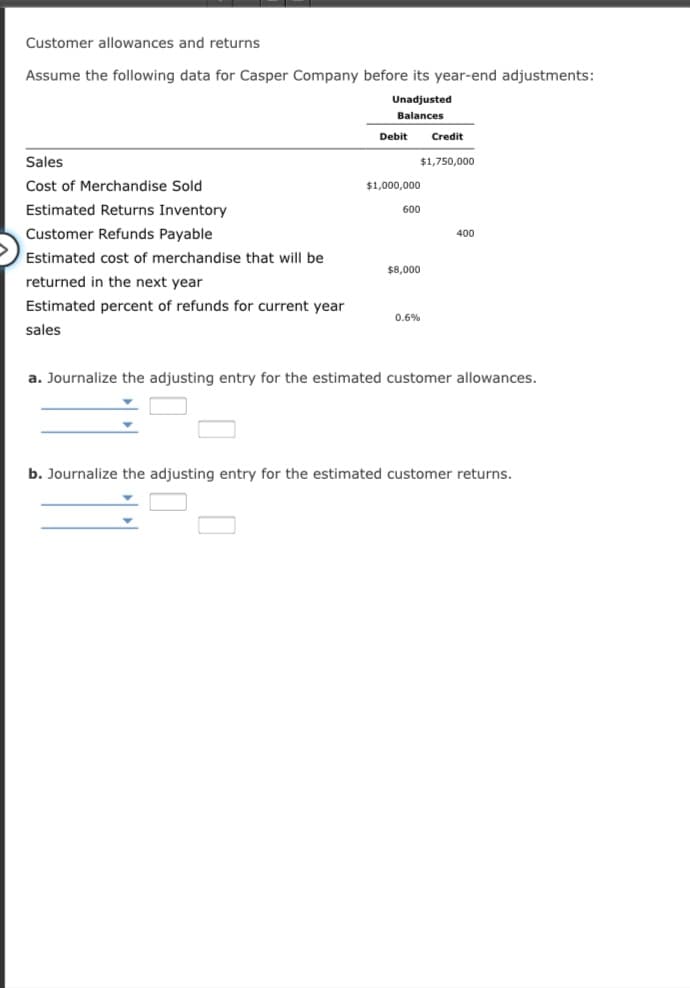

Customer allowances and returns Assume the following data for Casper Company before its year-end adjustments: Unadjusted Balances Debit Credit Sales $1,750,000 Cost of Merchandise Sold $1,000,000 Estimated Returns Inventory 600 Customer Refunds Payable 400 Estimated cost of merchandise that will be $8,000 returned in the next year Estimated percent of refunds for current year 0.6% sales a. Journalize the adjusting entry for the estimated customer allowances. b. Journalize the adjusting entry for the estimated customer returns.

Customer allowances and returns Assume the following data for Casper Company before its year-end adjustments: Unadjusted Balances Debit Credit Sales $1,750,000 Cost of Merchandise Sold $1,000,000 Estimated Returns Inventory 600 Customer Refunds Payable 400 Estimated cost of merchandise that will be $8,000 returned in the next year Estimated percent of refunds for current year 0.6% sales a. Journalize the adjusting entry for the estimated customer allowances. b. Journalize the adjusting entry for the estimated customer returns.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter14: Adjustments For A Merchandising Business

Section: Chapter Questions

Problem 3MC: Under the periodic inventory system, what account is debited when an estimate is made for the cost...

Related questions

Question

Transcribed Image Text:Customer allowances and returns

Assume the following data for Casper Company before its year-end adjustments:

Unadjusted

Balances

Debit

Credit

Sales

$1,750,000

Cost of Merchandise Sold

$1,000,000

Estimated Returns Inventory

600

Customer Refunds Payable

400

Estimated cost of merchandise that will be

$8,000

returned in the next year

Estimated percent of refunds for current year

0.6%

sales

a. Journalize the adjusting entry for the estimated customer allowances.

b. Journalize the adjusting entry for the estimated customer returns.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning