chapter 10 question 1 Assume an investor can earn 0.15 before tax and 0.12 after tax. A corporation can earn 0.14 after corporate tax. It has $100 available for investment. The tax rate on dividends and capital gains is 0.15. If the corporation retains for 15 years and then pays a dividend the investor nets $__________. If the corporation pays an immediate dividend, the investor will have (after 15 years) $_________

chapter 10 question 1 Assume an investor can earn 0.15 before tax and 0.12 after tax. A corporation can earn 0.14 after corporate tax. It has $100 available for investment. The tax rate on dividends and capital gains is 0.15. If the corporation retains for 15 years and then pays a dividend the investor nets $__________. If the corporation pays an immediate dividend, the investor will have (after 15 years) $_________

Chapter8: Budgets And Bank Reconciliations

Section: Chapter Questions

Problem 3.3C

Related questions

Question

chapter 10 question 1 Assume an investor can earn 0.15 before tax and 0.12 after tax. A corporation can earn 0.14 after corporate tax. It has $100 available for investment.

The tax rate on dividends and

- If the corporation retains for 15 years and then pays a dividend the investor nets $__________.

- If the corporation pays an immediate dividend, the investor will have (after 15 years) $_________

Transcribed Image Text:A. Week 5 Assignment

A Bookshelf - The Capital Budgetin X

d VitalSource Bookshelf: The Capita X

b My Questions | bartleby

+

A online.vitalsource.com/#/books/9781135656232/cfi/6/36!/4/170/2@0.00:0

A < 10. Distribution Polic...

Problems

Go to 10. Distribution Policy and

Capital Budgeting

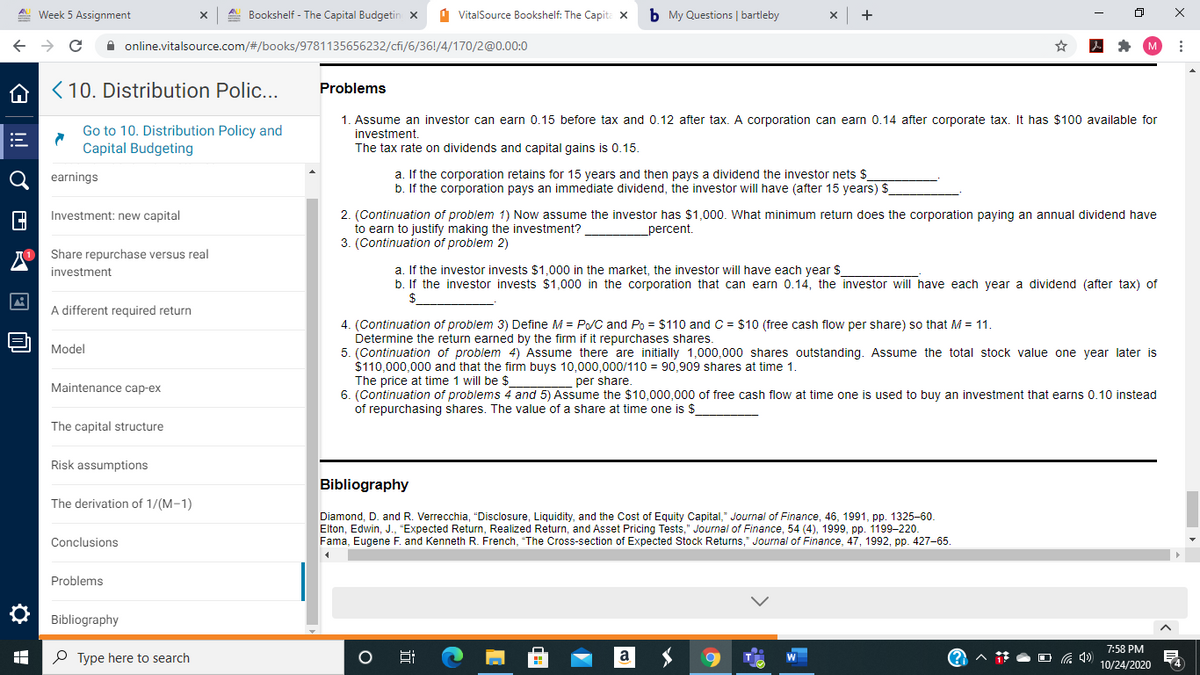

1. Assume an investor can earn 0.15 before tax and 0.12 after tax. A corporation can earn 0.14 after corporate tax. It has $100 available for

investment.

The tax rate on dividends and capital gains is 0.15.

a. If the corporation retains for 15 years and then pays a dividend the investor nets $

b. If the corporation pays an immediate dividend, the investor will have (after 15 years) $

earnings

2. (Continuation of problem 1) Now assume the investor has $1,000. What minimum return does the corporation paying an annual dividend have

to earn to justify making the investment?

3. (Continuation of problem 2)

Investment: new capital

_percent.

Share repurchase versus real

a. If the investor invests $1,000 in the market, the investor will have each year $

b. If the investor invests $1,000 in the corporation that can earn 0.14, the investor will have each year a dividend (after tax) of

investment

A different required return

4. (Continuation of problem 3) Define M = P/C and Po = $110 and C = $10 (free cash flow per share) so that M = 11.

Determine the return earned by the firm if it repurchases shares.

5. (Continuation of problem 4) Assume there are initially 1,000,000 shares outstanding. Assume the total stock value one year later is

$110,000,000 and that the firm buys 10,000,000/110 = 90,909 shares at time 1.

The price at time 1 will be $

6. (Continuation of problems 4 and 5) Assume the $10,000,000 of free cash flow at time one is used to buy an investment that earns 0.10 instead

of repurchasing shares. The value of a share at time one is $

Model

Maintenance cap-ex

per share.

The capital structure

Risk assumptions

Bibliography

The derivation of 1/(M-1)

Diamond, D. and R. Verrecchia, "Disclosure, Liquidity, and the Cost of Equity Capital," Journal of Finance, 46, 1991, pp. 1325-60

Elton, Edwin, J., "Expected Return, Realized Return, and Asset Pricing Tests," Journal of Finance, 54 (4), 1999, pp. 1199-220.

Fama, Eugene F. and Kenneth R. French, "The Cross-section of Expected Stock Returns," Journal of Finance, 47, 1992, pp. 427-65.

Conclusions

Problems

Bibliography

7:58 PM

P Type here to search

a

10/24/2020

!!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning