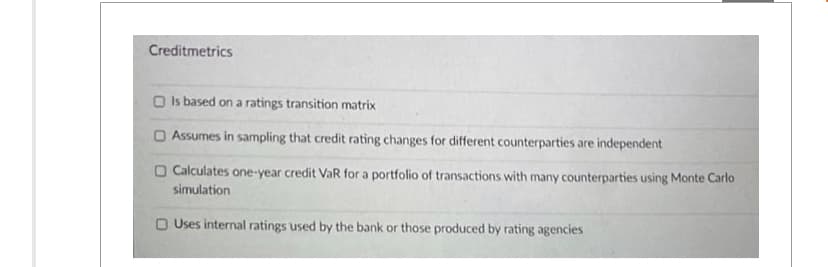

Creditmetrics O Is based on a ratings transition matrix O Assumes in sampling that credit rating changes for different counterparties are independent O Calculates one-year credit VaR for a portfolio of transactions with many counterparties using Monte Carlo simulation O Uses internal ratings used by the bank or those produced by rating agencies

Creditmetrics O Is based on a ratings transition matrix O Assumes in sampling that credit rating changes for different counterparties are independent O Calculates one-year credit VaR for a portfolio of transactions with many counterparties using Monte Carlo simulation O Uses internal ratings used by the bank or those produced by rating agencies

Economics Today and Tomorrow, Student Edition

1st Edition

ISBN:9780078747663

Author:McGraw-Hill

Publisher:McGraw-Hill

Chapter14: Money And Banking

Section14.2: History Of Americans Money And Banking

Problem 2R

Related questions

Question

Transcribed Image Text:Creditmetrics

Is based on a ratings transition matrix

O Assumes in sampling that credit rating changes for different counterparties are independent

O Calculates one-year credit VaR for a portfolio of transactions with many counterparties using Monte Carlo

simulation

O Uses internal ratings used by the bank or those produced by rating agencies

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co