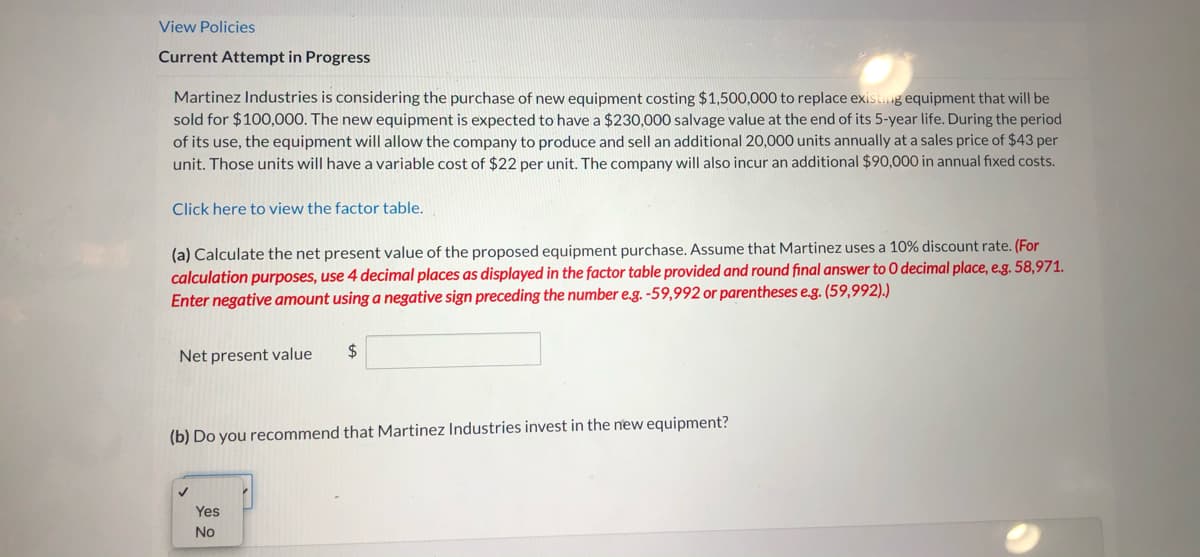

Current Attempt in Progress Martinez Industries is considering the purchase of new equipment costing $1,500,000 to replace existng equipment that will be sold for $100,000. The new equipment is expected to have a $230,000 salvage value at the end of its 5-year life. During the period of its use, the equipment will allow the company to produce and sell an additional 20,000 units annually at a sales price of $43 per unit. Those units will have a variable cost of $22 per unit. The company will also incur an additional $90,000 in annual fixed costs. Click here to view the factor table. (a) Calculate the net present value of the proposed equipment purchase. Assume that Martinez uses a 10% discount rate. (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to 0 decimal place, eg. 58,971. Enter negative amount using a negative sign preceding the number e.g. -59,992 or parentheses e.g. (59,992).) Net present value $ (b) Do you recommend that Martinez Industries invest in the new equipment? Yes No

Current Attempt in Progress Martinez Industries is considering the purchase of new equipment costing $1,500,000 to replace existng equipment that will be sold for $100,000. The new equipment is expected to have a $230,000 salvage value at the end of its 5-year life. During the period of its use, the equipment will allow the company to produce and sell an additional 20,000 units annually at a sales price of $43 per unit. Those units will have a variable cost of $22 per unit. The company will also incur an additional $90,000 in annual fixed costs. Click here to view the factor table. (a) Calculate the net present value of the proposed equipment purchase. Assume that Martinez uses a 10% discount rate. (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to 0 decimal place, eg. 58,971. Enter negative amount using a negative sign preceding the number e.g. -59,992 or parentheses e.g. (59,992).) Net present value $ (b) Do you recommend that Martinez Industries invest in the new equipment? Yes No

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 11P: REPLACEMENT ANALYSIS St. Johns River Shipyards is considering the replacement of an 8-year-old...

Related questions

Question

I could use a hand with this

Transcribed Image Text:View Policies

Current Attempt in Progress

Martinez Industries is considering the purchase of new equipment costing $1,500,000 to replace existing equipment that will be

sold for $100,000. The new equipment is expected to have a $230,000 salvage value at the end of its 5-year life. During the period

of its use, the equipment will allow the company to produce and sell an additional 20,000 units annually at a sales price of $43 per

unit. Those units will have a variable cost of $22 per unit. The company will also incur an additional $90,000 in annual fixed costs.

Click here to view the factor table.

(a) Calculate the net present value of the proposed equipment purchase. Assume that Martinez uses a 10% discount rate. (For

calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to 0 decimal place, e.g. 58,971.

Enter negative amount using a negative sign preceding the number e.g. -59,992 or parentheses e.g. (59,992).)

Net present value

2$

(b) Do you recommend that Martinez Industries invest in the new equipment?

Yes

No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning