CW Ltd. had the following balance sheets at 31 December 2006 and 2007. ASSETS 2007 R Patents Land Machinery and equipment Accumulated depreciation, machinery and equipment Buildings Accumulated depreciation, buildings Prepaid expenses Stock Bills receivable Debtors Investments Bank LIABILITIES Creditors Salaries payable Bond Ordinary R10 shares Preference shares, R100 par value Ordinary share premium Retained earnings 1 2. 3. 4. 2006 6. R 124 000 60 000 174 000 R30 000 R26 000 (38 000) 290 000 (90 000) 4 884 54 830 112 000 52 200 62 840 R806 754 45 154 27 000 170 000 310 000 120 000 30 000 104 600 R806 754 Additional information in respect of 2007: The net income for the year, after tax of R61 074, amounted to R114 648. Dividends paid for the year, R63 024. Depreciation written off for year: Buildings Machinery and equipment A building costing R30 000, fully depreciated, was abandoned. 112 000 60 000 174 000 (64 000) 440 000 (90 000) 5714 70 352 20 000 175 110 78 400 79 122 R1 060 698 64 474 30 000 230 000 430 000 120 000 30 000 156 224 R1 060 698 5. Amortisation in respect of patents amounted to R12 000 for the year. An additional bond was acquired during the year. R180 000.

CW Ltd. had the following balance sheets at 31 December 2006 and 2007. ASSETS 2007 R Patents Land Machinery and equipment Accumulated depreciation, machinery and equipment Buildings Accumulated depreciation, buildings Prepaid expenses Stock Bills receivable Debtors Investments Bank LIABILITIES Creditors Salaries payable Bond Ordinary R10 shares Preference shares, R100 par value Ordinary share premium Retained earnings 1 2. 3. 4. 2006 6. R 124 000 60 000 174 000 R30 000 R26 000 (38 000) 290 000 (90 000) 4 884 54 830 112 000 52 200 62 840 R806 754 45 154 27 000 170 000 310 000 120 000 30 000 104 600 R806 754 Additional information in respect of 2007: The net income for the year, after tax of R61 074, amounted to R114 648. Dividends paid for the year, R63 024. Depreciation written off for year: Buildings Machinery and equipment A building costing R30 000, fully depreciated, was abandoned. 112 000 60 000 174 000 (64 000) 440 000 (90 000) 5714 70 352 20 000 175 110 78 400 79 122 R1 060 698 64 474 30 000 230 000 430 000 120 000 30 000 156 224 R1 060 698 5. Amortisation in respect of patents amounted to R12 000 for the year. An additional bond was acquired during the year. R180 000.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 17E

Related questions

Question

Please do not give solution in image format ?.

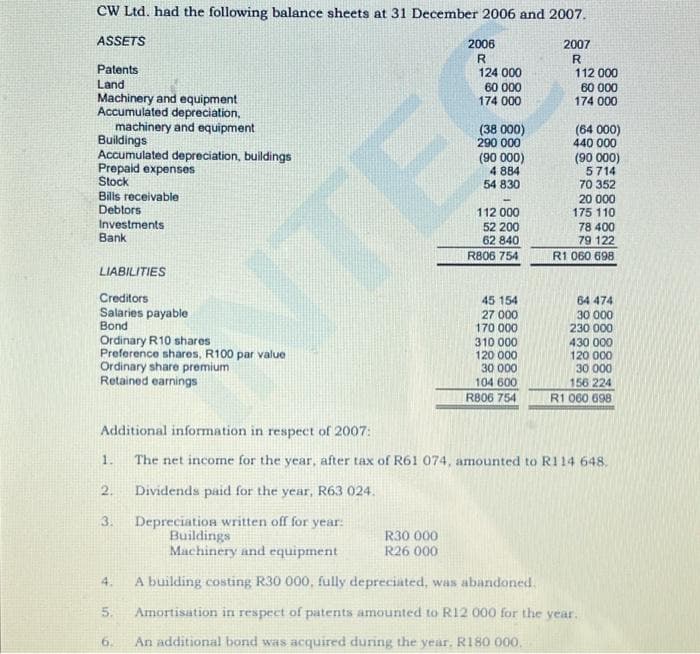

Transcribed Image Text:CW Ltd. had the following balance sheets at 31 December 2006 and 2007.

ASSETS

Patents

Land

Machinery and equipment

Accumulated depreciation,

machinery and equipment

Buildings

Accumulated depreciation, buildings

Prepaid expenses

Stock

Bills receivable

Debtors

Investments

Bank

LIABILITIES

Creditors

Salaries payable

Bond

Ordinary R10 shares

Preference shares, R100 par value

Ordinary share premium

Retained earnings

1.

2.

3.

4.

TI

5.

6.

2006

112 000

52 200

62 840

R806 754

R30 000

R26 000

45 154

27 000

170 000

310 000

120 000

30 000

104 600

R806 754

2007

R

Additional information in respect of 2007:

The net income for the year, after tax of R61 074, amounted to R114 648.

Dividends paid for the year, R63 024.

112 000

60 000

174 000

(64 000)

440 000

(90 000)

5714

70 352

20 000

175 110

78 400

79 122

R1 060 698

64 474

30 000

230 000

430 000

120 000

30 000

156 224

R1 060 698

Depreciation written off for year:

Buildings

Machinery and equipment

A building costing R30 000, fully depreciated, was abandoned.

Amortisation in respect of patents amounted to R12 000 for the year.

An additional bond was acquired during the year. R180 000.

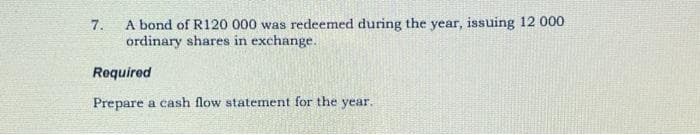

Transcribed Image Text:7.

A bond of R120 000 was redeemed during the year, issuing 12 000

ordinary shares in exchange.

Required

Prepare a cash flow statement for the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning