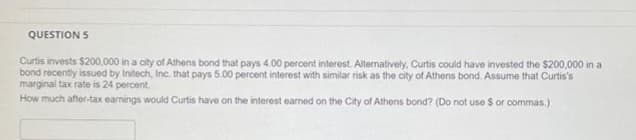

Curtis invests $200,000 in a city of Athens bond that pays 4.00 percent interest. Alternatively, Curtis could have invested the $200,000 in bond recently issued by Initech, Inc. that pays 5.00 percent interest with similar risk as the city of Athens bond. Assume that Curtis's marginal tax rate is 24 percent. How much after-tax earnings would Curtis have on the interest earned on the City of Athens bond? (Do not use $or commas)

Q: Scanion plans represent a group-level incentive plan that provides payouts based on whether the…

A: The company generally gives bonuses when the entity earns a profit. Scanlon's plan is a group-level…

Q: What accounting principle requires that revenues, and the related costs incurred to generate those…

A: Revenue: It is the amount of money earned by an entity by selling goods or providing…

Q: How do we decide whether to accept a special order? Which costs are relevant? What other factors…

A: Since multiple questions have been posted, as per the guidelines only the first question will be…

Q: How can advancements in technology, such as blockchain and artificial intelligence, revolutionize…

A: Blockchain technology and artificial intelligence (AI) have the potential to reshape the landscape…

Q: Find the future value and compound interest on $4,000 at 8% compounded semiannually for two years.…

A: Future value is the value of an asset or amount at a future date based on an assumed rate of growth…

Q: seems that these two are wrong? It is not -13700 and -28300 Less: Net loss for the year ended…

A: Net loss for the period is deducted from the opening retained earnings balance and dividends…

Q: Required: Gleason Guitars produces acoustic guitars. The table below contains budget and actual…

A: Variance is the difference between standard cost and actual cost incurred. Variance may be…

Q: The following information is provided in the 2021 annual report to shareholders of…

A: Financial Statement is the set of records that shows the financial position of the company at a…

Q: Super Canned Air Co (SCAC) produces high pressure canned air products. The company expects to pay…

A: DIRECT MATERIALS COST VARIANCEDirect materials cost variance is the difference between the actual…

Q: Plan A: Pay $0.07 per minute of long-distance calling. Plan B: Pay a fixed monthly fee of $14 for up…

A: A budget helps with cost management, resource allocation optimisation, and decision-making.…

Q: HOW Corporation prepared the following contribution format income statement based on a sa volume of…

A: Hi studentSince there are multiple subparts, we will answer only first three subparts.Variable costs…

Q: Use the balance sheet and Income statement below: Assets Current assets: Cash and marketable…

A: Cash flow statement :— It is one of the financial statements that shows change in cash and cash…

Q: Presented below is the trial balance for Akshara Bunga Bhd (ABB) as at 31 December 2020: Accounts…

A: Adjusting entries:These are the journal entries that are required to be prepared by a company to…

Q: Exercise 2: Flow of Cost - Cost System You are required to compute for the unknowns in the…

A: The cost of goods manufactured includes the cost of goods that are finished during the period. The…

Q: Required information [The following information applies to the questions displayed below.] On…

A: The adjusted trial balance represents the final balance of each account of the business. The…

Q: Required information Problem 12-27 (LO 12-2) (Static) [The following information applies to the…

A: An organization called a corporation is one whose shareholders choose a board of directors to manage…

Q: Lakeview Industries uses job costing to calculate the costs of its jobs with direct labor cost as…

A: PREDETERMINED OVERHEAD RATEPredetermined rate means the indirect cost rate.Predetermined overhead…

Q: The Polaris Company uses a job-order costing system. The following transactions occurred in October:…

A: Journal Entry :— It is an act of recording transactions in books of account when transaction…

Q: Cheese Factory Incorporated reported the following information for the fiscal year ended August 31,…

A: The balance sheet is one of the financial statements of the business. It represents the financial…

Q: HNI Corporation started operations this year. As the year went on, they compiled the following…

A: Job order costing is used when the products are customer specific. Thus each individual job is…

Q: The following T-account is a summary of the cash account of Shamrock Company. Balance, Jan. 1…

A: A cash flow statement is a financial statement that includes the inflow and outflow of cash during…

Q: Snow Inc., a calendar year, accrual basis corporation, wants to make a $20,000 donation to the Wild…

A: Charitable contributions are donations of money, goods, or assets made by individuals or…

Q: A $26,000 bond with interest at 5.5% payable semi-annually and redeemable at par is bought two years…

A: Bond is a financial intrument as a investment the amount of interest or coupon is received based on…

Q: Superior Company provided the following data for the year ended December 31 (all raw materials are…

A: Cost of Goods Sold: During a specific period, Cost of Goods Sold (COGS) refers to the direct costs a…

Q: Retained earnings, December 31, 2021 Cost of buildings purchased during 2022 Net loss for the year…

A: A Statement of Stockholders' Equity is an FS that provides a summary of the changes in a company's…

Q: Tatum Company has four products in its inventory. Information about ending inventory is as follows:…

A: Lower of cost or market value states that business entity should record the inventory at whichever…

Q: The December 31, 2021 balance sheet of the World Wide Distribution Company included the following…

A: Bonds are financial instruments that serve as a formal representation of the contract between an…

Q: Jacob is a member of WCC (an LLC taxed as partnership) Jacob was allocated $110,000 of business…

A: Answer:- Income tax meaning:- The taxpayer must pay income tax on all income regardless of the…

Q: Listed below are selected transactions of Flint Department Store for the current year ending…

A: The sale of the gift card cannot be recognized as revenue because the entity has to perform the…

Q: Jackson Corporation has a profit margin of 11 percent, total asset turnover of .97, and ROE of 14.49…

A: Debt to equity ratio is the ratio between total debt and total equity. It is calculated by dividing…

Q: In building their plant, the officers of the International Leather Company had the choice between…

A: Let's calculate the Rate of Return on Average Investment (RORAI) for Metro Manila =Initial cost =…

Q: Snapshot, Inc. is a manufacturer of digital cameras. It has two departments: assembly and testing.…

A: Journal Entry :— It is an act of recording transactions in books of account when transaction…

Q: Balance sheet and income statement below. Assets Current assets: Cash and marketable securities…

A: Cash flow statement is a statement that records the inflow or outflow of cash in the operations of…

Q: Use the following information to prepare a statement of cash flows for Studio One for the month…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: The Zingerman’s Community of Businesses (ZCoB) is a family of ten businesses all located in the Ann…

A: Open book management is a business philosophy that shares financial information with all…

Q: Cooke Corporation sells 400 shares of common stock being held as a short-term investment. The shares…

A: In this question, we will choose the correct journal entry. The foundation of the double-entry…

Q: At December 31, 2022, Pronghorn Corporation reported the following plant assets. Land $…

A: The relationship between a company's assets, liabilities, and shareholders' equity is represented by…

Q: A manufacturing company applies factory overhead based on direct labor hours. At the beginning of…

A: Predetermined overhead rate is a single rate used for allocating overhead. Since the actual factory…

Q: The Alfarm Corporation processes raw milk up to the splitoff point where two products, cream and…

A: Direct materials are raw materials that are created into finished merchandise. These don't seem to…

Q: On January 1, 2020, Sandhill Corporation issued a series of 500 convertible bonds, maturing in five…

A: IFRS 9 "Financial instruments" deals with accounting and measurement of a financial asset or a…

Q: Question 2 Shine Consultants' July bank statement shows the following: Date Description 1/7/23…

A: The bank reconciliation statement is prepared to equate the balances of the cash book and pass book…

Q: On December 31, 2023, Berclair Incorporated had 600 million shares of common stock and 17 million…

A: Earnings per share:EPS is the ratio between the net profit and outstanding shares of the company. It…

Q: An example of an analytical procedure is the comparison of O Results of a statistical sample with…

A: Analytical procedures involve comparing financial data or performance metrics of a company with…

Q: Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The…

A: The manufacturing overhead costs comprises the indirect costs of production. The pre-determined…

Q: Brief Exercise 9-3 Gross profit method [LO9-2] On February 26 a hurricane destroyed the entire…

A: The cost of goods available for sale includes the beginning inventory and net purchases. The ending…

Q: Required information Problem 3-9A Complete the full accounting cycle (LO3-3, 3-4, 3-5, 3-6, 3-7) The…

A: Statement that shows the ending balance of all the ledger accounts of a firm at the end of the…

Q: Super Canned Air Co (SCAC) produces high pressure canned air products. The company expects to pay…

A: DIRECT LABOUR COST VARIANCEDirect Labour Cost Variance is the difference between the actual direct…

Q: An owner canlease her building for $160,000 per year for three years. The explicit cost of…

A: Accounting profits are calculated by deducting the explicit cost from revenue. Economic profits are…

Q: On December 31, 2023, Dow Steel Corporation had 710,000 shares of common stock and 41,000 shares of…

A: EPS is often used in conjunction with other financial metrics and ratios to provide a more…

Q: A company is working on their budgets for the year 2021. They produce two unique products= Degreaser…

A: According to the question given, we need to prepare the material purchase cost budget.MATERIAL…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- Curtis invests $250,000 in a city of Athens bond that pays 7 percent interest. Alternatively, Curtis could have invested the $250,000 in a bond recently issued by Initech, Incorporated that pays 9 percent interest with similar risk as the city of Athens bond. Assume that Curtis's marginal tax rate is 24 percent. What is Curtis's after-tax rate of return on the city of Athens bond?Melinda invests $220,000 in a City of Heflin bond that pays 6.8 percent interest. Alternatively, Melinda could have invested the $220,000 in a bond recently issued by Surething Incorporated that pays 8 percent interest and has risk and other nontax characteristics similar to the City of Heflin bond. Assume Melinda's marginal tax rate is 15 percent. Note: Leave no cells blank - be sure to enter "0" wherever required. Round your after-tax rate of return to one decimal place. Required:1.What is her after-tax rate of return for the City of Heflin bond?2.How much explicit tax does Melinda pay on the City of Heflin bond?3.How much implicit tax does she pay on the City of Heflin bond?4.How much explicit tax would she have paid on the Surething Incorporated bond?5.What is her after-tax rate of return on the Surething Incorporated bond?a. After-tax rate of return ___% ? b. Explicit tax ___ ? c. Implicit tax __? d. Explicit tax __? e. After-tax rate of return ___% ?An 8.4 percent coupon bond issued by the state of Indiana sells for $1,000. What coupon rate on a corporate bond selling at its $1,000 par value would produce the same after-tax return to the investor as the municipal bond if the investor is in: a. the 15 percent marginal tax bracket? b. the 25 percent marginal tax bracket? c. the 35 percent marginal tax bracket?

- 5) An investor purchases one municipal and one corporate bond that pay rates of return of 8% and 10%, respectively. If the investor is in the 22% marginal tax bracket, what will be his or her after-tax rates of return on the municipal and corporate bonds?Curtis invests $800,000 in a city of Athens bond that pays 5 percent interest. Alternatively, Curtis could have invested the $800,000 in a bond recently issued by Initech, Incorporated that pays 7 percent interest with similar risk as the city of Athens bond. Assume that Curtis's marginal tax rate is 24 percent. How much implicit tax would Curtis pay on the city of Athens bond?Question 7 Gioanni Inc., has GH¢1 million in earnings before interest and taxes. Currently it is all-equity-financed. It may issue GH¢3 million in perpetual debt at 15 percent interest in order to repurchase stock, thereby recapitalizing the corporation. There are no personal taxes. If the corporate tax rate is 40 percent, what is the income available to all security holders if the company remains all-equity-financed? If it is recapitalized? What is the present value of the debt tax-shield benefits? The equity capitalization rate for the company’s common stock is 20 percent while it remains all-equity-financed. What is the value of the firm if it remains all-equity financed? What is the firm’s value if it is recapitalized?

- Problem 1-45 (LO 1-3, LO 1-4) (Algo) Fergie has the choice between investing in a State of New York bond at 10.0 percent and a Surething Incorporated bond at 13.0 percent. Assuming that both bonds have the same nontax characteristics and that Fergie has a 30 percent marginal tax rate, in which bond should she invest?Amar Corporation pays 11.6% interest on its outstanding bonds. If its tax rate is 40%, what is its after-tax cost of debt?D4) Finance The Grant Corporation is considering permanently adding $500 million of debt to its capital structure. Grant's corporate tax rate is 35% and investors pay a tax rate of 40% on their interest income and 20% on their income from capital gains and dividends. Using Miller’s (1977) model calculate the present value of the interest tax shield provided by this new debt. Please round your answer to the nearest 0.01. 33.33 million 50.00 million 66.67 million 80 million None of the above

- chapter 10 question 1 Assume an investor can earn 0.15 before tax and 0.12 after tax. A corporation can earn 0.14 after corporate tax. It has $100 available for investment. The tax rate on dividends and capital gains is 0.15. If the corporation retains for 15 years and then pays a dividend the investor nets $__________. If the corporation pays an immediate dividend, the investor will have (after 15 years) $_________Calculate the after-tax return of a(n) 5.625.62 percent, 20-year, A-rated corporate bond for an investor in the 1515 percent marginal tax bracket. Compare this yield to a(n) 3.683.68 percent, 20-year, A-rated, tax-exempt municipal bond, and explain which alternative is better. Repeat the calculations and comparison for an investor in the 3535 percent marginal tax bracket. Question content area bottom Part 1 The after-tax return of the 5.625.62%, 20-year, A-rated corporate bond for an investor in the 1515% marginal tax bracket is enter your response here%. (Round to two decimal places.) Part 2 Compare this yield to the 3.683.68%, 20-year, A-rated, tax-exempt municipal bond and explain which alternative is better. (Select the best answer below.) A. The after dash tax yield of 4.78 % for the corporate bond is a better alternative than the 3.68 % tax dash free municipal bondThe after-tax yield of 4.78% for the corporate bond is a better…Question content area top Part 1 Calculate the after-tax return of a(n) 8.858.85 percent, 20-year, A-rated corporate bond for an investor in the 1010 percent marginal tax bracket. Compare this yield to a(n) 5.955.95 percent, 20-year, A-rated, tax-exempt municipal bond, and explain which alternative is better. Repeat the calculations and comparison for an investor in the 3333 percent marginal tax bracket.