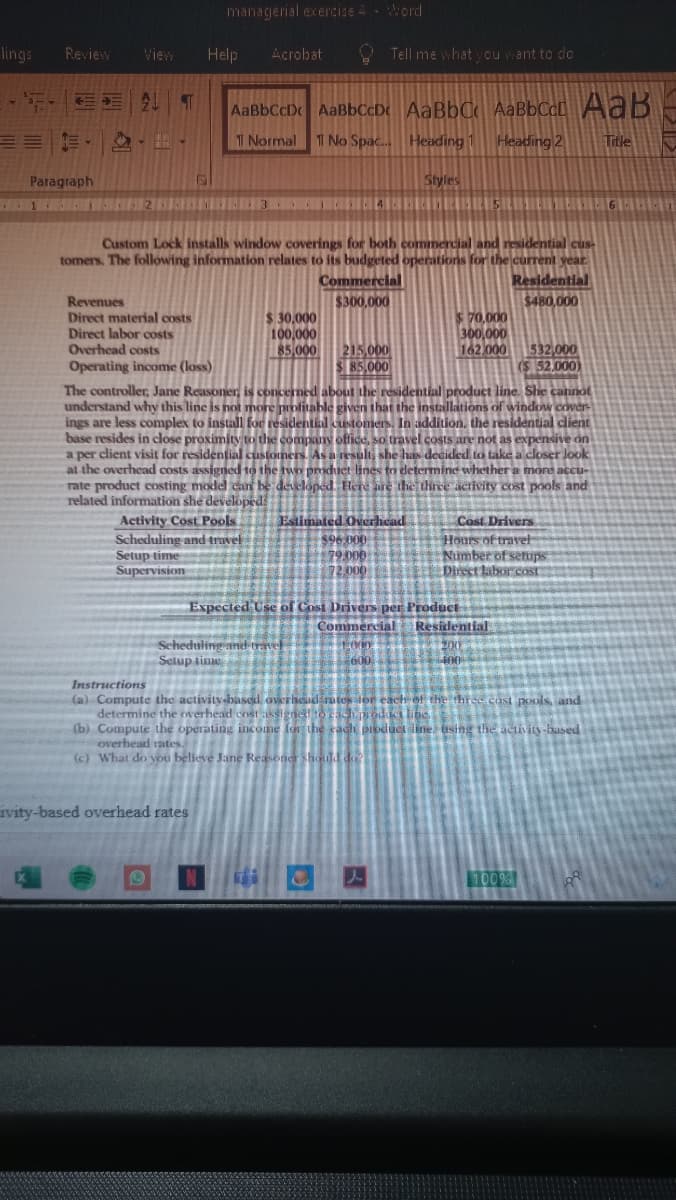

Custom Lock installs window coverings for both commercial and residential cus- tomers. The following information relates to its budgeted operations for the current year. Commercial $300,000 Residential $480,000 Revenues Direct material costs Direct labor costs Overhead costs Operating income (loss) $30,000 100,000 85,000 70.000 300,000 162,000 215, 000 $85,000 532 000 (S 52,000) The controller, Jane Reasoner is concerned about the residential product line. She cannot understand why this line is not more pmfitable given that the installations of window cover ings are less complex to install for residential Ustomers. In addition, the residential client base resides in close proximity to the company offidd, so travel costs are not as expensive dn a per client visit for residential customers. As a result; she has decided to take a closer Jook at the overhead costs assigned to the two poduet lines to determine whether a more accu- rate product costing model can be đeveloped. Here are the three activity cost pools and related information she developed Activity Cost Pools Scheduling and truvel Setup time Supervision Cost Drivers Hours of travel Number of senups Dinect labor.costr Esdimated Overhead 2496000 79000 72000 Expected Use of Cost Drives per Product Commercial Residential Scheduling and trater Seiup time 200 400 1:00 Instructions (a) Compute the activity-based overneadiates tor each determine the overhead cnst assigncl ož3 odua line. (b) Compute the operating income for the sach pibduci line using the activity-based overhead rates. (c) What do you believe Jane Reasoner sbaud de the threc cost pools, and

Custom Lock installs window coverings for both commercial and residential cus- tomers. The following information relates to its budgeted operations for the current year. Commercial $300,000 Residential $480,000 Revenues Direct material costs Direct labor costs Overhead costs Operating income (loss) $30,000 100,000 85,000 70.000 300,000 162,000 215, 000 $85,000 532 000 (S 52,000) The controller, Jane Reasoner is concerned about the residential product line. She cannot understand why this line is not more pmfitable given that the installations of window cover ings are less complex to install for residential Ustomers. In addition, the residential client base resides in close proximity to the company offidd, so travel costs are not as expensive dn a per client visit for residential customers. As a result; she has decided to take a closer Jook at the overhead costs assigned to the two poduet lines to determine whether a more accu- rate product costing model can be đeveloped. Here are the three activity cost pools and related information she developed Activity Cost Pools Scheduling and truvel Setup time Supervision Cost Drivers Hours of travel Number of senups Dinect labor.costr Esdimated Overhead 2496000 79000 72000 Expected Use of Cost Drives per Product Commercial Residential Scheduling and trater Seiup time 200 400 1:00 Instructions (a) Compute the activity-based overneadiates tor each determine the overhead cnst assigncl ož3 odua line. (b) Compute the operating income for the sach pibduci line using the activity-based overhead rates. (c) What do you believe Jane Reasoner sbaud de the threc cost pools, and

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter14: Decentralized Operations

Section: Chapter Questions

Problem 14.1.2P: Budget performance report for a cost center Sneed Industries Company sells vehicle parts to...

Related questions

Question

Transcribed Image Text:managerial exercize 4- Word

lings

Review

View

Help

Acrobat

O Tell me what ycu vant to do

AaBbCcD AaBbCcDc AaBbC AaBbCc[ AaB

三 .

T Normal

1 No Spac.

Heading 1

Heading 2

Title

Paragraph

120

Styles

Custom Lock installs window coverings for both commercial and residential cus-

tomers. The following information relates to its budgeted operations for the current vear.

Commercial

Residential

$300,000

$480,000

Revenues

Direct material costs

Direct labor costs

Overhead costs

Operating income (loss)

$ 30,000

100,000

85 000

$ 70.000

300,000

162,000

215,000

$ 85,000

532 000

52.000)

The controller, Jane Reasoner, is concerned about the residential product line. She cannot

understand why this line is not more profitable given that the installations of window cover

ings are less complex to install for residentil customers. In addition, the residential client

base resides in close proximity to the company offce, so travel costs are not as expensive on

a per client visit for residential customers. As a result, she has decided to take a closer look

at the overhead costs assignedHọ the two prodiet lines to determine whether

rate product costing model cunn be đeveloped Here are the thirce activity cost pools and

residen

more accu-

related information she developed

Estimated Oerhead

Activity Cost Pools.

Scheduling and truvel

Setup time

Supervision

$96,000

79.000

72.000

Cost Drivers

Hours of travel

Number of serups

Direct labor cost

Expected Use of Cost Drivers per Product

Resizlential

Commercial

Scheduling anet traet

Setup time

200

Instructions

(a) Compute the activity-based overheadirates tor each ef the three cast pools, and

determine the overhead costassignedto hoda line

(b) Compute the operating income for the cadi prbduci iline using the activity based

overhead rates.

(c) What do you believe Jane Reasoner shoudd do

ivity-based overhead rates

1009

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub