Creative Sound Systems sold investments, land, and its own common stock for $40 million, $16 million, and $42 million, respectively. Creative Sound Systems also purchased treasury stock, equipment, and a patent for $22 million, $26 million, and $13 million, respectively. What amount should Creative Sound Systems report as net cash flows from financing activities? (List cash outflows and any decrease in cash as negative amounts. Enter your answers in millions (i.e., $10,100,000 should be entered as 10.1).) * Answer is complete but not entirely correct. CREATIVE SOUND SYSTEMS Statement of Cash Flows (partial) Cash flows from financing activities Sale of investments 40 X Sale of land 16 X (26) X (13) X Purchase equipment Purchase a patent Net cash flows from financing activities 17

Creative Sound Systems sold investments, land, and its own common stock for $40 million, $16 million, and $42 million, respectively. Creative Sound Systems also purchased treasury stock, equipment, and a patent for $22 million, $26 million, and $13 million, respectively. What amount should Creative Sound Systems report as net cash flows from financing activities? (List cash outflows and any decrease in cash as negative amounts. Enter your answers in millions (i.e., $10,100,000 should be entered as 10.1).) * Answer is complete but not entirely correct. CREATIVE SOUND SYSTEMS Statement of Cash Flows (partial) Cash flows from financing activities Sale of investments 40 X Sale of land 16 X (26) X (13) X Purchase equipment Purchase a patent Net cash flows from financing activities 17

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 48P

Related questions

Topic Video

Question

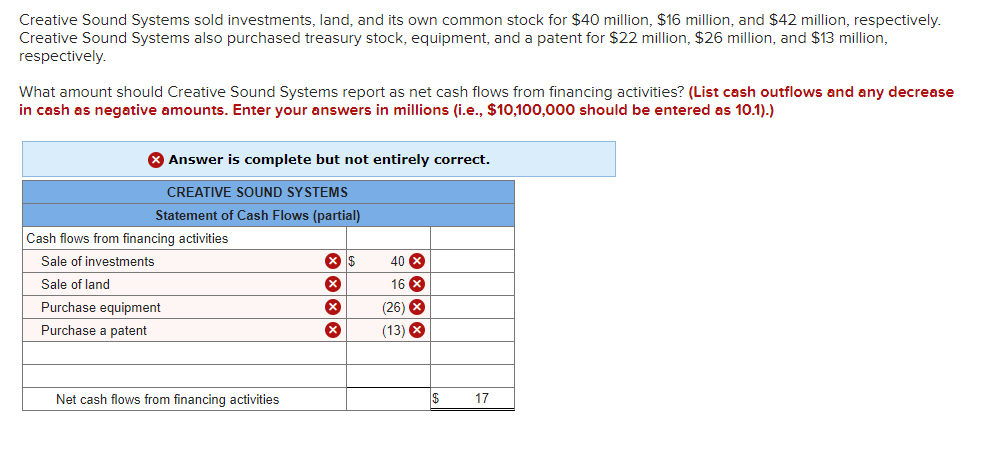

Transcribed Image Text:Creative Sound Systems sold investments, land, and its own common stock for $40 million, $16 million, and $42 million, respectively.

Creative Sound Systems also purchased treasury stock, equipment, and a patent for $22 million, $26 million, and $13 million,

respectively.

What amount should Creative Sound Systems report as net cash flows from financing activities? (List cash outflows and any decrease

in cash as negative amounts. Enter your answers in millions (i.e., $10,100,000 should be entered as 10.1).)

8 Answer is complete but not entirely correct.

CREATIVE SOUND SYSTEMS

Statement of Cash Flows (partial)

Cash flows from financing activities

Sale of investments

40 X

Sale of land

16 X

(26) х

(13) X

Purchase equipment

Purchase a patent

Net cash flows from financing activities

$

17

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,