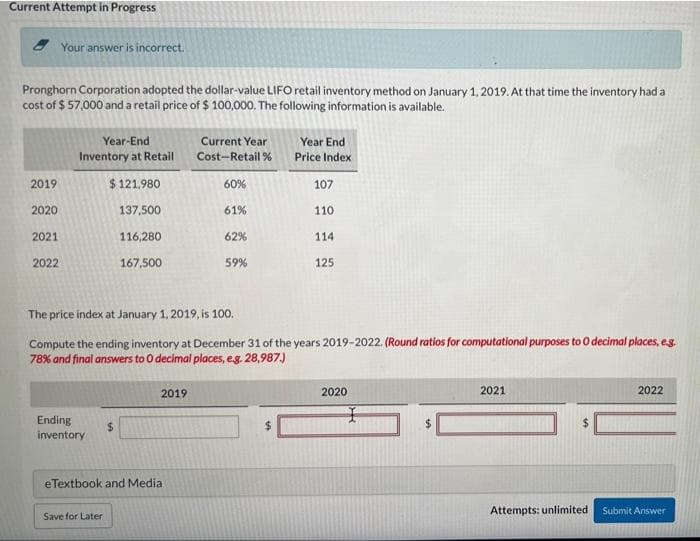

Current Attempt in Progress Your answer is incorrect. Pronghorn Corporation adopted the dollar-value LIFO retail inventory method on January 1, 2019. At that time the inventory had a cost of $ 57,000 and aretail price of $ 100,000. The following information is available. Year-End Current Year Cost-Retail % Price Index Year End Inventory at Retail 2019 $ 121,980 60% 107 2020 137,500 61% 110 2021 116,280 62% 114 2022 167,500 59% 125 The price index at January 1, 2019, is 100. Compute the ending inventory at December 31 of the years 2019-2022. (Round ratios for computational purposes to O decimal places, es. 78% and final answers to O decimal places, es 28,987.) 2019 2020 2021 2022 Ending %24 inventory %24 eTextbook and Media Attempts: unlimited Submit Answer Save for Later

Current Attempt in Progress Your answer is incorrect. Pronghorn Corporation adopted the dollar-value LIFO retail inventory method on January 1, 2019. At that time the inventory had a cost of $ 57,000 and aretail price of $ 100,000. The following information is available. Year-End Current Year Cost-Retail % Price Index Year End Inventory at Retail 2019 $ 121,980 60% 107 2020 137,500 61% 110 2021 116,280 62% 114 2022 167,500 59% 125 The price index at January 1, 2019, is 100. Compute the ending inventory at December 31 of the years 2019-2022. (Round ratios for computational purposes to O decimal places, es. 78% and final answers to O decimal places, es 28,987.) 2019 2020 2021 2022 Ending %24 inventory %24 eTextbook and Media Attempts: unlimited Submit Answer Save for Later

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 11P: Olson Company adopted the dollar-value LIFO method for inventory valuation at the beginning of 2015....

Related questions

Question

Compute the ending inventory at December 31 of the years 2019-2022.

Transcribed Image Text:Current Attempt in Progress

Your answer is incorrect.

Pronghorn Corporation adopted the dollar-value LIFO retail inventory method on January 1, 2019. At that time the inventory had a

cost of $ 57,000 and a retail price of $ 100,000. The following information is available.

Year-End

Current Year

Year End

Inventory at Retail

Cost-Retail % Price Index

2019

$ 121.980

60%

107

2020

137,500

61%

110

2021

116,280

62%

114

2022

167,500

59%

125

The price index at January 1, 2019, is 100.

Compute the ending inventory at December 31 of the years 2019-2022. (Round ratios for computational purposes to O decimal places, eg.

78% and final answers to O decimal places, eg. 28,987.)

2019

2020

2021

2022

Ending

%24

inventory

%24

eTextbook and Media

Attempts: unlimited

Submit Answer

Save for Later

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College