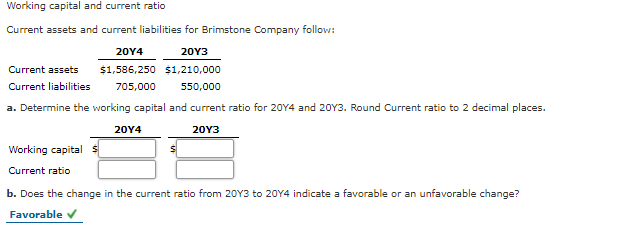

Current assets and current liabilities for Brimstone Company follow: 20Υ4 20Y3 Current assets $1,586,250 $1,210,000 Current liabilities 705,000 550,000 a. Determine the working capital and current ratio for 20Y4 and 20Y3. Round Current ratio to 2 decimal places. 20Y4 20Y3 Working capital $ Current ratio b. Does the change in the current ratio from 20Y3 to 20Y4 indicate a favorable or an unfavorable change? Favorable v

Current assets and current liabilities for Brimstone Company follow: 20Υ4 20Y3 Current assets $1,586,250 $1,210,000 Current liabilities 705,000 550,000 a. Determine the working capital and current ratio for 20Y4 and 20Y3. Round Current ratio to 2 decimal places. 20Y4 20Y3 Working capital $ Current ratio b. Does the change in the current ratio from 20Y3 to 20Y4 indicate a favorable or an unfavorable change? Favorable v

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.3.1P: Effect of transactions on current position analysis Data pertaining to the current position of...

Related questions

Question

Practice Pack

Transcribed Image Text:Working capital and current ratio

Current assets and current liabilities for Brimstone Company follow:

20Y4

20Y3

Current assets

$1,586,250 $1,210,000

Current liabilities

705,000

550,000

a. Determine the working capital and current ratio for 20Y4 and 20Y3. Round Current ratio to 2 decimal places.

20Y4

20Y3

Working capital s

Current ratio

b. Does the change in the current ratio from 20Y3 to 20Y4 indicate a favorable or an unfavorable change?

Favorable v

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning