culation of Annual Savings Needed to Meet a Retirement Goal cd Denny, age 42, single, and from Lansing, Michigan, is trying to estimate the amount she needs to save annually eds. Nicci currently earns $95,000 per year. She expects to need 90 percent of her current salary to live on at retir ceiving about $2,640 per month in Social Security benefits at age 67. Using the Run Numbers worksheet, answer t und your answers to the nearest dollar. What annual income would Nicci need for retirement? $ What would her annual expected Social Security benefit be? Nicci expects to receive $1,250 per month from her defined-benefit pension at work. What is her annual benefit?

culation of Annual Savings Needed to Meet a Retirement Goal cd Denny, age 42, single, and from Lansing, Michigan, is trying to estimate the amount she needs to save annually eds. Nicci currently earns $95,000 per year. She expects to need 90 percent of her current salary to live on at retir ceiving about $2,640 per month in Social Security benefits at age 67. Using the Run Numbers worksheet, answer t und your answers to the nearest dollar. What annual income would Nicci need for retirement? $ What would her annual expected Social Security benefit be? Nicci expects to receive $1,250 per month from her defined-benefit pension at work. What is her annual benefit?

Chapter17: Retirement And Estate Planning

Section: Chapter Questions

Problem 4FPC

Related questions

Question

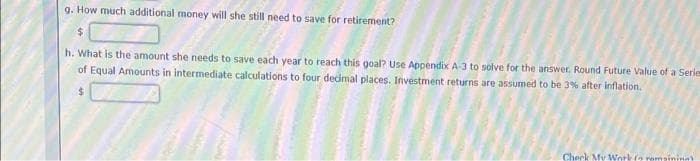

Transcribed Image Text:g. How much additional money will she still need to save for retirement?

h. What is the amount she needs to save each year to reach this goal? Use Appendix A-3 to solve for the answer, Round Future Value of a Series

of Equal Amounts in intermediate calculations to four decimal places. Investment returns are assumed to be 3% after inflation.

$

Check My Work ( remaining)

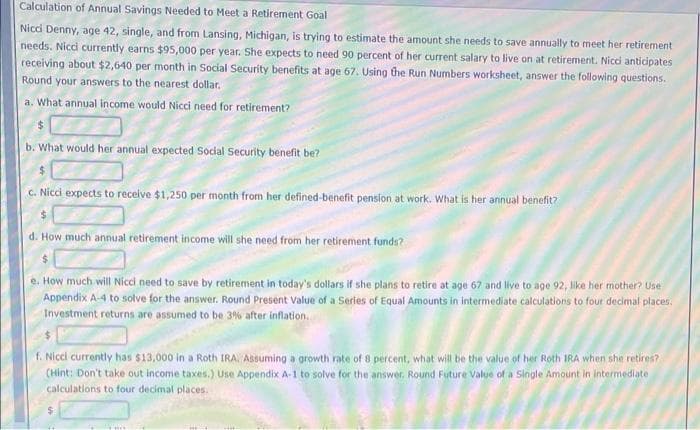

Transcribed Image Text:Calculation of Annual Savings Needed to Meet a Retirement Goal

Nicci Denny, age 42, single, and from Lansing, Michigan, is trying to estimate the amount she needs to save annually to meet her retirement

needs. Nicci currently earns $95,000 per year. She expects to need 90 percent of her current salary to live on at retirement. Nicci anticipates

receiving about $2,640 per month in Social Security benefits at age 67. Using the Run Numbers worksheet, answer the following questions.

Round your answers to the nearest dollar.

a. What annual income would Nicci need for retirement?

$

b. What would her annual expected Social Security benefit be?

$

c. Nicci expects to receive $1,250 per month from her defined-benefit pension at work. What is her annual benefit?

$

d. How much annual retirement income will she need from her retirement funds?

$

e. How much will Nicci need to save by retirement in today's dollars if she plans to retire at age 67 and live to age 92, like her mother? Use

Appendix A-4 to solve for the answer. Round Present Value of a Series of Equal Amounts in intermediate calculations to four decimal places.

Investment returns are assumed to be 3% after inflation.

f. Nicci currently has $13,000 in a Roth IRA. Assuming a growth rate of 8 percent, what will be the value of her Roth IRA when she retires?

(Hint: Don't take out income taxes.) Use Appendix A-1 to solve for the answer, Round Future Value of a Single Amount in intermediate

calculations to four decimal places.

www

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning