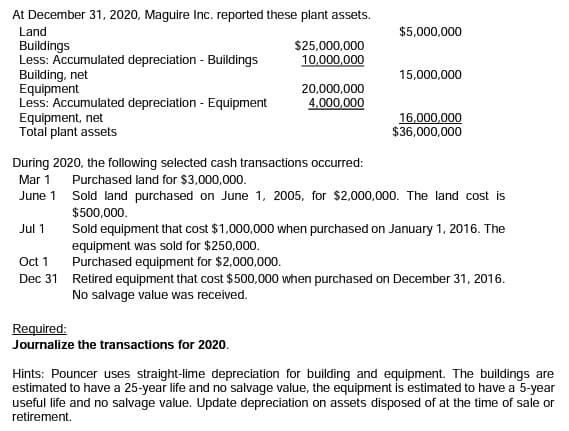

cumulated depreciation - Buildings

| At December 31, 2020, Maguire Inc. reported these plant assets. | ||||

| Land | $5,000,000 | |||

| Buildings | $25,000,000 | |||

| Less: |

10,000,000 | |||

| Building, net | 15,000,000 | |||

| Equipment | 20,000,000 | |||

| Less: Accumulated depreciation - Equipment | 4,000,000 | |||

| Equipment, net | 16,000,000 | |||

| Total plant assets | $36,000,000 | |||

During 2020, the following selected cash transactions occurred:

Mar 1 Purchased land for $3,000,000.

June 1 Sold land purchased on June 1, 2005, for $2,000,000. The land cost is $500,000.

Jul 1 Sold equipment that cost $1,000,000 when purchased on January 1, 2016. The equipment was sold for $250,000.

Oct 1 Purchased equipment for $2,000,000.

Dec 31 Retired equipment that cost $500,000 when purchased on December 31, 2016.

No salvage value was received.

Required:

Journalize the transactions for 2020.

Hints: Pouncer uses straight-lime depreciation for building and equipment. The buildings are

estimated to have a 25-year life and no salvage value, the equipment is estimated to have a 5-year

useful life and no salvage value. Update depreciation on assets disposed of at the time of sale or retirement.

Step by step

Solved in 3 steps