Create a Balance sheet from the information provided

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter6: Financial Statements And The Closing Process

Section: Chapter Questions

Problem 5RQ: Identify the sources of the information needed to prepare the balance sheet.

Related questions

Question

Create a

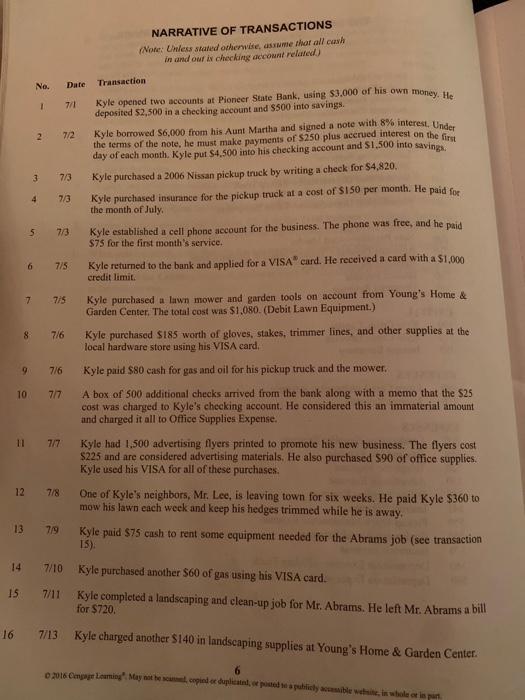

Transcribed Image Text:NARRATIVE OF TRANSACTIONS

(Note: Unless stated otherwise, assume that all cash

in and out is checking account related)

Date

Transaction

No.

Kyle opened two accounts at Pioneer State Bank, using 53,000 of his own money, H.

deposited $2,500 in a checking account and $500 into savings.

7/1

Kyle borrowed $6,000 from his Aunt Martha and signed a note with 8% interest, Und.

the terms of the note, he must make payments of $250 plus accrued interest on the fir

day of each month. Kyle put $4,500 into his checking account and S1,500 into savings

7/2

7/3

Kyle purchased a 2006 Nissan pickup truck by writing a check for $4,820.

3.

Kyle purchased insurance for the pickup truck at a cost of $150 per month. He pajd fo

the month of July.

4

7/3

Kyle established a cell phone account for the business. The phone was free, and he paid

$75 for the first month's service.

7/3

Kyle returned to the bank and applied for a VISA" card. He received a card with a $1,000

credit limit.

7/5

Kyle purchased a lawn mower and garden tools on account from Young's Home &

Garden Center. The total cost was $1,080. (Debit Lawn Equipment.)

7/5

Kyle purchased $185 worth of gloves, stakes, trimmer lines, and other supplies at the

local hardware store using his VISA card.

8.

7/6

9.

Kyle paid $80 cash for gas and oil for his pickup truck and the mower.

7/6

A box of 500 additional checks arrived from the bank along with a memo that the $25

cost was charged to Kyle's checking account. He considered this an immaterial amount

and charged it all to Office Supplies Expense.

7/7

Kyle had 1,500 advertising flyers printed to promote his new business. The flyers cost

$225 and are considered advertising materials. He also purchased $90 of office supplies.

Kyle used his VISA for all of these purchases.

11

7/7

12

One of Kyle's neighbors, Mr. Lee, is leaving town for six weeks. He paid Kyle $360 to

mow his lawn each week and keep his hedges trimmed while he is away.

7/8

13

7/9

Kyle paid $75 cash to rent some equipment needed for the Abrams job (see transaction

15).

14

7/10 Kyle purchased another S60 of gas using his VISA card.

7/11 Kyle completed a landscaping and clean-up job for Mr. Abrams. He left Mr. Abrams a bill

for $720.

15

16

7/13 Kyle charged another $140 in landscaping supplies at Young's Home & Garden Center.

6.

eI6 Cmae Leaming". May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part

10

%D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College