1. Equal end-of-year payments of P2,638 each are being made on a P10,000 loan at 10% effective interest per year. a. How many payments are required to repay the entire loan? b. Immediately after the second payment, what lump-sum amount would completely pay off the loan? 2. A contract has been signed to lease a building at P360,000 per year with an annual increase of P3,000 for 10 years. Payments are to be made at the end of each year, starting one year from now. The prevailing interest rate is 7%. What lump-sum paid today would be equivalent to the ten-year lease payment plan?

1. Equal end-of-year payments of P2,638 each are being made on a P10,000 loan at 10% effective interest per year. a. How many payments are required to repay the entire loan? b. Immediately after the second payment, what lump-sum amount would completely pay off the loan? 2. A contract has been signed to lease a building at P360,000 per year with an annual increase of P3,000 for 10 years. Payments are to be made at the end of each year, starting one year from now. The prevailing interest rate is 7%. What lump-sum paid today would be equivalent to the ten-year lease payment plan?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 9E: Each of the following scenarios is independent. All cash flows are after-tax cash flows. Required:...

Related questions

Question

Pls answer ty

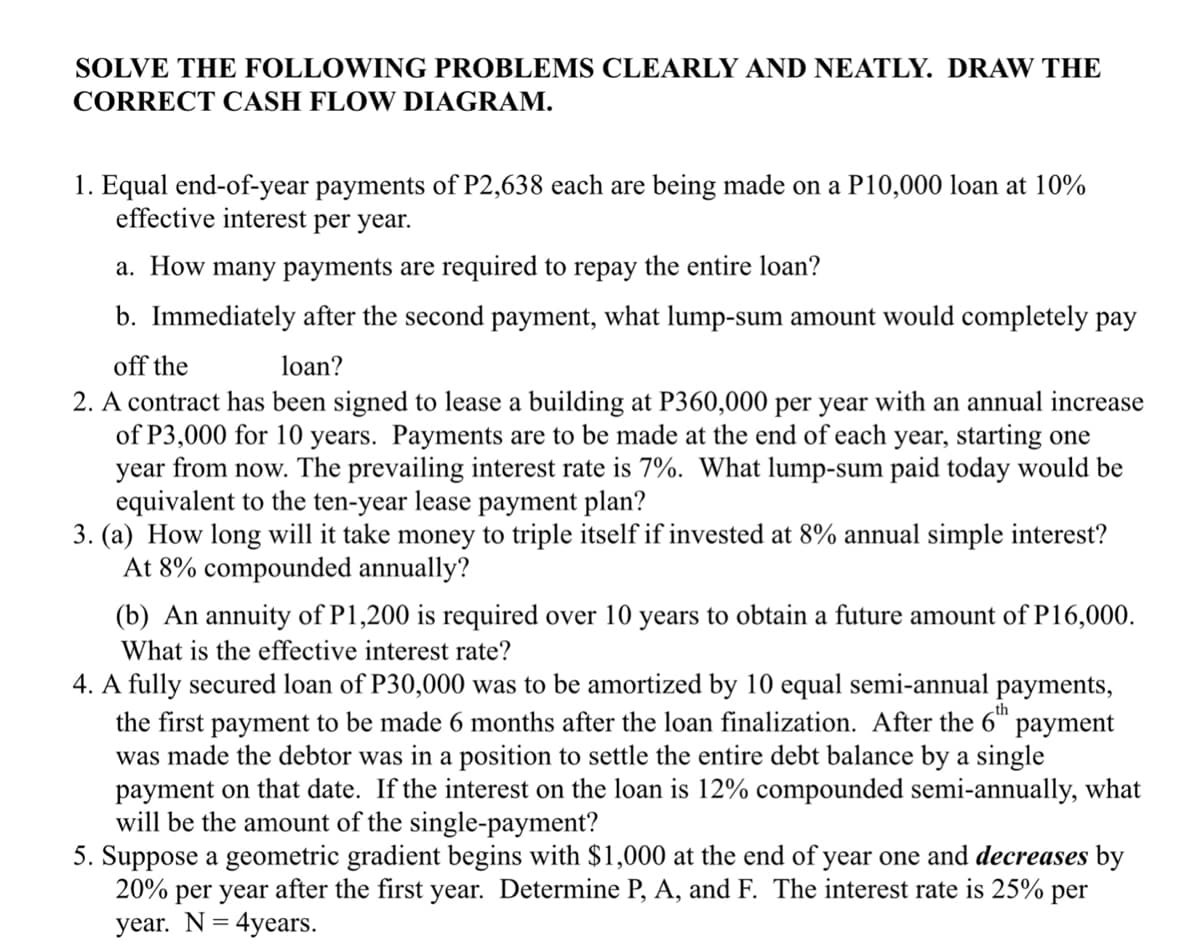

Transcribed Image Text:SOLVE THE FOLLOWING PROBLEMS CLEARLY AND NEATLY. DRAW THE

CORRECT CASH FLOW DIAGRAM.

1. Equal end-of-year payments of P2,638 each are being made on a P10,000 loan at 10%

effective interest per year.

a. How many payments are required to repay the entire loan?

b. Immediately after the second payment, what lump-sum amount would completely pay

off the

loan?

2. A contract has been signed to lease a building at P360,000 per year with an annual increase

of P3,000 for 10 years. Payments are to be made at the end of each year, starting one

year from now. The prevailing interest rate is 7%. What lump-sum paid today would be

equivalent to the ten-year lease payment plan?

3. (a) How long will it take money to triple itself if invested at 8% annual simple interest?

At 8% compounded annually?

(b) An annuity of P1,200 is required over 10 years to obtain a future amount of P16,000.

What is the effective interest rate?

4. A fully secured loan of P30,000 was to be amortized by 10 equal semi-annual payments,

the first payment to be made 6 months after the loan finalization. After the 6th payment

was made the debtor was in a position to settle the entire debt balance by a single

payment on that date. If the interest on the loan is 12% compounded semi-annually, what

will be the amount of the single-payment?

5. Suppose a geometric gradient begins with $1,000 at the end of year one and decreases by

20% per year after the first year. Determine P, A, and F. The interest rate is 25% per

year. N= 4years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,