The year before last, Victor earned $85,000 from his retail management position, and Maria began working full-time and earned $52,000 as a medical technician. After they took the standard deduction and claimed four exemptions (themselves plus their two children), their federal income tax liability was about $20,000. After being convinced by friends that they were paying too much in taxes, the cou- ple vowed to try to never again pay that much. Therefore, the Hernandezes embarked on a yearlong effort to reduce their income tax liability. This year they tracked all of their possible itemized deductions, and both made contribu- tions to retirement plans at their places of employment. A.) Calculate the Hernandezes’ income tax liability for this year as a joint return (using Table 4-2) given the following information: gross salary income (Victor, $85,000; Maria, $52,000); state income tax refund ($400); interest on checking and savings accounts ($250); holiday bonus from Maria’s employer ($1,000); contributions to qualified retirement accounts ($5,500); itemized deductions (real estate taxes, $4,600; mortgage interest, $6,300; charitable con- tributions, $2,500); and exemptions for themselves and their two children ($4,050 each). B.) List five additional strategies that Victor and Maria might consider for next year’s tax planning to reduce next year’s tax liability.

The year before last, Victor earned $85,000 from his retail management position, and Maria began working full-time and earned $52,000 as a medical technician. After they took the standard deduction and claimed four exemptions (themselves plus their two children), their federal income tax liability was about $20,000. After being convinced by friends that they were paying too much in taxes, the cou- ple vowed to try to never again pay that much. Therefore, the Hernandezes embarked on a yearlong effort to reduce their income tax liability. This year they tracked all of their possible itemized deductions, and both made contribu- tions to retirement plans at their places of employment.

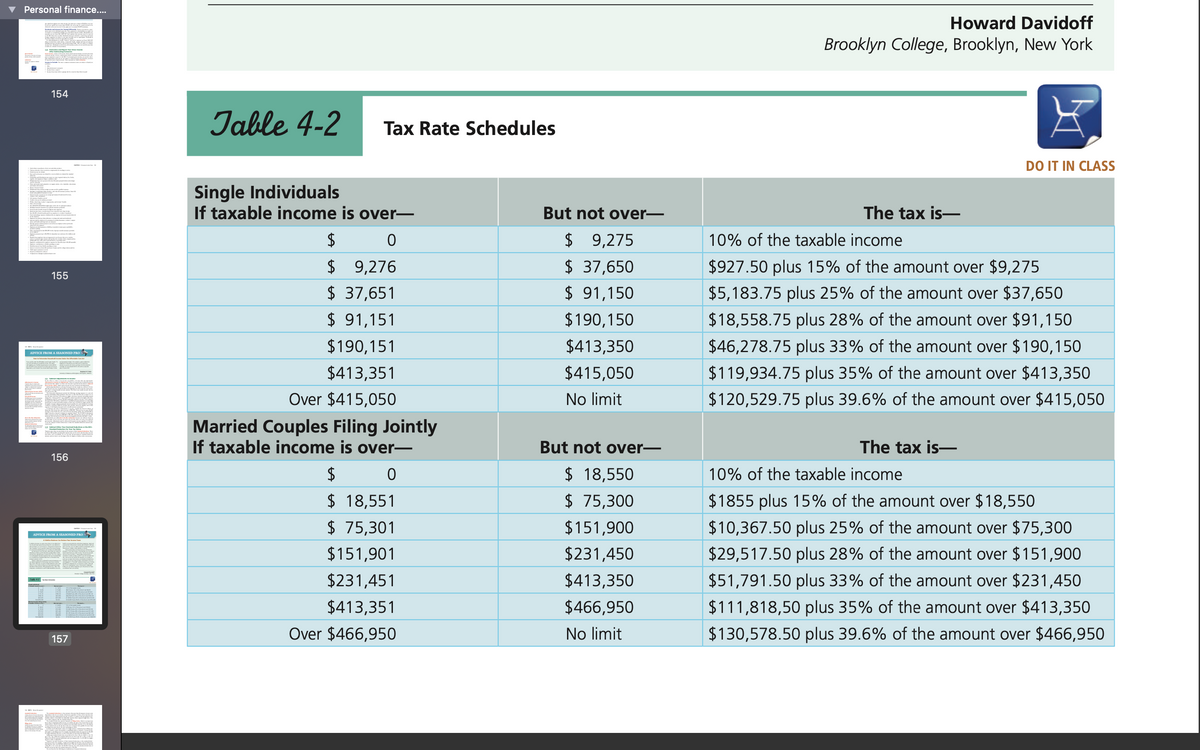

A.) Calculate the Hernandezes’ income tax liability for this year as a joint return (using Table 4-2) given the following information: gross salary income (Victor, $85,000; Maria, $52,000); state income tax refund ($400); interest on checking and savings accounts ($250); holiday bonus from Maria’s employer ($1,000); contributions to qualified retirement accounts ($5,500); itemized deductions (real estate taxes, $4,600; mortgage interest, $6,300; charitable con- tributions, $2,500); and exemptions for themselves and their two children ($4,050 each).

B.) List five additional strategies that Victor and Maria might consider for next year’s tax planning to reduce next year’s tax liability.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images