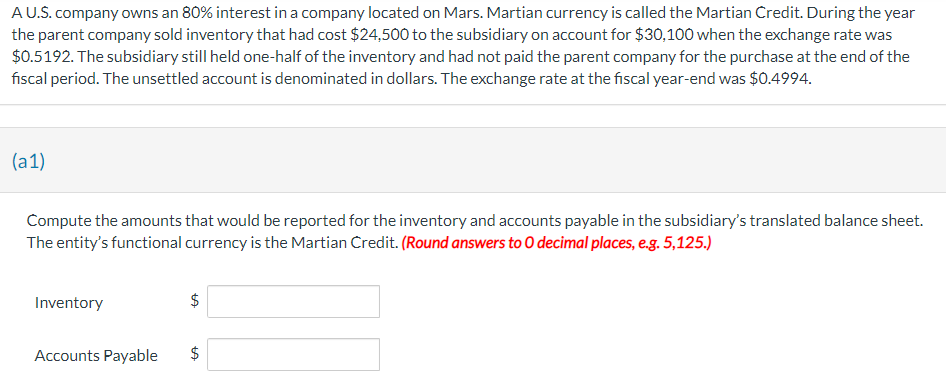

company owns company locate the year the parent company sold inventory that had cost $24,500 to the subsidiary on account for $30,100 when the exchange rate was $0.5192. The subsidiary still held one-half of the inventory and had not paid the parent company for the purchase at the end of the fiscal period. The unsettled account is denominated in dollars. The exchange rate at the fiscal year-end was $0.4994. (a1) Compute the amounts that would be reported for the inventory and accounts payable in the subsidiary's translated balance sheet. The entity's functional currency is the Martian Credit. (Round answers to 0 decimal places, e.g. 5,125.) Inventory Accounts Payable $ $ LA

company owns company locate the year the parent company sold inventory that had cost $24,500 to the subsidiary on account for $30,100 when the exchange rate was $0.5192. The subsidiary still held one-half of the inventory and had not paid the parent company for the purchase at the end of the fiscal period. The unsettled account is denominated in dollars. The exchange rate at the fiscal year-end was $0.4994. (a1) Compute the amounts that would be reported for the inventory and accounts payable in the subsidiary's translated balance sheet. The entity's functional currency is the Martian Credit. (Round answers to 0 decimal places, e.g. 5,125.) Inventory Accounts Payable $ $ LA

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter8: Investing Activities

Section: Chapter Questions

Problem 25PC

Related questions

Question

Sd

Subject: acounting

Transcribed Image Text:A U.S. company owns an 80% interest in a company located on Mars. Martian currency is called the Martian Credit. During the year

the parent company sold inventory that had cost $24,500 to the subsidiary on account for $30,100 when the exchange rate was

$0.5192. The subsidiary still held one-half of the inventory and had not paid the parent company for the purchase at the end of the

fiscal period. The unsettled account is denominated in dollars. The exchange rate at the fiscal year-end was $0.4994.

(a1)

Compute the amounts that would be reported for the inventory and accounts payable in the subsidiary's translated balance sheet.

The entity's functional currency is the Martian Credit. (Round answers to O decimal places, e.g. 5,125.)

Inventory

Accounts Payable

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning