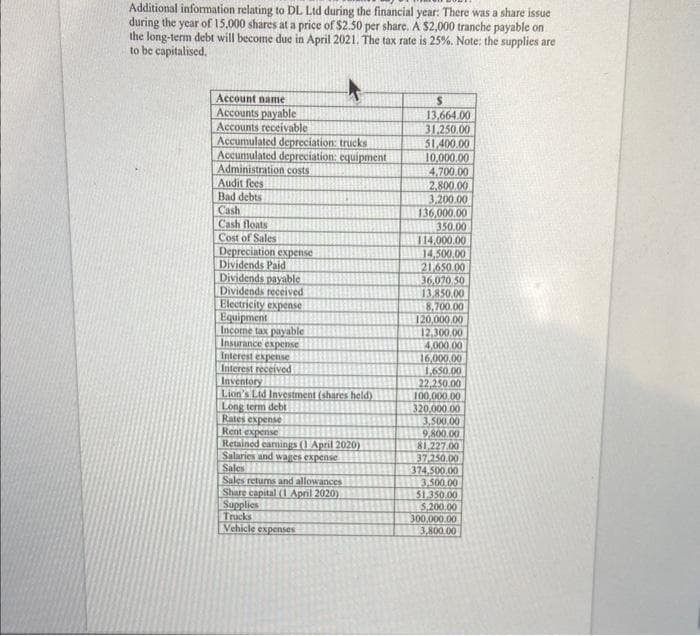

Additional information relating to DL. Ltd during the financial year: There was a share issue during the year of 15,000 shares at a price of $2.50 per share. A $2,000 tranche payable on i the long-term debt will become due in April 2021. The tax rate is 25%. Note: the supplies are to be capitalised. Account name Accounts payable Accounts receivable Accumulated depreciation: trucks Accumulated depreciation: equipment Administration costs Audit fees Bad debts Cash Cash floats Cost of Sales Depreciation expense Dividends Paid Dividends payable Dividends received Electricity expense Equipment Income tax payable Insurance expense Interest expense Interest received Inventory Lion's Ltd Investment (shares held) Long term debt Rates expense Rent expense Retained earnings (1 April 2020) Salaries and wages expense Sales Sales returns and allowances Share capital (1 April 2020) Supplies Trucks Vehicle expenses S 13,664.00 31.250.00 51,400.00 10,000.00 4,700.00 2,800.00 3,200.00 136,000.00 350.00 114,000.00 14,500.00 21,650.00 36,070 50 13,850.00 8,700.00 120,000.00 12,300.00 4,000.00 16,000.00 1,650.00 22,250.00 100,000.00 320,000.00 3,500,00 9,800.00 181,227.00 37,250.00 374,500.00 11113,500.00 51.350.00 5,200.00 300,000.00 3,800.00

Additional information relating to DL. Ltd during the financial year: There was a share issue during the year of 15,000 shares at a price of $2.50 per share. A $2,000 tranche payable on i the long-term debt will become due in April 2021. The tax rate is 25%. Note: the supplies are to be capitalised. Account name Accounts payable Accounts receivable Accumulated depreciation: trucks Accumulated depreciation: equipment Administration costs Audit fees Bad debts Cash Cash floats Cost of Sales Depreciation expense Dividends Paid Dividends payable Dividends received Electricity expense Equipment Income tax payable Insurance expense Interest expense Interest received Inventory Lion's Ltd Investment (shares held) Long term debt Rates expense Rent expense Retained earnings (1 April 2020) Salaries and wages expense Sales Sales returns and allowances Share capital (1 April 2020) Supplies Trucks Vehicle expenses S 13,664.00 31.250.00 51,400.00 10,000.00 4,700.00 2,800.00 3,200.00 136,000.00 350.00 114,000.00 14,500.00 21,650.00 36,070 50 13,850.00 8,700.00 120,000.00 12,300.00 4,000.00 16,000.00 1,650.00 22,250.00 100,000.00 320,000.00 3,500,00 9,800.00 181,227.00 37,250.00 374,500.00 11113,500.00 51.350.00 5,200.00 300,000.00 3,800.00

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 11P: Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as...

Related questions

Question

Create a Balance sheet for this information given:

Transcribed Image Text:Additional information relating to DL. Ltd during the financial year: There was a share issue

during the year of 15,000 shares at a price of $2.50 per share. A $2,000 tranche payable on

the long-term debt will become due in April 2021. The tax rate is 25%. Note: the supplies are

to be capitalised.

Account name

Accounts payable

Accounts receivable

Accumulated depreciation: trucks

Accumulated depreciation: equipment

Administration costs

Audit fees

Bad debts

Cash

Cash floats

Cost of Sales

Depreciation expense

Dividends Paid

Dividends payable

Dividends received

Electricity expense

Equipment

Income tax payable

Insurance expense

Interest expense

Interest received

Inventory

Lion's Ltd Investment (shares held)

Long term debt

Rates expense

Rent expense

Retained earnings (1 April 2020)

Salaries and wages expense

Sales

Sales returns and allowances

Share capital (1 April 2020)

Supplies

Trucks

Vehicle expenses

S

13,664.00

31.250.00

51,400.00

10,000.00

4.700.00

2,800.00

3.200.00

136,000.00

350.00

114.000.00

14,500.00

21,650.00

36,070 50

13,850.00

8,700.00

120,000.00

12,300,00

4,000.00

16,000.00

1,650.00

22,250.00

100,000.00

320,000.00

3,500,00

9,800.00

81,227.00

37,250.00

374.500.00

1113,500.00

51.350.00

5,200.00

300,000.00

3,800.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,