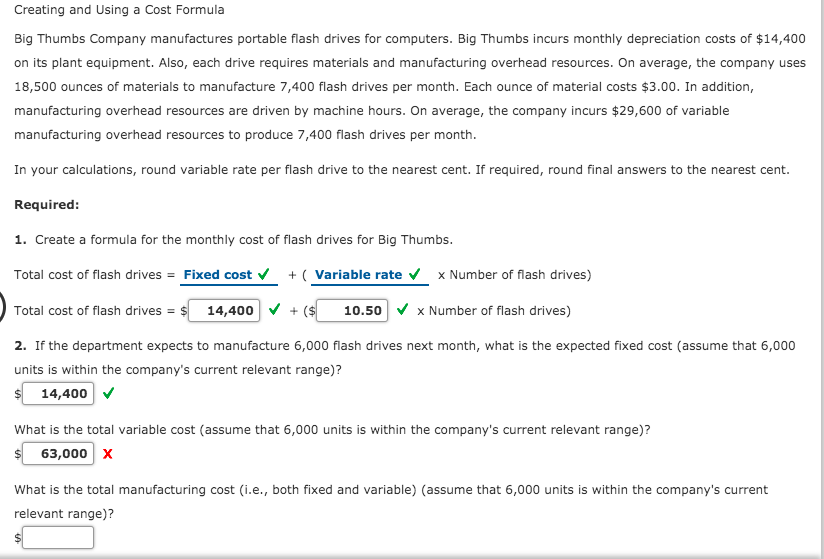

Creating and Using a Cost Formula Big Thumbs Company manufactures portable flash drives for computers. Big Thumbs incurs monthly depreciation costs of $14,400 on its plant equipment. Also, each drive requires materials and manufacturing overhead resources. On average, the company uses 18,500 ounces of materials to manufacture 7,400 flash drives per month. Each ounce of material costs $3.00. In addition, manufacturing overhead resources are driven by machine hours. On average, the company incurs $29,600 of variable manufacturing overhead resources to produce 7,400 flash drives per month. In your calculations, round variable rate per flash drive to the nearest cent. If required, round final answers to the nearest cent. Required: 1. Create a formula for the monthly cost of flash drives for Big Thumbs. Total cost of flash drives = Fixed cost + ( Variable rate v x Number of flash drives) Total cost of flash drives = $ 14,400 + ($ 10.50 v x Number of flash drives) 2. If the department expects to manufacture 6,000 flash drives next month, what is the expected fixed cost (assume that 6,000 units is within the company's current relevant range)? 14,400 v What is the total variable cost (assume that 6,000 units is within the company's current relevant range)? 63,000 x What is the total manufacturing cost (i.e., both fixed and variable) (assume that 6,000 units is within the company's current relevant range)?

Creating and Using a Cost Formula Big Thumbs Company manufactures portable flash drives for computers. Big Thumbs incurs monthly depreciation costs of $14,400 on its plant equipment. Also, each drive requires materials and manufacturing overhead resources. On average, the company uses 18,500 ounces of materials to manufacture 7,400 flash drives per month. Each ounce of material costs $3.00. In addition, manufacturing overhead resources are driven by machine hours. On average, the company incurs $29,600 of variable manufacturing overhead resources to produce 7,400 flash drives per month. In your calculations, round variable rate per flash drive to the nearest cent. If required, round final answers to the nearest cent. Required: 1. Create a formula for the monthly cost of flash drives for Big Thumbs. Total cost of flash drives = Fixed cost + ( Variable rate v x Number of flash drives) Total cost of flash drives = $ 14,400 + ($ 10.50 v x Number of flash drives) 2. If the department expects to manufacture 6,000 flash drives next month, what is the expected fixed cost (assume that 6,000 units is within the company's current relevant range)? 14,400 v What is the total variable cost (assume that 6,000 units is within the company's current relevant range)? 63,000 x What is the total manufacturing cost (i.e., both fixed and variable) (assume that 6,000 units is within the company's current relevant range)?

Chapter6: Activity-based, Variable, And Absorption Costing

Section: Chapter Questions

Problem 9PA: Carltons Kitchens makes two types of pasta makers: Strands and Shapes. The company expects to...

Related questions

Question

100%

Transcribed Image Text:Creating and Using a Cost Formula

Big Thumbs Company manufactures portable flash drives for computers. Big Thumbs incurs monthly depreciation costs of $14,400

on its plant equipment. Also, each drive requires materials and manufacturing overhead resources. On average, the company uses

18,500 ounces of materials to manufacture 7,400 flash drives per month. Each ounce of material costs $3.00. In addition,

manufacturing overhead resources are driven by machine hours. On average, the company incurs $29,600 of variable

manufacturing overhead resources to produce 7,400 flash drives per month.

In your calculations, round variable rate per flash drive to the nearest cent. If required, round final answers to the nearest cent.

Required:

1. Create a formula for the monthly cost of flash drives for Big Thumbs.

Total cost of flash drives = Fixed cost v

+ ( Variable rate

x Number of flash drives)

Total cost of flash drives = $ 14,400 v + ($

10.50 v x Number of flash drives)

2. If the department expects to manufacture 6,000 flash drives next month, what is the expected fixed cost (assume that 6,000

units is within the company's current relevant range)?

$ 14,400 v

What is the total variable cost (assume that 6,000 units is within the company's current relevant range)?

63,000 x

What is the total manufacturing cost (i.e., both fixed and variable) (assume that 6,000 units is within the company's current

relevant range)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,