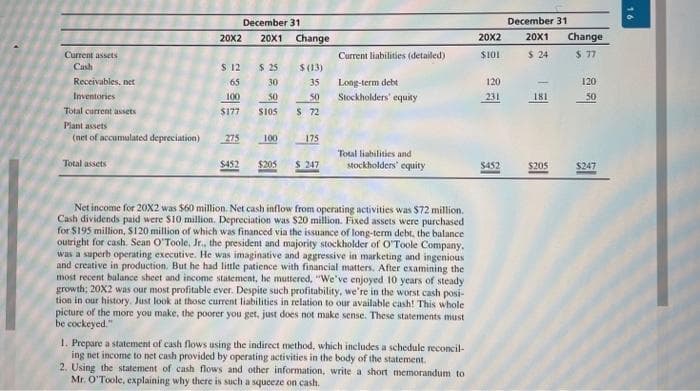

Current assets Cash Receivables, net Inventories Total current assets Plant assets (net of accumulated depreciation) Total assets 20X2 20X1 $ 12 65 100 $177 December 31 275 $ 25 30 50 $105 100 Change $ (13) 35 50 $ 72 175 $452 $205 $ 247 Current liabilities (detailed) Long-term debt. Stockholders' equity Total liabilities and stockholders' equity Net income for 20X2 was $60 million. Net cash inflow from operating activities was $72 million. Cash dividends paid were $10 million. Depreciation was $20 million. Fixed assets were purchased for $195 million, $120 million of which was financed via the issuance of long-term debt, the balance outright : cash. Sean O'Toole, Jr., the president and majority stockholder of O'Toole Company. was a superb operating executive. He was imaginative and aggressive in marketing and ingenious and creative in production. But he had little patience with financial matters. After examining the most recent balance sheet and income statement, he muttered. "We've enjoyed 10 years of steady growth; 20X2 was our most profitable ever. Despite such profitability, we're in the worst cash posi- tion in our history. Just look at those current liabilities in relation to our available cash! This whole picture of the more you make, the poorer you get, just does not make sense. These statements must be cockeyed." 1. Prepare a statement of cash flows using the indirect method, which includes a schedule reconcil- ing net income to net cash provided by operating activities in the body of the statement. 2. Using the statement of cash flows and other information, write a short memorandum to Mr. O'Toole, explaining why there is such a squeeze on cash. December 31 20X2 20X1 Change $101 $24 $ 77 120 231 $452 181 $205 - 120 50 $247

Current assets Cash Receivables, net Inventories Total current assets Plant assets (net of accumulated depreciation) Total assets 20X2 20X1 $ 12 65 100 $177 December 31 275 $ 25 30 50 $105 100 Change $ (13) 35 50 $ 72 175 $452 $205 $ 247 Current liabilities (detailed) Long-term debt. Stockholders' equity Total liabilities and stockholders' equity Net income for 20X2 was $60 million. Net cash inflow from operating activities was $72 million. Cash dividends paid were $10 million. Depreciation was $20 million. Fixed assets were purchased for $195 million, $120 million of which was financed via the issuance of long-term debt, the balance outright : cash. Sean O'Toole, Jr., the president and majority stockholder of O'Toole Company. was a superb operating executive. He was imaginative and aggressive in marketing and ingenious and creative in production. But he had little patience with financial matters. After examining the most recent balance sheet and income statement, he muttered. "We've enjoyed 10 years of steady growth; 20X2 was our most profitable ever. Despite such profitability, we're in the worst cash posi- tion in our history. Just look at those current liabilities in relation to our available cash! This whole picture of the more you make, the poorer you get, just does not make sense. These statements must be cockeyed." 1. Prepare a statement of cash flows using the indirect method, which includes a schedule reconcil- ing net income to net cash provided by operating activities in the body of the statement. 2. Using the statement of cash flows and other information, write a short memorandum to Mr. O'Toole, explaining why there is such a squeeze on cash. December 31 20X2 20X1 Change $101 $24 $ 77 120 231 $452 181 $205 - 120 50 $247

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Please help me

Transcribed Image Text:Current assets

Cash

Receivables, net

Inventories

Total current assets

Plant assets

(net of accumulated depreciation)

Total assets

20X2 20X1

$ 12

65

100

$177

December 31

275

$ 25

30

50

$105

100

Change

$(13)

35

50

$ 72

175

$452 $205 $ 247

Current liabilities (detailed)

Long-term debt

Stockholders' equity

Total liabilities and

stockholders' equity

Net income for 20X2 was $60 million. Net cash inflow from operating activities was $72 million.

Cash dividends paid were $10 million. Depreciation was $20 million. Fixed assets were purchased

for $195 million, $120 million of which was financed via the issuance of long-term debt, the balance

outright for cash. Sean O'Toole, Jr., the president and majority stockholder of O'Toole Company.

was a superb operating executive. He was imaginative and aggressive in marketing and ingenious

and creative in production. But he had little patience with financial matters. After examining the

most recent balance sheet and income statement, he muttered. "We've enjoyed 10 years of steady

growth; 20X2 was our most profitable ever. Despite such profitability, we're in the worst cash posi-

tion in our history. Just look at those current liabilities in relation to our available cash! This whole

picture of the more you make, the poorer you get, just does not make sense. These statements must

be cockeyed."

1. Prepare a statement of cash flows using the indirect method, which includes a schedule reconcil-

ing net income to net cash provided by operating activities in the body of the statement.

2. Using the statement of cash flows and other information, write a short memorandum to

Mr. O'Toole, explaining why there is such a squeeze on cash.

December 31

20X2 20X1 Change

$101

$ 24

$.77

120

231

$452

1

181

$205

120

50

$247

16

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education