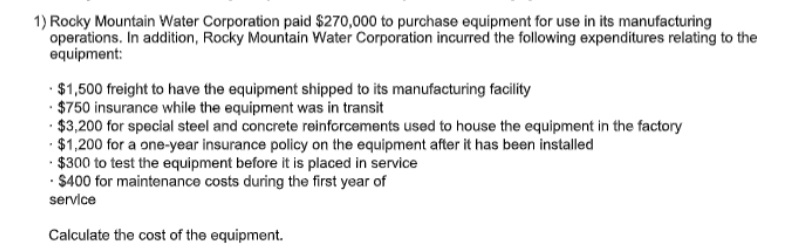

1) Rocky Mountain Water Corporation paid $270,000 to purchase equipment for use in its manufacturing operations. In addition, Rocky Mountain Water Corporation incurred the following expenditures relating to the equipment: $1,500 freight to have the equipment shipped to its manufacturing facility · $750 insurance while the equipment was in transit · $3,200 for special steel and concrete reinforcements used to house the equipment in the factory · $1,200 for a one-year insurance policy on the equipment after it has been installed • $300 to test the equipment before it is placed in service · $400 for maintenance costs during the first year of service Calculate the cost of the equipment.

1) Rocky Mountain Water Corporation paid $270,000 to purchase equipment for use in its manufacturing operations. In addition, Rocky Mountain Water Corporation incurred the following expenditures relating to the equipment: $1,500 freight to have the equipment shipped to its manufacturing facility · $750 insurance while the equipment was in transit · $3,200 for special steel and concrete reinforcements used to house the equipment in the factory · $1,200 for a one-year insurance policy on the equipment after it has been installed • $300 to test the equipment before it is placed in service · $400 for maintenance costs during the first year of service Calculate the cost of the equipment.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5PB: Johnson, Incorporated, had the following transactions during the year: Purchased a building for...

Related questions

Question

Transcribed Image Text:1) Rocky Mountain Water Corporation paid $270,000 to purchase equipment for use in its manufacturing

operations. In addition, Rocky Mountain Water Corporation incurred the following expenditures relating to the

equipment:

· $1,500 freight to have the equipment shipped to its manufacturing facility

· $750 insurance while the equipment was in transit

· $3,200 for special steel and concrete reinforcements used to house the equipment in the factory

· $1,200 for a one-year insurance policy on the equipment after it has been installed

· $300 to test the equipment before it is placed in service

· $400 for maintenance costs during the first year of

service

Calculate the cost of the equipment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning