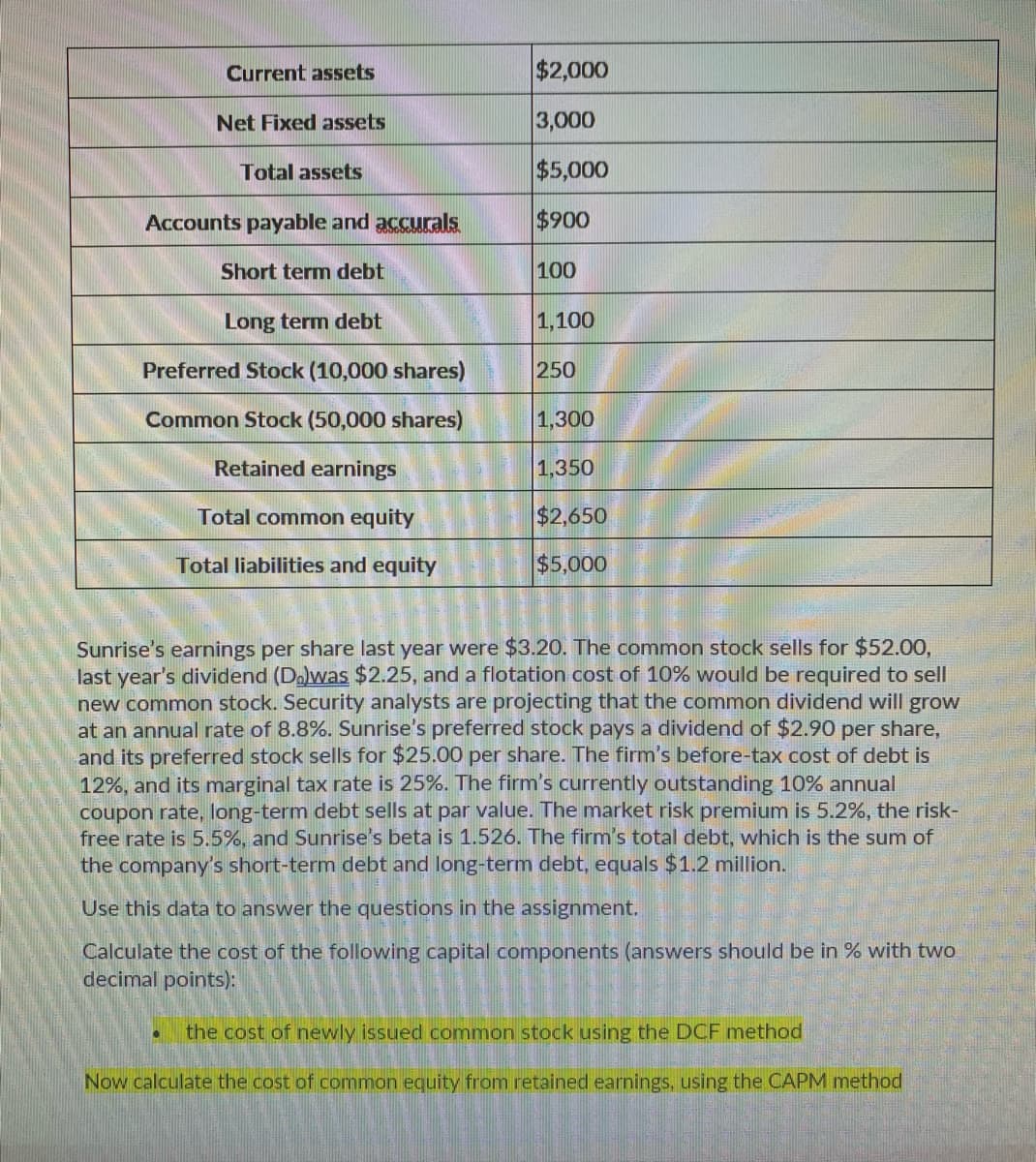

Current assets Net Fixed assets Total assets Accounts payable and accurals. Short term debt Long term debt Preferred Stock (10,000 shares) Common Stock (50,000 shares) Retained earnings Total common equity Total liabilities and equity $2,000 3,000 $5,000 $900 100 1,100 250 1,300 1,350 $2,650 $5,000 Sunrise's earnings per share last year were $3.20. The common stock sells for $52.00, last year's dividend (D)was $2.25, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 8.8%. Sunrise's preferred stock pays a dividend of $2.90 per share, and its preferred stock sells for $25.00 per share. The firm's before-tax cost of debt is 12%, and its marginal tax rate is 25%. The firm's currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5.2%, the risk- free rate is 5.5%, and Sunrise's beta is 1.526. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1.2 million. Use this data to answer the questions in the assignment. Calculate the cost of the following capital components (answers should be in % with two decimal points): the cost of newly issued common stock using the DCF method Now calculate the cost of common equity from retained earnings, using the CAPM method

Current assets Net Fixed assets Total assets Accounts payable and accurals. Short term debt Long term debt Preferred Stock (10,000 shares) Common Stock (50,000 shares) Retained earnings Total common equity Total liabilities and equity $2,000 3,000 $5,000 $900 100 1,100 250 1,300 1,350 $2,650 $5,000 Sunrise's earnings per share last year were $3.20. The common stock sells for $52.00, last year's dividend (D)was $2.25, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 8.8%. Sunrise's preferred stock pays a dividend of $2.90 per share, and its preferred stock sells for $25.00 per share. The firm's before-tax cost of debt is 12%, and its marginal tax rate is 25%. The firm's currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5.2%, the risk- free rate is 5.5%, and Sunrise's beta is 1.526. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1.2 million. Use this data to answer the questions in the assignment. Calculate the cost of the following capital components (answers should be in % with two decimal points): the cost of newly issued common stock using the DCF method Now calculate the cost of common equity from retained earnings, using the CAPM method

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 16E: Contributed Capital Adams Companys records provide the following information on December 31, 2019:...

Related questions

Question

Transcribed Image Text:Current assets

Net Fixed assets

Total assets

Accounts payable and accurals.

Short term debt

Long term debt

Preferred Stock (10,000 shares)

Common Stock (50,000 shares)

Retained earnings

.

Total common equity

Total liabilities and equity

$2,000

3,000

$5,000

$900

100

1,100

250

1,300

1,350

$2,650

$5,000

Sunrise's earnings per share last year were $3.20. The common stock sells for $52.00,

last year's dividend (Do)was $2.25, and a flotation cost of 10% would be required to sell

new common stock. Security analysts are projecting that the common dividend will grow

at an annual rate of 8.8%. Sunrise's preferred stock pays a dividend of $2.90 per share,

and its preferred stock sells for $25.00 per share. The firm's before-tax cost of debt is

12%, and its marginal tax rate is 25%. The firm's currently outstanding 10% annual

coupon rate, long-term debt sells at par value. The market risk premium is 5.2%, the risk-

free rate is 5.5%, and Sunrise's beta is 1.526. The firm's total debt, which is the sum of

the company's short-term debt and long-term debt, equals $1.2 million.

Use this data to answer the questions in the assignment.

Calculate the cost of the following capital components (answers should be in % with two

decimal points):

the cost of newly issued common stock using the DCF method

Now calculate the cost of common equity from retained earnings, using the CAPM method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning