the total current assets of Gorgan company is equal to $540,000. This includes cash of $40,000, inventories of $250,000, and accounts receivables of $250,000. the current liabilities of the company is equal to $400,000. Calculate the companies quick ratio (round to 2 decimal places). A) 1.35 B) 1.25 C) 0.63 D) 0.73

the total current assets of Gorgan company is equal to $540,000. This includes cash of $40,000, inventories of $250,000, and accounts receivables of $250,000. the current liabilities of the company is equal to $400,000. Calculate the companies quick ratio (round to 2 decimal places). A) 1.35 B) 1.25 C) 0.63 D) 0.73

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 19P

Related questions

Question

Practice Pack

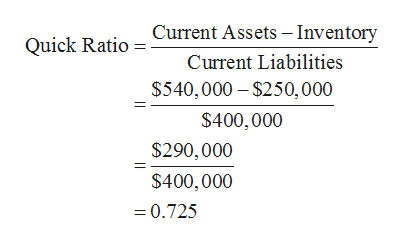

the total current assets of Gorgan company is equal to $540,000. This includes cash of $40,000, inventories of $250,000, and accounts receivables of $250,000. the current liabilities of the company is equal to $400,000. Calculate the companies quick ratio (round to 2 decimal places).

A) 1.35

B) 1.25

C) 0.63

D) 0.73

Expert Solution

Step 1

Hence, the correct option is (D). The quick ratio is 0.73. It is obtained by dividing current assets minus inventory by current liabilities.

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps with 1 images

Better your learning with

Practice Pack

Better your learning with

Practice Pack

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning