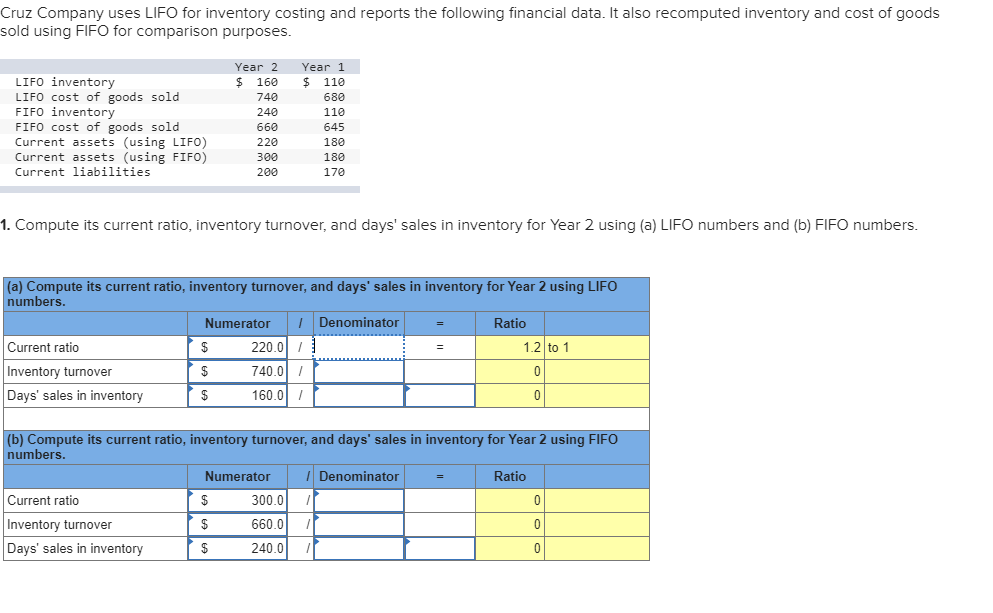

Cruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of goods sold using FIFO for comparison purposes. Year 1 Year 2 $ 160 LIFO inventory LIFO Cost of goods sold FIFO inventory FIFO COst of goods sold Current assets (using LIFO) Current assets (using FIFO) $ 110 740 680 240 110 660 645 220 180 300 180 Current liabilities 200 170 1. Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using (a) LIFO numbers and (b) FIFO numbers. (a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO numbers. IDenominator Numerator Ratio Current ratio 1.2 to 1 220.0 Inventory turnover $ 740.0 0 Days' sales in inventory 160.0 0 (b) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using FIFO numbers. Numerator Denominator Ratio Current ratio $ 300.0 0 Inventory turnover 660.0 $ 0 Days' sales in inventory 240.0 $ 0

Cruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of goods sold using FIFO for comparison purposes. Year 1 Year 2 $ 160 LIFO inventory LIFO Cost of goods sold FIFO inventory FIFO COst of goods sold Current assets (using LIFO) Current assets (using FIFO) $ 110 740 680 240 110 660 645 220 180 300 180 Current liabilities 200 170 1. Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using (a) LIFO numbers and (b) FIFO numbers. (a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO numbers. IDenominator Numerator Ratio Current ratio 1.2 to 1 220.0 Inventory turnover $ 740.0 0 Days' sales in inventory 160.0 0 (b) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using FIFO numbers. Numerator Denominator Ratio Current ratio $ 300.0 0 Inventory turnover 660.0 $ 0 Days' sales in inventory 240.0 $ 0

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 50E: Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the...

Related questions

Question

Transcribed Image Text:Cruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of goods

sold using FIFO for comparison purposes.

Year 1

Year 2

$ 160

LIFO inventory

LIFO Cost of goods sold

FIFO inventory

FIFO COst of goods sold

Current assets (using LIFO)

Current assets (using FIFO)

$ 110

740

680

240

110

660

645

220

180

300

180

Current liabilities

200

170

1. Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using (a) LIFO numbers and (b) FIFO numbers.

(a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO

numbers.

IDenominator

Numerator

Ratio

Current ratio

1.2 to 1

220.0

Inventory turnover

$

740.0

0

Days' sales in inventory

160.0

0

(b) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using FIFO

numbers.

Numerator

Denominator

Ratio

Current ratio

$

300.0

0

Inventory turnover

660.0

$

0

Days' sales in inventory

240.0

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 6 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,