d. Estimate the cost of equity raised by issuing new shares using the dividend growth method. e. Calculate the cost of retained earnings using three approaches; CAPM, dividend growth method and risk premium. Reconcile the three approaches into a single estimate for the cost of retained earnings. f. Using the target capital structure, calculate the WACC, including retained earnings. Where is the first bro

d. Estimate the cost of equity raised by issuing new shares using the dividend growth method. e. Calculate the cost of retained earnings using three approaches; CAPM, dividend growth method and risk premium. Reconcile the three approaches into a single estimate for the cost of retained earnings. f. Using the target capital structure, calculate the WACC, including retained earnings. Where is the first bro

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 16P

Related questions

Question

Solution for d, e, and f

Transcribed Image Text:ABCDE

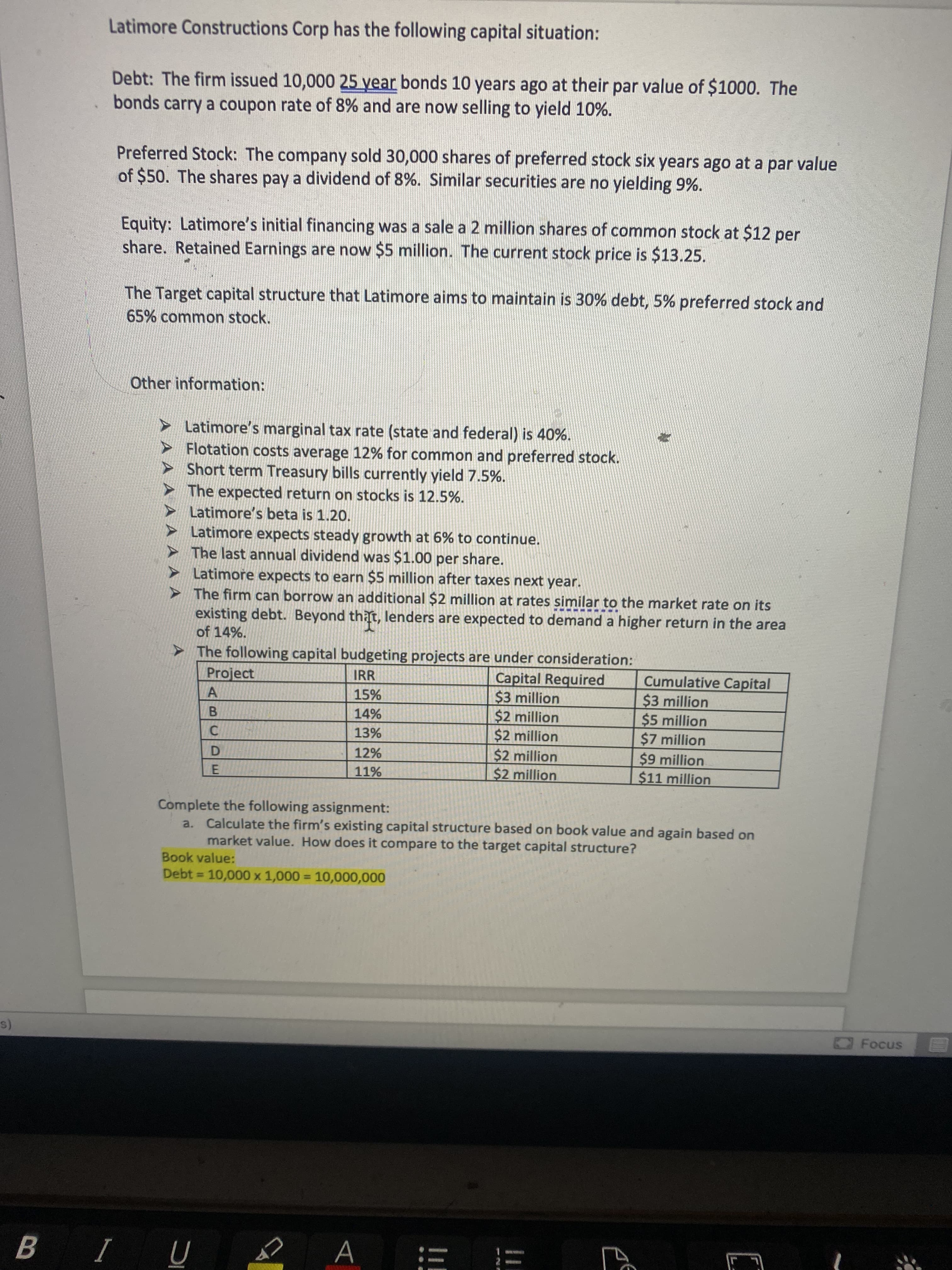

Latimore Constructions Corp has the following capital situation:

Debt: The firm issued 10,000 25 year bonds 10 years ago at their par value of $1000. The

bonds carry a coupon rate of 8% and are now selling to yield 10%.

Preferred Stock: The company sold 30,000 shares of preferred stock six years ago at a par value

of $50. The shares pay a dividend of 8%. Similar securities are no yielding 9%.

Equity: Latimore's initial financing was a sale a 2 million shares of common stock at $12 per

share. Retained Earnings are now $5 million. The current stock price is $13.25.

The Target capital structure that Latimore aims to maintain is 30% debt, 5% preferred stock and

65% common stock.

Other information:

> Latimore's marginal tax rate (state and federal) is 40%.

> Flotation costs average 12% for common and preferred stock.

> Short term Treasury bills currently yield 7.5%.

The expected return on stocks is 12.5%.

Latimore's beta is 1.20.

Latimore expects steady growth at 6% to continue.

> The last annual dividend was $1.00 per share.

> Latimore expects to earn $5 million after taxes next year.

> The firm can borrow an additional $2 million at rates similar to the market rate on its

existing debt. Beyond that, lenders are expected to demand a higher return in the area

of 14%.

> The following capital budgeting projects are under consideration:

Capital Required

$3 million

$2 million

$2 million

$2 million

$2 million

Cumulative Capital

$3 million

$5 million

$7 million

$9 million

$11 million

Project

IRR

15%

14%

13%

12%

11%

Complete the following assignment:

a. Calculate the firm's existing capital structure based on book value and again based on

market value. How does it compare to the target capital structure?

Book value:

Debt = 10,000 x 1,000 = 10,000,000

Focus

B IU 2 A = =

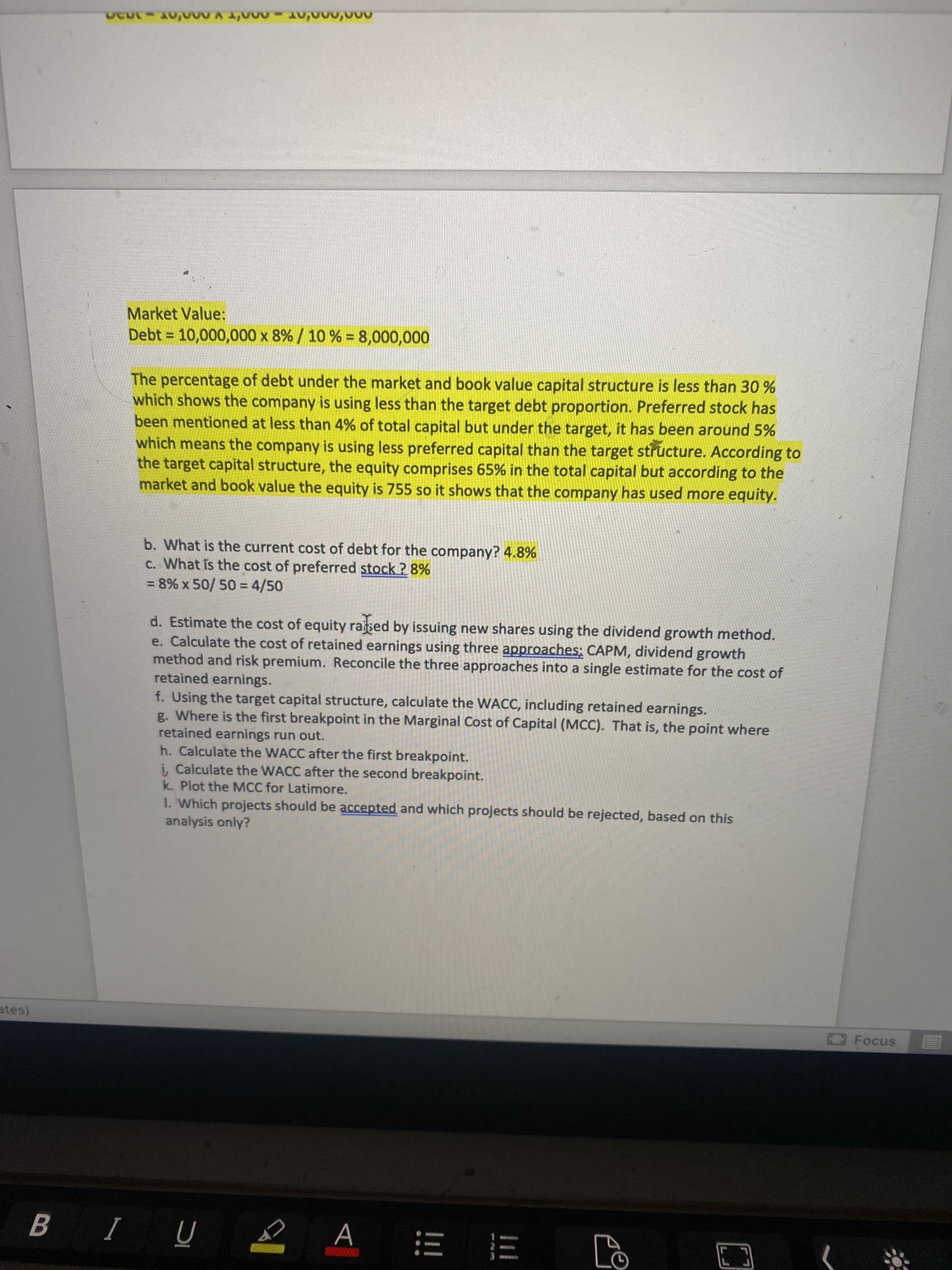

Transcribed Image Text:Market Value:

Debt = 10,000,000 x 8% / 10 % = 8,000,000

%3D

The percentage of debt under the market and book value capital structure is less than 30 %

which shows the company is using less than the target debt proportion. Preferred stock has

been mentioned at less than 4% of total capital but under the target, it has been around 5%

which means the company is using less preferred capital than the target structure. According to

the target capital structure, the equity comprises 65% in the total capital but according to the

market and book value the equity is 755 so it shows that the company has used more equity.

b. What is the current cost of debt for the company? 4.8%

c. What is the cost of preferred stock ? 8%

= 8% x 50/ 50 = 4/50

d. Estimate the cost of equity rased by issuing new shares using the dividend growth method.

e. Calculate the cost of retained earnings using three approaches; CAPM, dividend growth

method and risk premium. Reconcile the three approaches into a single estimate for the cost of

retained earnings.

f. Using the target capital structure, calculate the WACC, including retained earnings.

g. Where is the first breakpoint in the Marginal Cost of Capital (MCC). That is, the point where

retained earnings run out.

h. Calculate the WACC after the first breakpoint.

i, Calculate the WACC after the second breakpoint.

k. Plot the MCC for Latimore.

1. Which projects should be accepted and which projects should be rejected, based on this

analysis only?

Focus

A

E E

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning