Cymbal E-Motors is a fast-growing start-up firm that manufactures electric motors for bicycles. The following income statement is available for April: Sales revenue (750 units @ $700 per unit) Less Manufacturing costs Variable costs Depreciation (fixed) Marketing and administrative costs Fixed costs (cash) Depreciation (fixed) Total costs Operating profits Required: Prepare a budgeted income statement for May. Note: Do not round intermediate calculations. Sales volume is expected to increase by 30 percent in May, but the sales price is expected to fall 5 percent. Variable manufacturing costs are expected to increase by 7.5 percent per unit in May. In addition to these cost changes, variable manufacturing costs also will change with sales volume. Marketing and administrative cash costs are expected to increase by 15 percent. Sales revenue All revenues and costs at Cymbal are cash transactions, except for depreciation. Cymbal maintains no inventories. Depreciation is fixed and is forecast to remain unchanged in the next six months. Cymbal E-Motors Budgeted Income Statement For the Month of May Manufacturing costs: Depreciation (fixed) Variable costs Total manufacturing costs Gross profit margin $ 525,000 S 49,000 58,800 49,000 S 49,000 S (49,000) 122,000 57,000 $286,800 $ 238,200

Cymbal E-Motors is a fast-growing start-up firm that manufactures electric motors for bicycles. The following income statement is available for April: Sales revenue (750 units @ $700 per unit) Less Manufacturing costs Variable costs Depreciation (fixed) Marketing and administrative costs Fixed costs (cash) Depreciation (fixed) Total costs Operating profits Required: Prepare a budgeted income statement for May. Note: Do not round intermediate calculations. Sales volume is expected to increase by 30 percent in May, but the sales price is expected to fall 5 percent. Variable manufacturing costs are expected to increase by 7.5 percent per unit in May. In addition to these cost changes, variable manufacturing costs also will change with sales volume. Marketing and administrative cash costs are expected to increase by 15 percent. Sales revenue All revenues and costs at Cymbal are cash transactions, except for depreciation. Cymbal maintains no inventories. Depreciation is fixed and is forecast to remain unchanged in the next six months. Cymbal E-Motors Budgeted Income Statement For the Month of May Manufacturing costs: Depreciation (fixed) Variable costs Total manufacturing costs Gross profit margin $ 525,000 S 49,000 58,800 49,000 S 49,000 S (49,000) 122,000 57,000 $286,800 $ 238,200

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 10CE: Coral Seas Jewelry Company makes and sells costume jewelry. For the coming year, Coral Seas expects...

Related questions

Question

100%

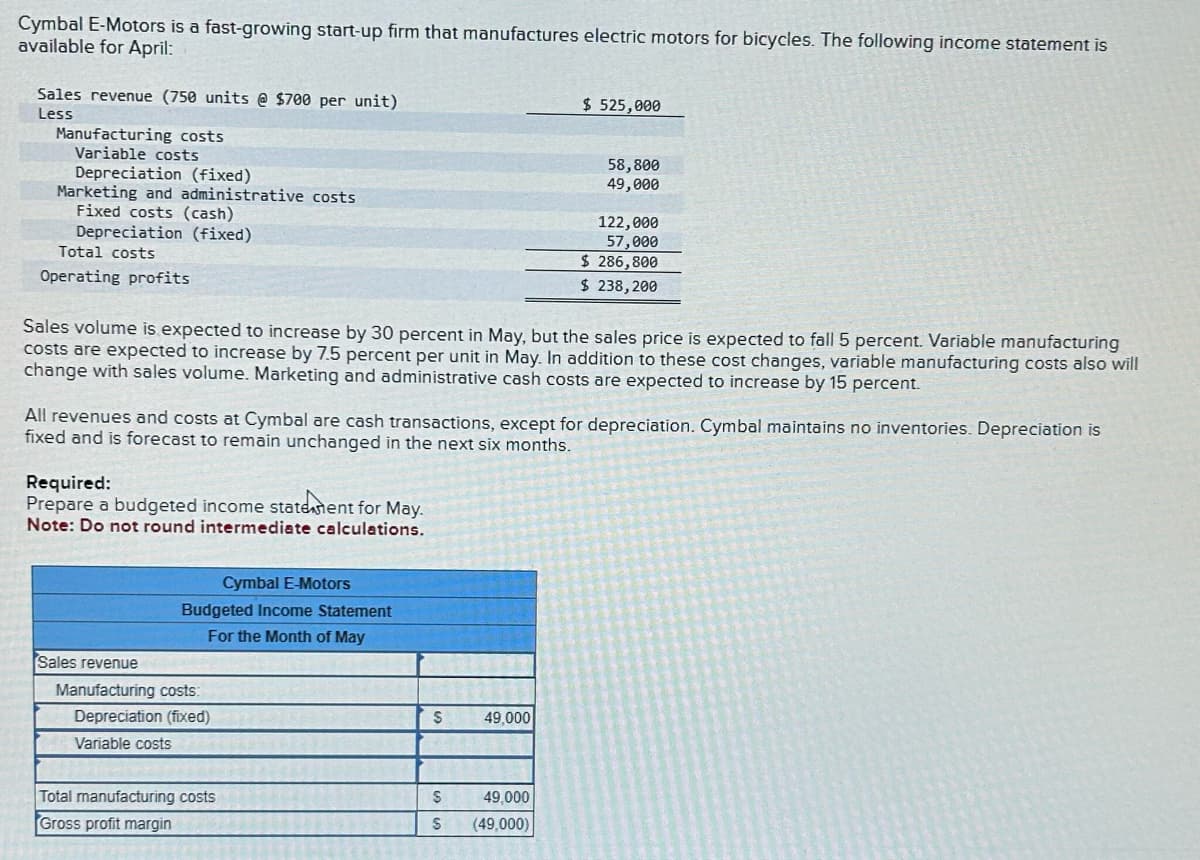

Cymbal E-Motors is a fast-growing start-up firm that manufactures electric motors for bicycles. The following income statement is available for April:

Sales volume is expected to increase by 30 percent in May, but the sales price is expected to fall 5 percent. Variable manufacturing costs are expected to increase by 7.5 percent per unit in May. In addition to these cost changes, variable manufacturing costs also will change with sales volume. Marketing and administrative cash costs are expected to increase by 15 percent.

All revenues and costs at Cymbal are cash transactions, except for depreciation . Cymbal maintains no inventories. Depreciation is fixed and is forecast to remain unchanged in the next six months.

Required:

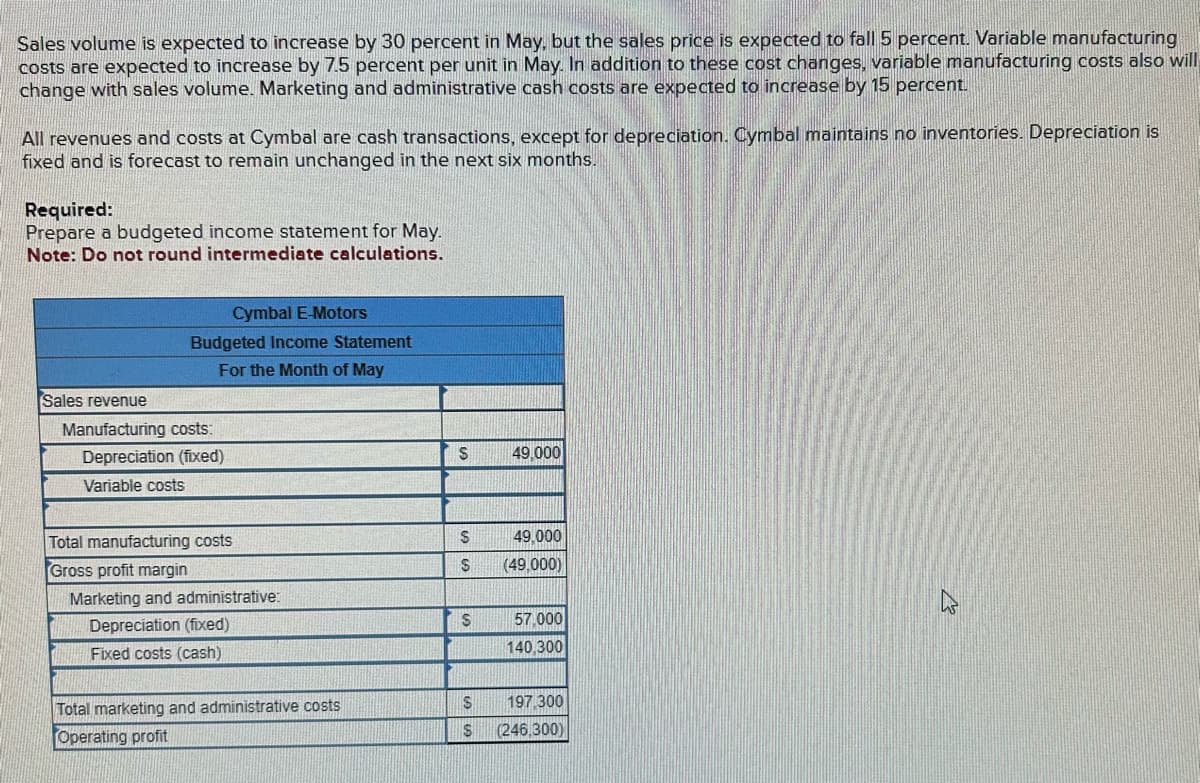

Prepare a budgeted income statement for May.

Cymbal E-Motors

Budgeted Income Statement

For the Month of May

Sales revenue

Manufacturing costs:

Depreciation (fixed)

49,000

Variable costs

Total manufacturing costs

49.000

Gross profit margin

(49.000)

Marketing and administrative:

Depreciation (xed)

57.000

Fixed costs (cash)

140,300

Total marketing and administrative costs

197.300

Operating profit

(246,300

Note: Do not round intermediate calculations.

Transcribed Image Text:Cymbal E-Motors is a fast-growing start-up firm that manufactures electric motors for bicycles. The following income statement is

available for April:

Sales revenue (750 units @ $700 per unit)

Less

Manufacturing costs

Variable costs

Depreciation (fixed)

Marketing and administrative costs

Fixed costs (cash)

Depreciation (fixed)

Total costs

Operating profits

Required:

Prepare a budgeted income statement for May.

Note: Do not round intermediate calculations.

Sales volume is expected to increase by 30 percent in May, but the sales price is expected to fall 5 percent. Variable manufacturing

costs are expected to increase by 7.5 percent per unit in May. In addition to these cost changes, variable manufacturing costs also will

change with sales volume. Marketing and administrative cash costs are expected to increase by 15 percent.

Sales revenue

All revenues and costs at Cymbal are cash transactions, except for depreciation. Cymbal maintains no inventories. Depreciation is

fixed and is forecast to remain unchanged in the next six months.

Cymbal E-Motors

Budgeted Income Statement

For the Month of May

Manufacturing costs:

Depreciation (fixed)

Variable costs

Total manufacturing costs

Gross profit margin

S

$ 525,000

49,000

58,800

49,000

S

49,000

S (49,000)

122,000

57,000

$ 286,800

$ 238,200

Transcribed Image Text:Sales volume is expected to increase by 30 percent in May, but the sales price is expected to fall 5 percent. Variable manufacturing

costs are expected to increase by 7.5 percent per unit in May. In addition to these cost changes, variable manufacturing costs also will

change with sales volume. Marketing and administrative cash costs are expected to increase by 15 percent.

All revenues and costs at Cymbal are cash transactions, except for depreciation. Cymbal maintains no inventories. Depreciation is

fixed and is forecast to remain unchanged in the next six months.

Required:

Prepare a budgeted income statement for May.

Note: Do not round intermediate calculations.

Sales revenue

Cymbal E-Motors

Budgeted Income Statement

For the Month of May

Manufacturing costs:

Depreciation (fixed)

Variable costs

Total manufacturing costs

Gross profit margin

Marketing and administrative:

Depreciation (fixed)

Fixed costs (cash)

Total marketing and administrative costs

Operating profit

$

S

S

S

$

49,000

49,000

(49,000)

57,000

140,300

197,300

(246,300)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning