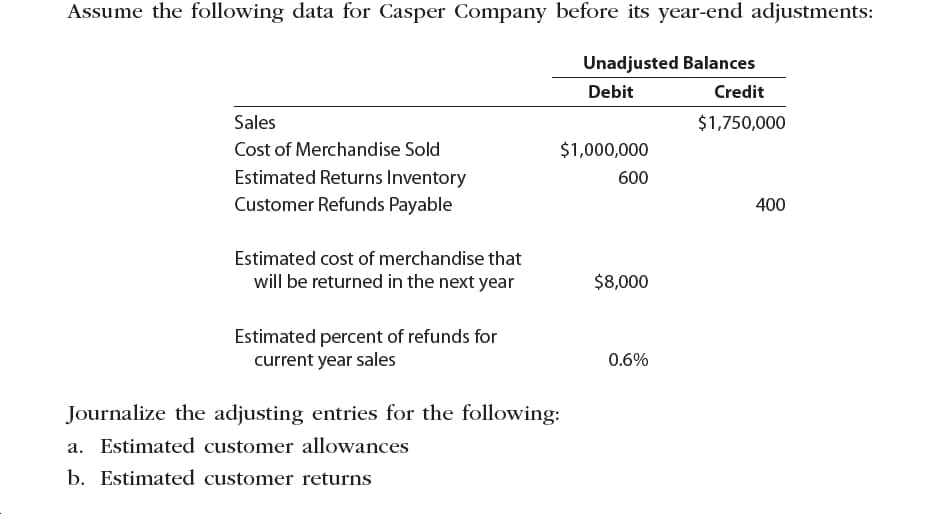

Assume the following data for Casper Company before its year-end adjustments: Unadjusted Balances Debit Credit Sales $1,750,000 Cost of Merchandise Sold $1,000,000 Estimated Returns Inventory 600 Customer Refunds Payable 400 Estimated cost of merchandise that $8,000 will be returned in the next year Estimated percent of refunds for current year sales 0.6% Journalize the adjusting entries for the following: a. Estimated customer allowances b. Estimated customer returns

Assume the following data for Casper Company before its year-end adjustments: Unadjusted Balances Debit Credit Sales $1,750,000 Cost of Merchandise Sold $1,000,000 Estimated Returns Inventory 600 Customer Refunds Payable 400 Estimated cost of merchandise that $8,000 will be returned in the next year Estimated percent of refunds for current year sales 0.6% Journalize the adjusting entries for the following: a. Estimated customer allowances b. Estimated customer returns

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter14: Adjustments For A Merchandising Business

Section: Chapter Questions

Problem 3MC: Under the periodic inventory system, what account is debited when an estimate is made for the cost...

Related questions

Question

Transcribed Image Text:Assume the following data for Casper Company before its year-end adjustments:

Unadjusted Balances

Debit

Credit

Sales

$1,750,000

Cost of Merchandise Sold

$1,000,000

Estimated Returns Inventory

600

Customer Refunds Payable

400

Estimated cost of merchandise that

$8,000

will be returned in the next year

Estimated percent of refunds for

current year sales

0.6%

Journalize the adjusting entries for the following:

a. Estimated customer allowances

b. Estimated customer returns

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage