Current Attempt in Progress Sonya Jared opened a law office on July 1, 2022. On July 31, the balance sheet showed Cash $5,000, Accounts Receivable $1,500, Supplies $500, Equipment $6,000, Accounts Payable $4,200, and Owner's Capital $8,800. During August, the following transactions occurred. 1. 2. 3. 4. 5. 6. 7. 8. Collected $1,200 of accounts receivable. Paid $2,800 cash on accounts payable. Recognized revenue of $7,500 of which $4,000 is collected in cash and the balance is due in September. Purchased additional equipment for $2,000, paying $400 in cash and the balance on account. Paid salaries $2,800, rent for August $900, and advertising expenses $400. Withdrew $700 in cash for personal use. Received $2,000 from Standard Federal Bank-money borrowed on a note payable. Incurred utility expenses for month on account $270.

Current Attempt in Progress Sonya Jared opened a law office on July 1, 2022. On July 31, the balance sheet showed Cash $5,000, Accounts Receivable $1,500, Supplies $500, Equipment $6,000, Accounts Payable $4,200, and Owner's Capital $8,800. During August, the following transactions occurred. 1. 2. 3. 4. 5. 6. 7. 8. Collected $1,200 of accounts receivable. Paid $2,800 cash on accounts payable. Recognized revenue of $7,500 of which $4,000 is collected in cash and the balance is due in September. Purchased additional equipment for $2,000, paying $400 in cash and the balance on account. Paid salaries $2,800, rent for August $900, and advertising expenses $400. Withdrew $700 in cash for personal use. Received $2,000 from Standard Federal Bank-money borrowed on a note payable. Incurred utility expenses for month on account $270.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter3: The Double-entry Framework

Section: Chapter Questions

Problem 6SEB: TRANSACTION ANALYSIS George Atlas started a business on June 1,20--. Analyze the following...

Related questions

Question

22.

Subject:- Accounting

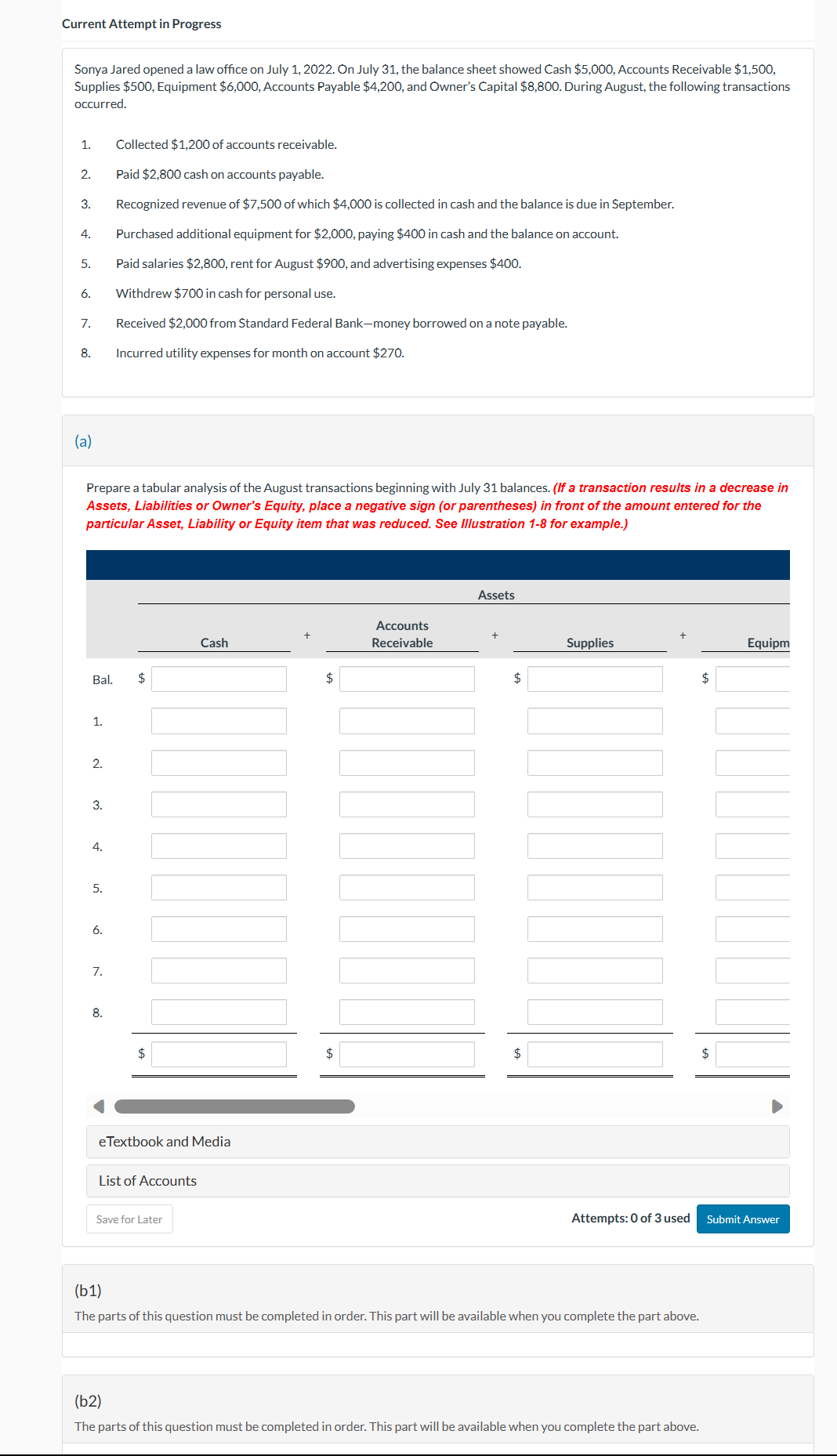

Transcribed Image Text:Current Attempt in Progress

Sonya Jared opened a law office on July 1, 2022. On July 31, the balance sheet showed Cash $5,000, Accounts Receivable $1,500,

Supplies $500, Equipment $6,000, Accounts Payable $4,200, and Owner's Capital $8,800. During August, the following transactions

occurred.

Collected $1,200 of accounts receivable.

Paid $2,800 cash on accounts payable.

3. Recognized revenue of $7,500 of which $4,000 is collected in cash and the balance is due in September.

Purchased additional equipment for $2,000, paying $400 in cash and the balance on account.

Paid salaries $2,800, rent for August $900, and advertising expenses $400.

Withdrew $700 in cash for personal use.

1.

2.

4.

5.

6.

7.

8.

(a)

Prepare a tabular analysis of the August transactions beginning with July 31 balances. (If a transaction results in a decrease in

Assets, Liabilities or Owner's Equity, place a negative sign (or parentheses) in front of the amount entered for the

particular Asset, Liability or Equity item that was reduced. See Illustration 1-8 for example.)

Bal. $

1.

2.

3.

4.

5.

6.

Received $2,000 from Standard Federal Bank-money borrowed on a note payable.

Incurred utility expenses for month on account $270.

7.

8.

$

eTextbook and Media

List of Accounts

Cash

Save for Later

$

$

Accounts

Receivable

Assets

$

$

Supplies

WILL

Attempts: 0 of 3 used

(b1)

The parts of this question must be completed in order. This part will be available when you complete the part above.

(b2)

The parts of this question must be completed in order. This part will be available when you complete the part above.

$

$

Equipm

Submit Answer

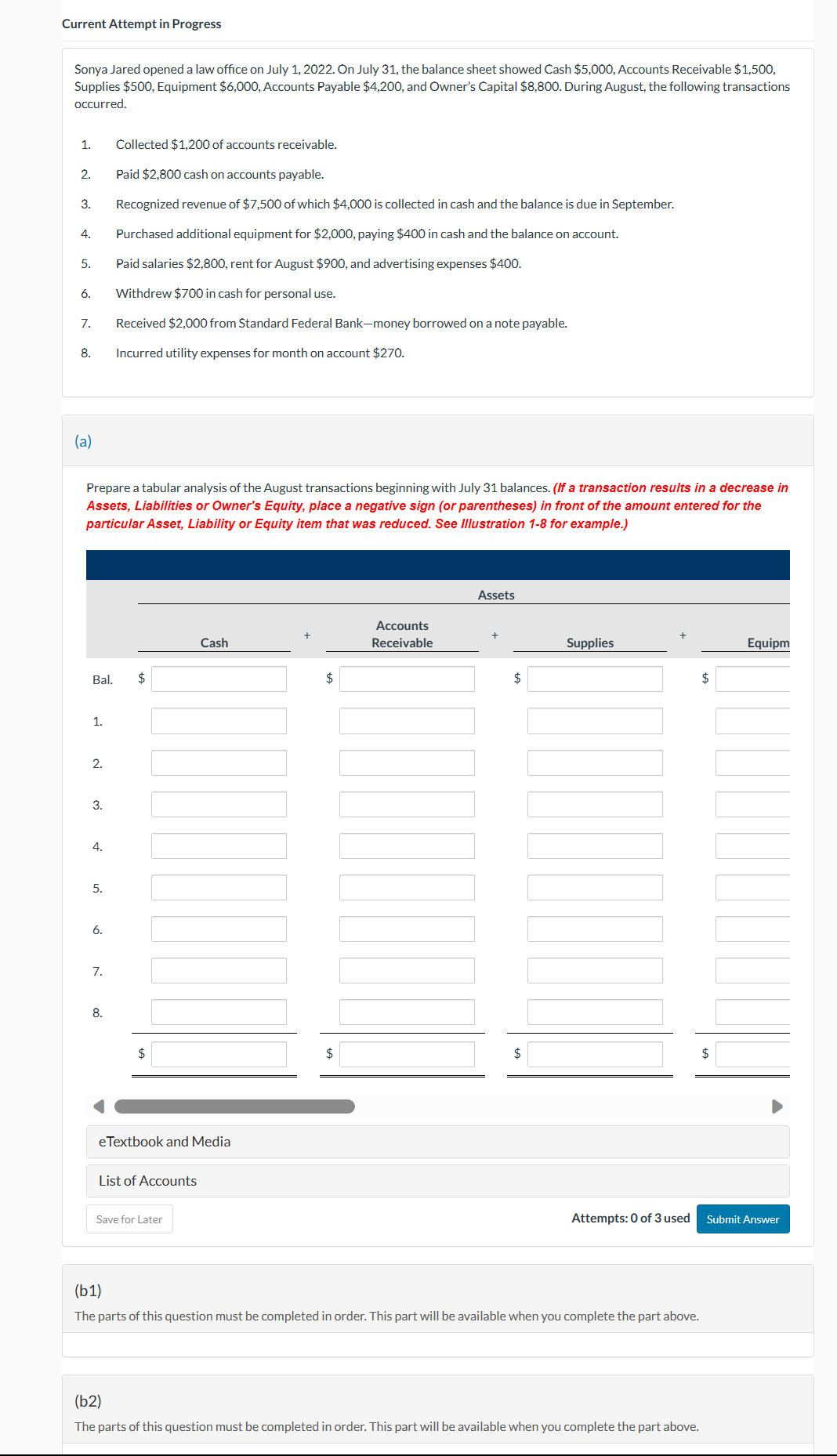

Transcribed Image Text:Current Attempt in Progress

Sonya Jared opened a law office on July 1, 2022. On July 31, the balance sheet showed Cash $5,000, Accounts Receivable $1,500,

Supplies $500, Equipment $6,000, Accounts Payable $4,200, and Owner's Capital $8,800. During August, the following transactions

occurred.

Collected $1,200 of accounts receivable.

Paid $2,800 cash on accounts payable.

3. Recognized revenue of $7,500 of which $4,000 is collected in cash and the balance is due in September.

Purchased additional equipment for $2,000, paying $400 in cash and the balance on account.

Paid salaries $2,800, rent for August $900, and advertising expenses $400.

Withdrew $700 in cash for personal use.

1.

2.

4.

5.

6.

7.

8.

(a)

Prepare a tabular analysis of the August transactions beginning with July 31 balances. (If a transaction results in a decrease in

Assets, Liabilities or Owner's Equity, place a negative sign (or parentheses) in front of the amount entered for the

particular Asset, Liability or Equity item that was reduced. See Illustration 1-8 for example.)

Bal. $

1.

2.

3.

4.

5.

6.

Received $2,000 from Standard Federal Bank-money borrowed on a note payable.

Incurred utility expenses for month on account $270.

7.

8.

$

eTextbook and Media

List of Accounts

Cash

Save for Later

$

$

Accounts

Receivable

Assets

$

$

Supplies

WILL

Attempts: 0 of 3 used

(b1)

The parts of this question must be completed in order. This part will be available when you complete the part above.

(b2)

The parts of this question must be completed in order. This part will be available when you complete the part above.

$

$

Equipm

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College