Curry Corporation began operations in the current year. During year it incurred the following expenditures in purchasing materials for producing its product: Purchase price of raw materials = Import duty and other non-refundable purchase taxes = • Refundable purchase taxes = P100,000 Freight costs for bringing the goods from the supplier to the factory raw material storeroom = P300,000 Costs of unloading the materials into the raw material storeroom = P2,000 • Packaging = P200,000 P3,000,000 P800,000 The entity received P53,000 volume rebate from a supplier for purchasing more than P1,500,000 from the supplier during the year. The entity incurred the following additional costs in the production run: • Salary of the machine workers in the factory = • Salary of factory supervisor = P300,000 Depreciation of the factory building and equipment used for production process = P60,000 • Consumables used in the production process = P20,000 Depreciation of vehicle used to transport the goods from the raw materials storeroom to the machine floor = P500,000 P40,000 Factory electricity usage charges = P30,000 Factory rental = P100,000 • Depreciation and maintenance of the entity's vehicle used by the factory supervisor (50 per cent for official use and 50 per cent for personal use) = P20,000. Private use of the vehicle is an employee benefit. %3D

Curry Corporation began operations in the current year. During year it incurred the following expenditures in purchasing materials for producing its product: Purchase price of raw materials = Import duty and other non-refundable purchase taxes = • Refundable purchase taxes = P100,000 Freight costs for bringing the goods from the supplier to the factory raw material storeroom = P300,000 Costs of unloading the materials into the raw material storeroom = P2,000 • Packaging = P200,000 P3,000,000 P800,000 The entity received P53,000 volume rebate from a supplier for purchasing more than P1,500,000 from the supplier during the year. The entity incurred the following additional costs in the production run: • Salary of the machine workers in the factory = • Salary of factory supervisor = P300,000 Depreciation of the factory building and equipment used for production process = P60,000 • Consumables used in the production process = P20,000 Depreciation of vehicle used to transport the goods from the raw materials storeroom to the machine floor = P500,000 P40,000 Factory electricity usage charges = P30,000 Factory rental = P100,000 • Depreciation and maintenance of the entity's vehicle used by the factory supervisor (50 per cent for official use and 50 per cent for personal use) = P20,000. Private use of the vehicle is an employee benefit. %3D

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter10: Accounting Systems For Manufacturing Operations

Section: Chapter Questions

Problem 10.3E: Classifying costs as factory overhead Which of the following items are properly classified as part...

Related questions

Question

1st picture: Problem

2nd picture: Requirement

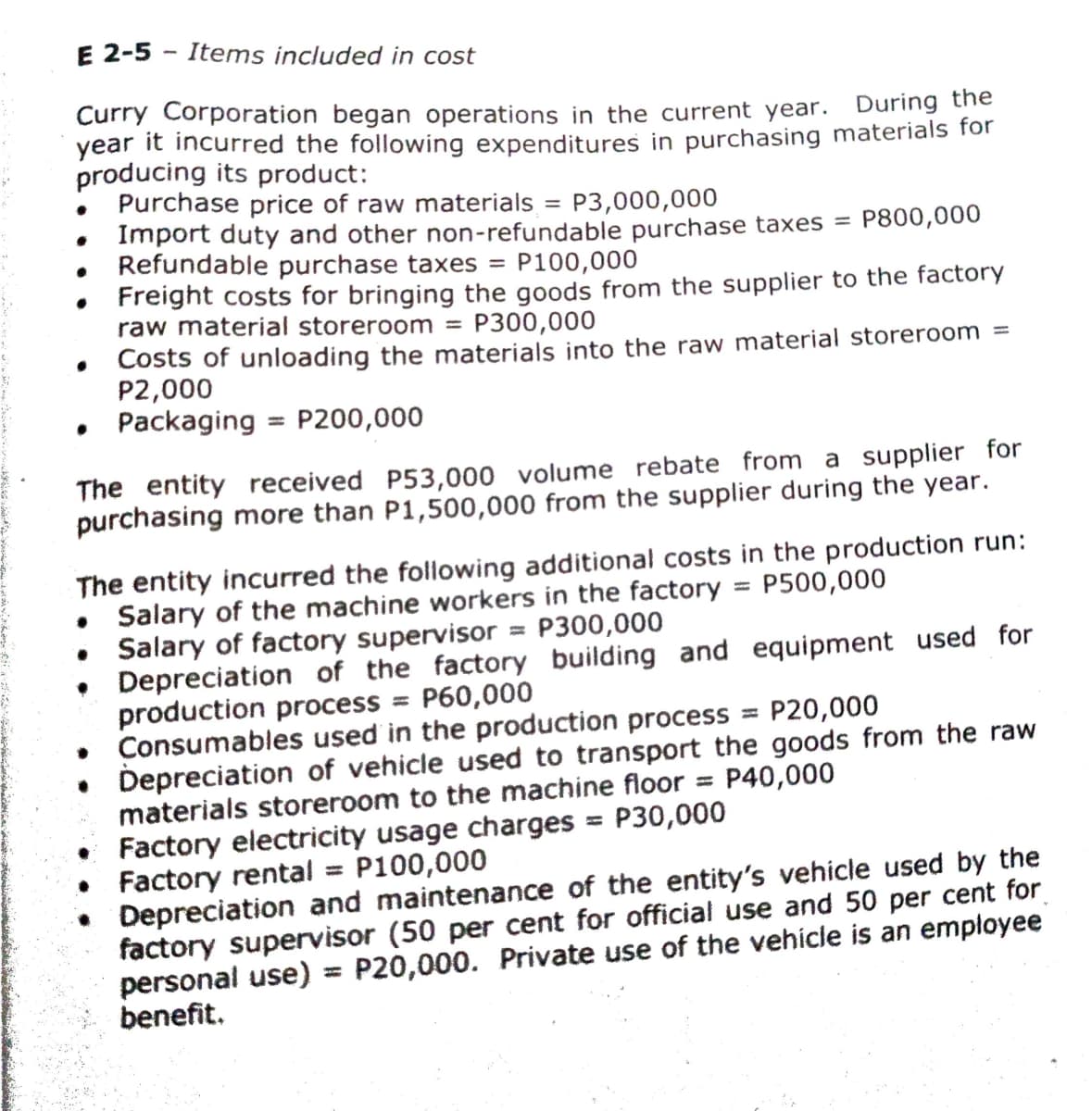

Transcribed Image Text:E 2-5 - Items included in cost

Curry Corporation began operations in the current year. During the

year it incurred the following expenditures in purchasing materials for

producing its product:

Purchase price of raw materials = P3,000,000

Import duty and other non-refundable purchase taxes =

Refundable purchase taxes =

Freight costs for bringing the goods from the supplier to the factory

raw material storeroom = P300,000

Costs of unloading the materials into the raw material storeroom =

P2,000

Packaging

P800,000

P100,000

P200,000

The entity received P53,000 volume rebate from a supplier for

purchasing more than P1,500,000 from the supplier during the year.

The entity incurred the following additional costs in the production run:

Salary of the machine workers in the factory

Salary of factory supervisor = P300,000

• Depreciation of the factory building and equipment used for

production process = P60,000

Consumables used in the production process

• Depreciation of vehicle used to transport the goods from the raw

materials storeroom to the machine floor

Factory electricity usage charges = P30,000

Factory rental = P100,000

Depreciation and maintenance of the entity's vehicle used by the

factory supervisor (50 per cent for official use and 50 per cent for

personal use)

benefit.

P500,000

%3D

P20,000

P40,000

%3D

%3D

P20,000. Private use of the vehícle is an employee

%3D

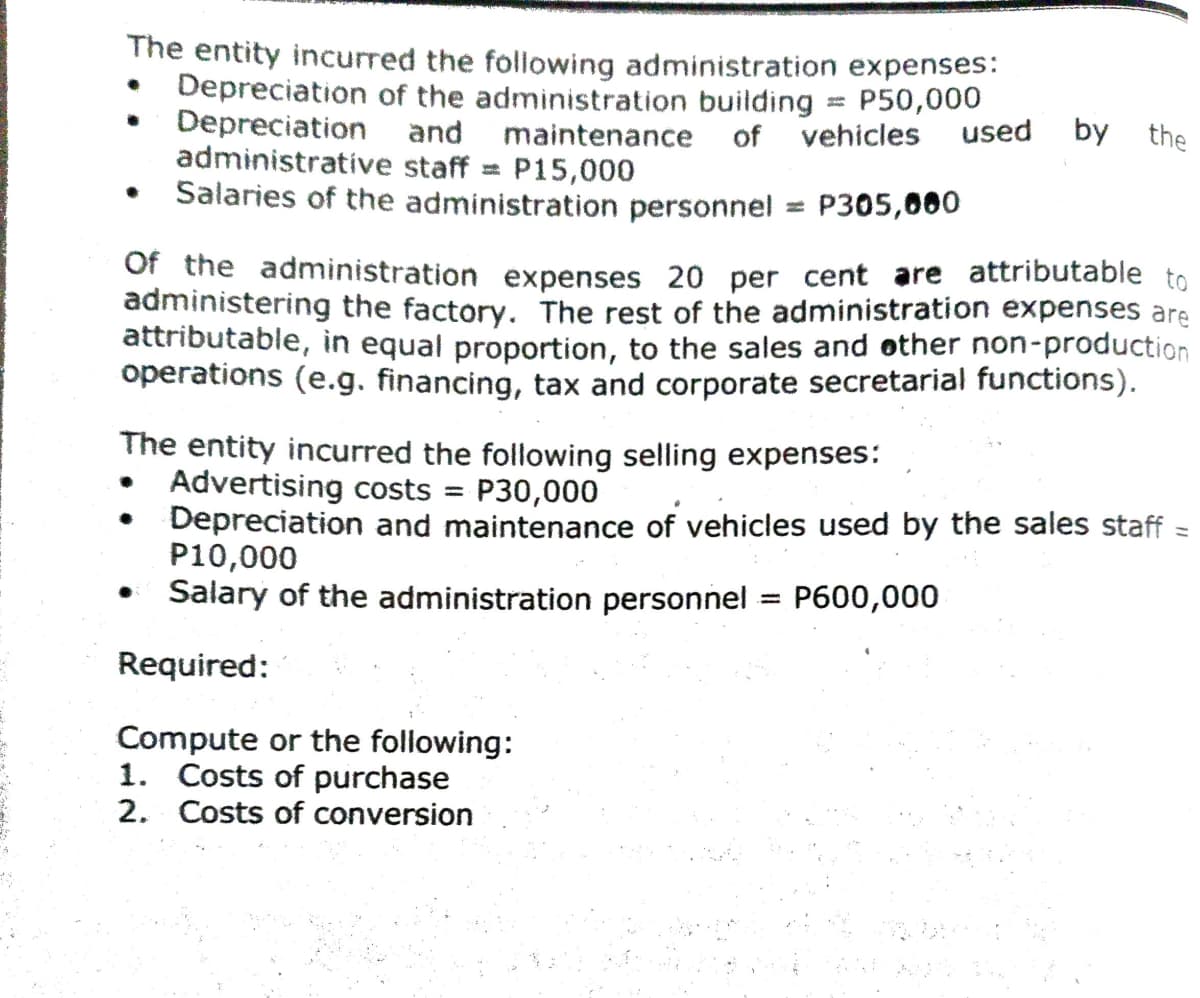

Transcribed Image Text:The entity incurred the following administration expenses:

Depreciation of the administration building

Depreciation and maintenance

administrative staff = P15,000

Salaries of the administration personnel = P305,060

P50,000

of vehicles

used

by the

Of the administration expenses 20 per cent are attributable to

administering the factory. The rest of the administration expenses are

attributable, in equal proportion, to the sales and other non-production

operations (e.g. financing, tax and corporate secretarial functions).

The entity incurred the following selling expenses:

Advertising costs = P30,000

Depreciation and maintenance of vehicles used by the sales staff

P10,000

Salary of the administration personnel = P600,000

%3D

Required:

Compute or the following:

1. Costs of purchase

2. Costs of conversion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning