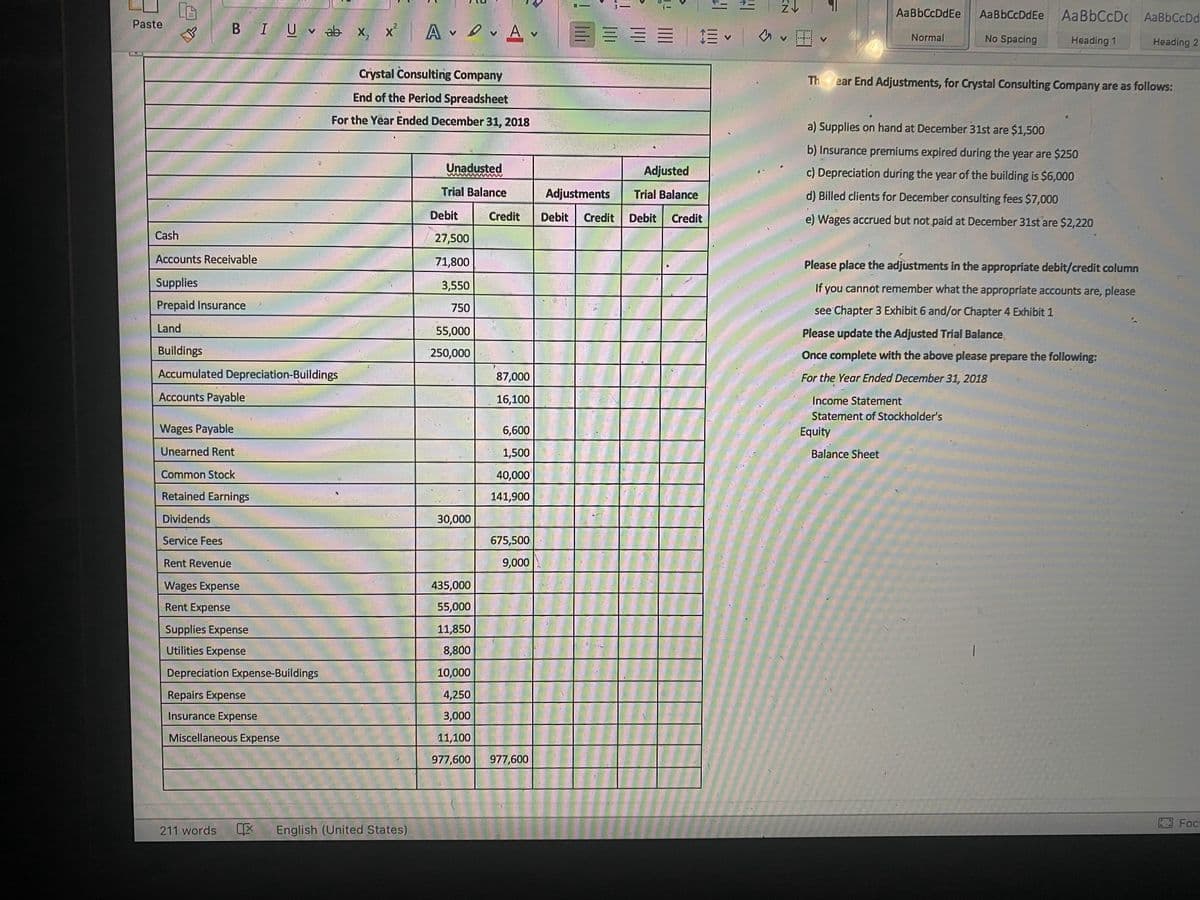

Crystal Consulting Company Th ear End Adjustments, for Crystal Consulting Company are as follows: End of the Period Spreadsheet For the Year Ended December 31, 2018 a) Supplies on hand at December 31st are $1,500 b) Insurance premiums expired during the year are $250 Unadusted Adjusted c) Depreciation during the year of the building is $6,000 Trial Balance Adjustments d) Billed clients for December consulting fees $7,000 Trial Balance Debit Debit e) Wages accrued but not paid at December 31st are $2,220 Credit Credit Debit Credit Cash 27,500 Accounts Receivable 71,800 Please place the adjustments in the appropriate debit/credit column Supplies 3,550 If you cannot remember what the appropriate accounts are, please Prepaid Insurance 750 see Chapter 3 Exhibit 6 and/or Chapter 4 Exhibit 1 Land 55,000 Please update the Adjusted Trial Balance Buildings 250,000 Once complete with the above please prepare the following: Accumulated Depreciation-Buildings 87,000 For the Year Ended December 31, 2018 Accounts Payable Income Statement: Statement of Stockholder's 16,100 Wages Payable 6,600 Equity Unearned Rent 1,500 Balance Sheet Common Stock 40,000 Retained Earnings 141,900 Dividends 30,000 Service Fees 675,500 Rent Revenue 9,000 Wages Expense 435,000 Rent Expense 55,000 Supplies Expense 11,850 Utilities Expense 8,800 Depreciation Expense-Buildings 10,000 Repairs Expense 4,250 Insurance Expense 3,000 Miscellaneous Expense 11,100 977,600 977,600

Crystal Consulting Company Th ear End Adjustments, for Crystal Consulting Company are as follows: End of the Period Spreadsheet For the Year Ended December 31, 2018 a) Supplies on hand at December 31st are $1,500 b) Insurance premiums expired during the year are $250 Unadusted Adjusted c) Depreciation during the year of the building is $6,000 Trial Balance Adjustments d) Billed clients for December consulting fees $7,000 Trial Balance Debit Debit e) Wages accrued but not paid at December 31st are $2,220 Credit Credit Debit Credit Cash 27,500 Accounts Receivable 71,800 Please place the adjustments in the appropriate debit/credit column Supplies 3,550 If you cannot remember what the appropriate accounts are, please Prepaid Insurance 750 see Chapter 3 Exhibit 6 and/or Chapter 4 Exhibit 1 Land 55,000 Please update the Adjusted Trial Balance Buildings 250,000 Once complete with the above please prepare the following: Accumulated Depreciation-Buildings 87,000 For the Year Ended December 31, 2018 Accounts Payable Income Statement: Statement of Stockholder's 16,100 Wages Payable 6,600 Equity Unearned Rent 1,500 Balance Sheet Common Stock 40,000 Retained Earnings 141,900 Dividends 30,000 Service Fees 675,500 Rent Revenue 9,000 Wages Expense 435,000 Rent Expense 55,000 Supplies Expense 11,850 Utilities Expense 8,800 Depreciation Expense-Buildings 10,000 Repairs Expense 4,250 Insurance Expense 3,000 Miscellaneous Expense 11,100 977,600 977,600

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter4: Completing The Accounting Cycle

Section: Chapter Questions

Problem 4.24EX: Adjustment data on an end-of-period spreadsheet Alert Security Services Co. offers security services...

Related questions

Question

100%

Can't figure this problem out, please help.

Transcribed Image Text:AaBbCcDdEe

AaBbCcDdEe

AaBbCcDc AaBbCcDd

I U v ab x, x A A v

Paste

三===|三、a

en v

Normal

No Spacing

Heading 1

Heading 2

Crystal Consulting Company

Th ear End Adjustments, for Crystal Consulting Company are as follows:

End of the Period Spreadsheet

For the Year Ended December 31, 2018

a) Supplies on hand at December 31st are $1,500

b) Insurance premiums expired during the year are $250

Unadusted

Adjusted

c) Depreciation during the year of the building is $6,000

Trial Balance

Adjustments

Trial Balance

d) Billed clients for December consulting fees $7,000

Debit

Credit

Debit

Credit

Debit

e) Wages accrued but not paid at December 31st are $2,220

Credit

Cash

27,500

Accounts Receivable

71,800

Please place the adjustments in the appropriate debit/credit column

Supplies

3,550

If you cannot remember what the appropriate accounts are, please

Prepaid Insurance

750

see Chapter 3 Exhibit 6 and/or Chapter 4 Exhibit 1

Land

55,000

Please update the Adjusted Trial Balance

Buildings

250,000

Once complete with the above please prepare the following:

Accumulated Depreciation-Buildings

87,000

For the Year Ended December 31, 2018

Accounts Payable

16,100

Income Statement

Statement of Stockholder's

Equity

Wages Payable

6,600

Unearned Rent

1,500

Balance Sheet

Common Stock

40,000

Retained Earnings

141,900

Dividends

30,000

Service Fees

675,500

Rent Revenue

9,000

Wages Expense

435,000

Rent Expense

55,000

Supplies Expense

11,850

Utilities Expense

8,800

Depreciation Expense-Buildings

10,000

Repairs Expense

4,250

Insurance Expense

3,000

Miscellaneous Expense

11,100

977,600

977,600

Foc

211 words

English (United States)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning