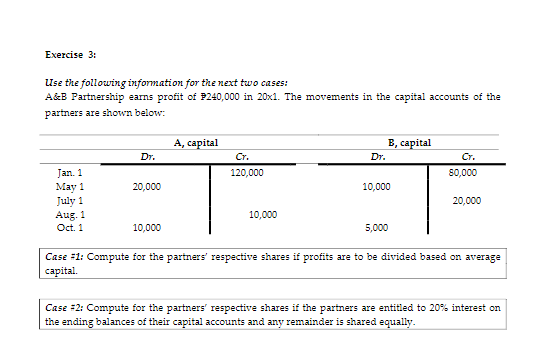

Exercise 3: Use the following information for the next two cases: A&B Partnership earns profit of $240,000 in 20x1. The movements in the capital accounts of the partners are shown below: Jan. 1 May 1 July 1 Aug. 1 Oct. 1 DT. 20,000 10,000 A, capital Cr. 120,000 10,000 Dr. B, capital 10,000 5,000 CT. 80,000 20,000 Case #1: Compute for the partners' respective shares if profits are to be divided based on average capital. Case #2: Compute for the partners' respective shares if the partners are entitled to 20% interest on the ending balances of their capital accounts and any remainder is shared equally.

Exercise 3: Use the following information for the next two cases: A&B Partnership earns profit of $240,000 in 20x1. The movements in the capital accounts of the partners are shown below: Jan. 1 May 1 July 1 Aug. 1 Oct. 1 DT. 20,000 10,000 A, capital Cr. 120,000 10,000 Dr. B, capital 10,000 5,000 CT. 80,000 20,000 Case #1: Compute for the partners' respective shares if profits are to be divided based on average capital. Case #2: Compute for the partners' respective shares if the partners are entitled to 20% interest on the ending balances of their capital accounts and any remainder is shared equally.

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

Please solve what is asked in the two cases. Thank you!

Transcribed Image Text:Exercise 3:

Use the following information for the next two cases:

A&B Partnership earns profit of $240,000 in 20x1. The movements in the capital accounts of the

partners are shown below:

Jan. 1

May 1

July 1

Aug. 1

Oct. 1

DT.

20,000

10,000

A, capital

Cr.

120,000

10,000

Dr.

B, capital

10,000

5,000

CT.

80,000

20,000

Case #1: Compute for the partners' respective shares if profits are to be divided based on average

capital.

Case #2: Compute for the partners' respective shares if the partners are entitled to 20% interest on

the ending balances of their capital accounts and any remainder is shared equally.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,