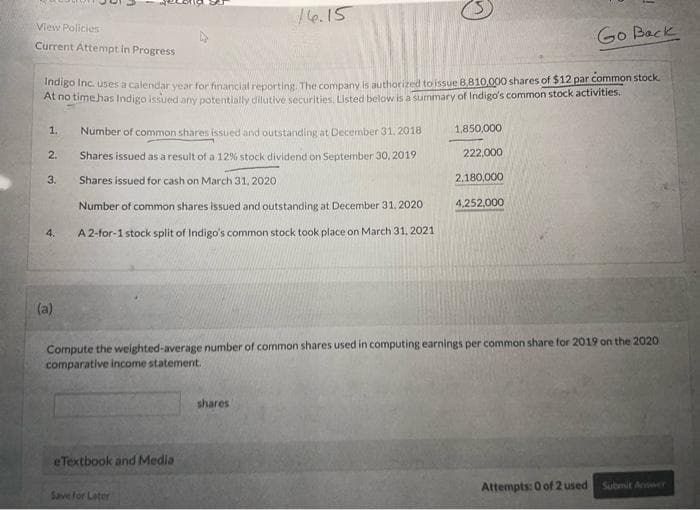

Current Attempt In Progress mungo inc. uses a calendar year for financial reporting. The company is authorized to issue 8.810,000 shares of $12 par common stock. At ho timehas Indigo issued any potentially dilutive securities Listed below is a summary of Indigo's common stock activities. 1. Number of common shares issued and outstanding at December 31. 2018 1,850,000 2. Shares issued as a result of a 12% stock dividend on September 30, 2019 222,000 3. Shares issued for cash on March 31, 2020 2,180,000 Number of common shares isued and outstanding at December 31, 2020 4.252,000 4. A 2-for-1 stock split of Indigo's common stock took place on March 31, 2021 (a) Compute the weighted-average number of common shares used in computing earnings per common share for 2019 on the 2020 comparative income statement. shares

Current Attempt In Progress mungo inc. uses a calendar year for financial reporting. The company is authorized to issue 8.810,000 shares of $12 par common stock. At ho timehas Indigo issued any potentially dilutive securities Listed below is a summary of Indigo's common stock activities. 1. Number of common shares issued and outstanding at December 31. 2018 1,850,000 2. Shares issued as a result of a 12% stock dividend on September 30, 2019 222,000 3. Shares issued for cash on March 31, 2020 2,180,000 Number of common shares isued and outstanding at December 31, 2020 4.252,000 4. A 2-for-1 stock split of Indigo's common stock took place on March 31, 2021 (a) Compute the weighted-average number of common shares used in computing earnings per common share for 2019 on the 2020 comparative income statement. shares

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 4SEA: STOCK DIVIDENDS Kaufman Company currently has 200,000 shares of 1 par common stock outstanding. On...

Related questions

Question

help accounting 3304

Transcribed Image Text:/6.15

View Policies

Go Back

Current Attempt in Progress

mungo inc. uses a calendar year for financial reporting. The company is authorized to issue 8.810,000 shares of $12 par common stock.

ALIO timehas Indigo issued any potentially dilutive securities, Listed below is a surmmary of Indigo's common stock activities.

1.

Number of common shares issued and outstanding at December 31. 2018

1,850,000

2.

Shares issued as a result of a 12% stock dividend on September 30, 2019

222,000

Shares issued for cash on March 31, 2020

2,180,000

3.

Number of common shares isued and outstanding at December 31, 2020

4,252,000

4.

A 2-for-1 stock split of Indigo's common stock took place on March 31, 2021

(a)

Compute the weighted-average number of common shares used in computing earnings per common share for 2019 on the 2020

comparative income statement.

shares

eTextbook and Media

Attempts: 0 of 2 used

Submit Awer

Save for Later

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning