Charles and Martha (both age 30), each saved $15,000 (pre tax) at the end of every year over their working lives. Both worked till age 65 years Charles saved his and the combination money in a qualified pension plan while Martha saved in her personal account after paying taxes. Martha turned over her portfolio every vestment retams. If both generated a pretic retam of 6% of ordinary income on dividends and interest and capital gains on sale of stock came to a 20% tax rate on unilated savings at retirement per year and were in 25% marginal tax bracket throughout their lives, compute the difference in their net O $167,137 O $278,654 $222,849 O $696.535

Charles and Martha (both age 30), each saved $15,000 (pre tax) at the end of every year over their working lives. Both worked till age 65 years Charles saved his and the combination money in a qualified pension plan while Martha saved in her personal account after paying taxes. Martha turned over her portfolio every vestment retams. If both generated a pretic retam of 6% of ordinary income on dividends and interest and capital gains on sale of stock came to a 20% tax rate on unilated savings at retirement per year and were in 25% marginal tax bracket throughout their lives, compute the difference in their net O $167,137 O $278,654 $222,849 O $696.535

Chapter13: Choice Of Business Entity—general Tax And Nontax Factors/formation

Section: Chapter Questions

Problem 76TPC

Related questions

Question

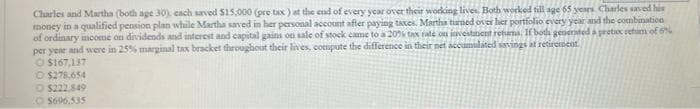

Transcribed Image Text:Charles and Martha (both age 30), cach saved $15,000 (pre tax) at the end of every year over their working lives. Both worked till age 65 years. Charles saved his

money in a qualified pension plan while Martha saved in her personal account after paying taxes. Martha turned over her portfolio every year and the combination

of ordinary income on dividends and interest and capital gains on sale of stock came to a 20% tax rate on investment retums. If both generated a pretax retum of 6%

per year and were in 25% marginal tax bracket throughout their lives, compute the difference in their net accumulated savings at retirement

$167,137

O $278,654

$222,849

O $696.535

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT