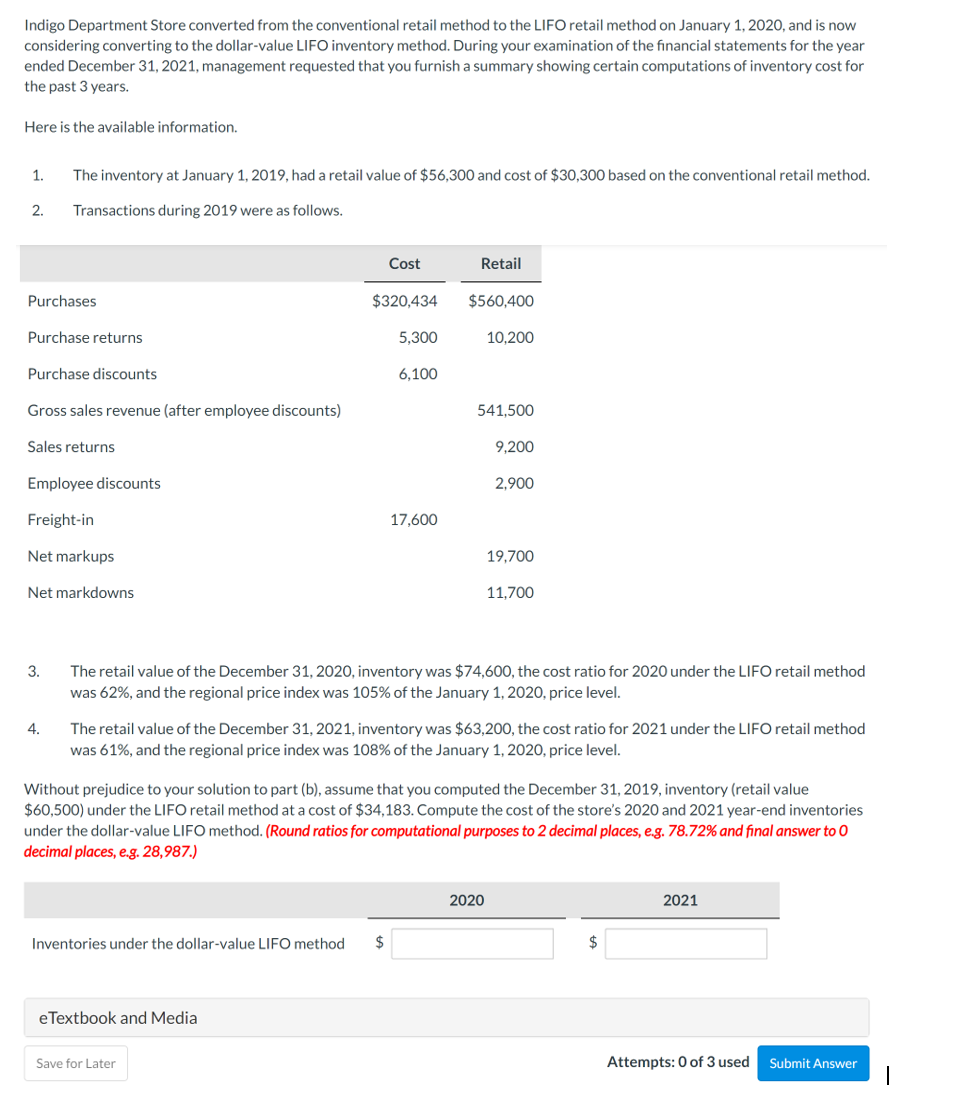

Indigo Department Store converted from the conventional retail method to the LIFO retail method on January 1, 2020, and is now considering converting to the dollar-value LIFO inventory method. During your examination of the financial statements for the year ended December 31, 2021, management requested that you furnish a summary showing certain computations of inventory cost for the past 3 years. Here is the available information. 1. The inventory at January 1, 2019, had a retail value of $56,300 and cost of $30,300 based on the conventional retail method. Transactions during 2019 were as follows. 2. Purchases Purchase returns Purchase discounts Gross sales revenue (after employee discounts) Sales returns Employee discounts Freight-in Net markups Net markdowns 3. 4. Cost $320,434 5,300 6,100 Inventories under the dollar-value LIFO method $ 17,600 Retail $560,400 10,200 541,500 9,200 2,900 The retail value of the December 31, 2020, inventory was $74,600, the cost ratio for 2020 under the LIFO retail method was 62%, and the regional price index was 105% of the January 1, 2020, price level. 2020 19,700 11,700 The retail value of the December 31, 2021, inventory was $63,200, the cost ratio for 2021 under the LIFO retail method was 61%, and the regional price index was 108% of the January 1, 2020, price level. Without prejudice to your solution to part (b), assume that you computed the December 31, 2019, inventory (retail value $60,500) under the LIFO retail method at a cost of $34,183. Compute the cost of the store's 2020 and 2021 year-end inventories under the dollar-value LIFO method. (Round ratios for computational purposes to 2 decimal places, e.g. 78.72% and final answer to O decimal places, e.g. 28,987.) $ 2021

Indigo Department Store converted from the conventional retail method to the LIFO retail method on January 1, 2020, and is now considering converting to the dollar-value LIFO inventory method. During your examination of the financial statements for the year ended December 31, 2021, management requested that you furnish a summary showing certain computations of inventory cost for the past 3 years. Here is the available information. 1. The inventory at January 1, 2019, had a retail value of $56,300 and cost of $30,300 based on the conventional retail method. Transactions during 2019 were as follows. 2. Purchases Purchase returns Purchase discounts Gross sales revenue (after employee discounts) Sales returns Employee discounts Freight-in Net markups Net markdowns 3. 4. Cost $320,434 5,300 6,100 Inventories under the dollar-value LIFO method $ 17,600 Retail $560,400 10,200 541,500 9,200 2,900 The retail value of the December 31, 2020, inventory was $74,600, the cost ratio for 2020 under the LIFO retail method was 62%, and the regional price index was 105% of the January 1, 2020, price level. 2020 19,700 11,700 The retail value of the December 31, 2021, inventory was $63,200, the cost ratio for 2021 under the LIFO retail method was 61%, and the regional price index was 108% of the January 1, 2020, price level. Without prejudice to your solution to part (b), assume that you computed the December 31, 2019, inventory (retail value $60,500) under the LIFO retail method at a cost of $34,183. Compute the cost of the store's 2020 and 2021 year-end inventories under the dollar-value LIFO method. (Round ratios for computational purposes to 2 decimal places, e.g. 78.72% and final answer to O decimal places, e.g. 28,987.) $ 2021

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 9PB: On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as...

Related questions

Topic Video

Question

Transcribed Image Text:Indigo Department Store converted from the conventional retail method to the LIFO retail method on January 1, 2020, and is now

considering converting to the dollar-value LIFO inventory method. During your examination of the financial statements for the year

ended December 31, 2021, management requested that you furnish a summary showing certain computations of inventory cost for

the past 3 years.

Here is the available information.

The inventory at January 1, 2019, had a retail value of $56,300 and cost of $30,300 based on the conventional retail method.

2. Transactions during 2019 were as follows.

1.

Purchases

Purchase returns

Purchase discounts

Gross sales revenue (after employee discounts)

Sales returns

Employee discounts

Freight-in

Net markups

Net markdowns

3.

4.

Cost

$320,434

5,300

6,100

Inventories under the dollar-value LIFO method $

eTextbook and Media

17,600

Save for Later

Retail

$560,400

10,200

541,500

9,200

The retail value of the December 31, 2020, inventory was $74,600, the cost ratio for 2020 under the LIFO retail method

was 62%, and the regional price index was 105% of the January 1, 2020, price level.

2,900

The retail value of the December 31, 2021, inventory was $63,200, the cost ratio for 2021 under the LIFO retail method

was 61%, and the regional price index was 108% of the January 1, 2020, price level.

19,700

Without prejudice to your solution to part (b), assume that you computed the December 31, 2019, inventory (retail value

$60,500) under the LIFO retail method at a cost of $34,183. Compute the cost of the store's 2020 and 2021 year-end inventories

under the dollar-value LIFO method. (Round ratios for computational purposes to 2 decimal places, e.g. 78.72% and final answer to O

decimal places, e.g. 28,987.)

2020

11,700

$

2021

Attempts: 0 of 3 used

Submit Answer

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College