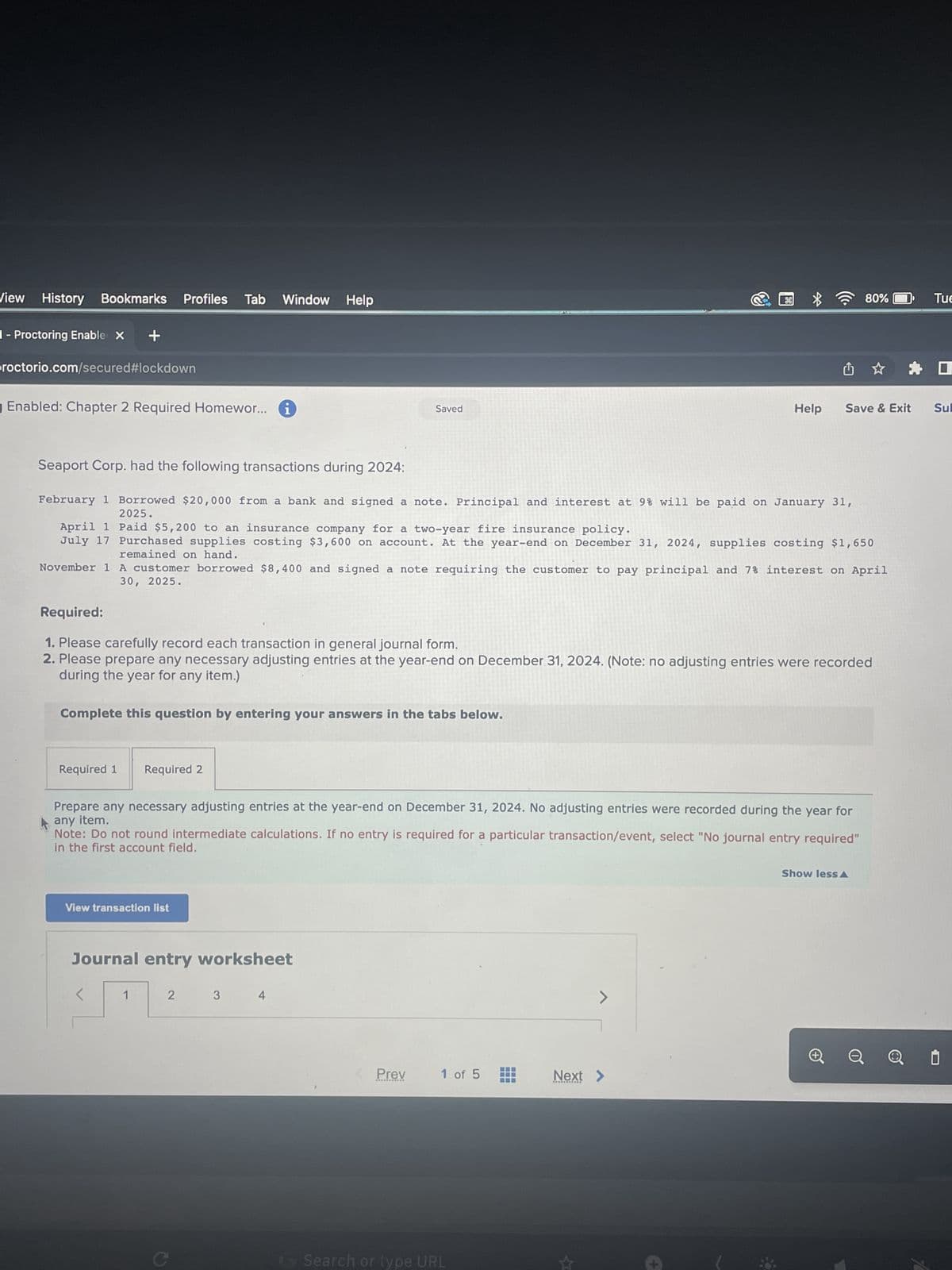

Seaport Corp. had the following transactions during 2024: February 1 Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31, 2025. April 1 Paid $5,200 to an insurance company for a two-year fire insurance policy. July 17 Purchased supplies costing $3,600 on account. At the year-end on December 31, 2024, supplies costing $1,650 remained on hand. November 1 A customer borrowed $8,400 and signed a note requiring the customer to pay principal and 7% interest on April 30, 2025. Required: 1. Please carefully record each transaction in general journal form. 2. Please prepare any necessary adjusting entries at the year-end on December 31, 2024. (Note: no adjusting entries were recorded during the year for any item.)

Seaport Corp. had the following transactions during 2024: February 1 Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31, 2025. April 1 Paid $5,200 to an insurance company for a two-year fire insurance policy. July 17 Purchased supplies costing $3,600 on account. At the year-end on December 31, 2024, supplies costing $1,650 remained on hand. November 1 A customer borrowed $8,400 and signed a note requiring the customer to pay principal and 7% interest on April 30, 2025. Required: 1. Please carefully record each transaction in general journal form. 2. Please prepare any necessary adjusting entries at the year-end on December 31, 2024. (Note: no adjusting entries were recorded during the year for any item.)

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter3: Journalizing Transactions

Section3.4: Starting A New Journal

Problem 1WT

Related questions

Question

Transcribed Image Text:View History Bookmarks

1- Proctoring Enable X +

proctorio.com/secured#lockdown

Enabled: Chapter 2 Required Homewor... i

Profiles Tab Window Help

Required 1

Seaport Corp. had the following transactions during 2024:

February 1 Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31,

2025.

April 1

Paid $5,200 to an insurance company for a two-year fire insurance policy.

July 17 Purchased supplies costing $3,600 on account. At the year-end on December 31, 2024, supplies costing $1,650

remained on hand.

November 1

A customer borrowed $8,400 and signed a note requiring the customer to pay principal and 7% interest on April

30, 2025.

Complete this question by entering your answers in the tabs below.

Required:

1. Please carefully record each transaction in general journal form.

2. Please prepare any necessary adjusting entries at the year-end on December 31, 2024. (Note: no adjusting entries were recorded

during the year for any item.)

View transaction list

Required 2

<

Prepare any necessary adjusting entries at the year-end on December 31, 2024. No adjusting entries were recorded during the year for

any item.

Note: Do not round intermediate calculations. If no entry is required for a particular transaction/event, select "No journal entry required"

in the first account field.

Journal entry worksheet

1

2

Saved

3

4

Prev

1 of 5

G Search or type URL

>

80%

Help Save & Exit Sul

Next >

Show less A

Tue

0

Transcribed Image Text:View History Bookmarks

n 1 - Proctoring Enable X +

tproctorio.com/secured#lockdown

ng Enabled: Chapter 2 Required Homewor... i

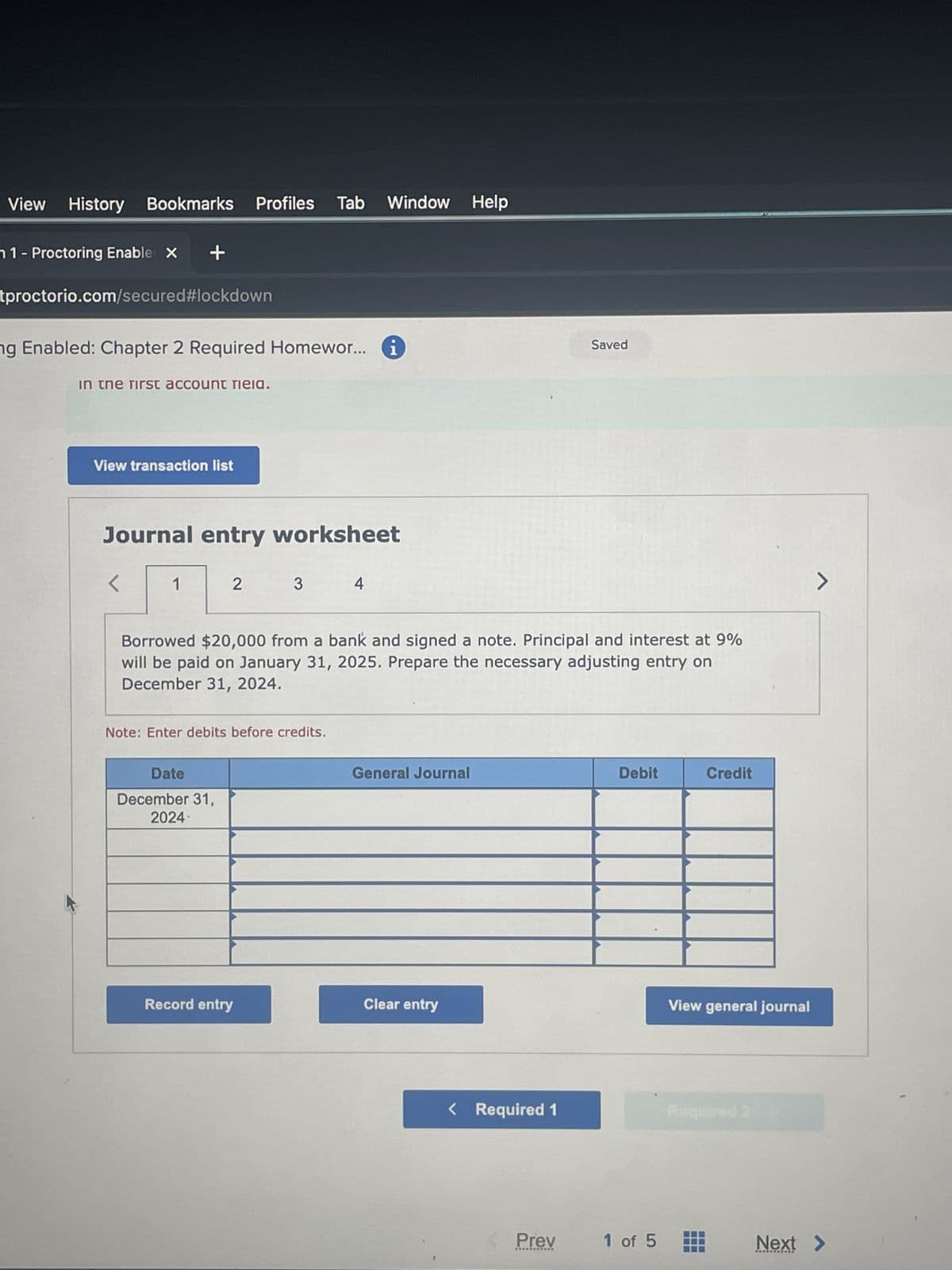

in the first account riela.

View transaction list

Journal entry worksheet

<

Profiles Tab Window Help

1

2

Date

December 31,

2024

3

Note: Enter debits before credits.

Record entry

Borrowed $20,000 from a bank and signed a note. Principal and interest at 9%

will be paid on January 31, 2025. Prepare the necessary adjusting entry on

December 31, 2024.

4

General Journal

Clear entry

< Required 1

Saved

Prev

Debit

1 of 5

Credit

View general journal

Required 2

>

Next >

ABOOGCOCOON

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage