d. Would it be beneficial to increase the maximum amount invested in U.S. Oil? Why or why not?

Q: What is the difference between an analytical and a synthetic manufacturing process? Give an example…

A: There are mainly 4 types of manufacturing processes namely: analytic, synthetic, continuous, and…

Q: Using an appropriate Fixed Order Quantity system model compute the following: (a) Minimum cost…

A: NOTE: We are allowed to do the first three sub-parts only. Please post the rest parts again to get…

Q: 1. What’s the cycle time for this production line? 2. What’s the theoretical minimum number of…

A:

Q: In your innovative project, you are requested to produce a documentary film about the training…

A: Since you have submitted a question with multiple subparts, as per guidelines we should answer the…

Q: Savemore has 4 check-out counters. Prediction says that the duration of customer transaction is…

A: Number of servers M = 4 Service rate μ = 1Service time×60 = 14.9×60=12.2449 customers/hr per server…

Q: Complex problem solving, Critical thinking, Creativity, Coordinating with others, Service…

A: Daily life is the bunch of working skills which are managed by an individual everyday by performing…

Q: Application Development: Build In-House or Outsource Use the information in the table below to…

A:

Q: What advantages does object-oriented analysis provide in system analysis and design?

A: Object oriented analysis is the process of finding where a team building team appreciates and…

Q: "Relationships between Job Stress and Employee Well-Being in the Implications of Information and…

A: Job stress and employee wellbeing are significant challenges to human resources management and…

Q: Do: 12-21 Truck drivers working for Juhn and Sons (see Problems 12-19 and 12-20) are paid a salary…

A: Given information: Truck drivers salary=$20 per hour on average Fruit loaders receive $12 per hour…

Q: Sugar prices in the United States are several times higher than the world price of sugar. This…

A: The price of oil is another key element that determines the price of sugar. This is because sugar…

Q: How is inventory management a balancing act between stock-out costs and holding costs?

A: Holding costs are described as the costs that are linked and associated with the inventory that is…

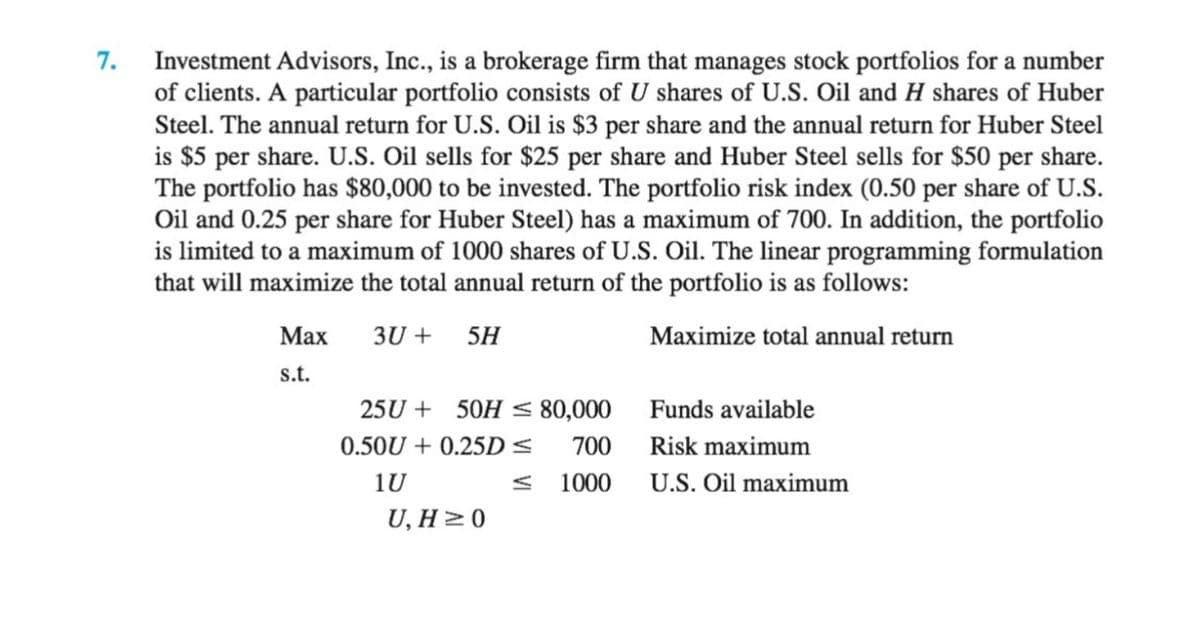

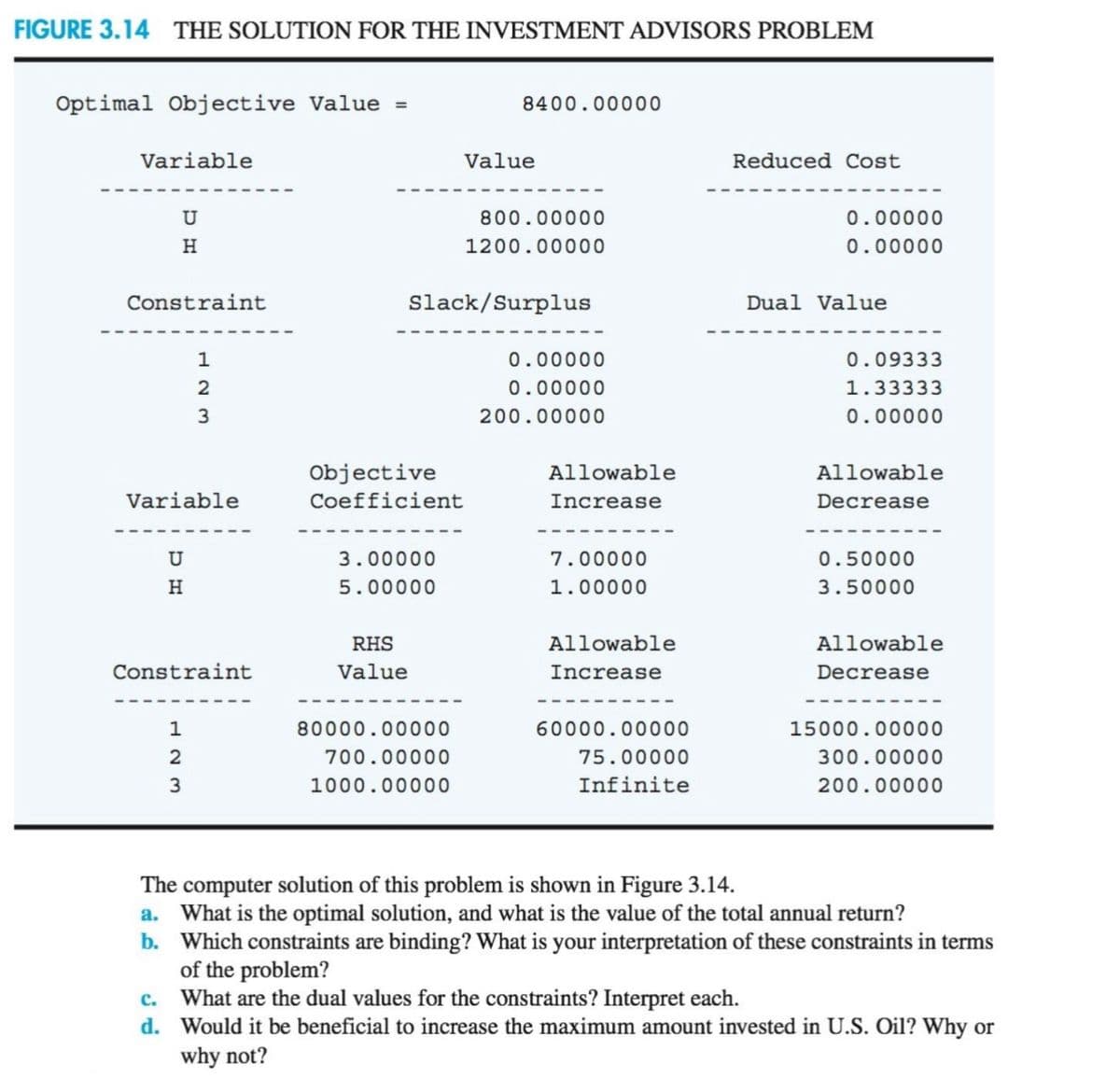

Q: 7. Investment Advisors, Inc., is a brokerage firm that manages stock portfolios for a number of…

A: Given, Max 3U+5H s.t 25U+50H <= 80000 0.5U+0.25D <= 700 U <= 1000 U,H >= 0

Q: The public interest theory of government and the economic theory of regulation provide similar…

A: Consumer welfare is described as the benefits that individual consumers receive from the consumption…

Q: Operations management is the process of creating a set of specifications from which the product can…

A: Operations management is a management area where the designing and controlling part of the…

Q: point, wu is $70 per chair per year. Given the following demand probabilities during the lead time,…

A: Given data: Reorder Point without stock-out = $200 chairs Carrying cost per year = $20 per…

Q: In 2016, Ford Motor Co. announced an effort to expand its environmental and resource conservation…

A: Supply-chain sustainability can be stated as the process of meeting the requirements of current…

Q: a. Which of the two suppliers would provide the lowest annual cost to Weekend Projects? What…

A:

Q: of units sc

A: Given data: Item Annual number of units sold Cost per unit Diaries 50000 ∈3.50 Notepads 40000…

Q: Ray wishes to determine the optimal order quantity for its best-selling bike in his bike store. Ray…

A: Daily demand, AVG = 23 units Unit price, u= $107 Number of working days, w= 269 Carrying cost, h =…

Q: A Republican and a Democratic candidate are running for office in a heavily Republican county. A…

A: given, republic leads = 20% when compare with democratic welfare then republic leads =35%

Q: A corporation that is incorporated North Dakota and doing business in South Dakota is called a(n)…

A: Any alien corporation is one that was formed in another nation yet conducts business in the United…

Q: if drivers wanting to fill up their cars arrive randomly at another gas station across the street at…

A:

Q: If you are asked to negotiate a contract to purchase IT software what would be your top 5 must haves…

A: Contractual obligations can be stated as those duties or responsibilities that both corporate…

Q: Problem 1: The following data was taken from experiment. The data can be modeled by the following…

A: given,

Q: What is the purpose of the sports tournament system?

A: Sports tournament is a competition that involves teams or individuals in which the game is being…

Q: Explain the process involved in tour guiding.

A: Vigilant planning is mandatory when evolving a route for tour.

Q: The process of balancing an assembly line determines the ____ of the line. 1. Actual output 2.…

A: The process of balancing assembly line aims to distribute the tasks in such a way so that…

Q: n the world of companies, what would be the reasons for acquisitions and the problems in achieving…

A: Reasons acquisitions : Increased Market Power : Exists when a firm can sell its goods or services…

Q: newsletter to highlight

A: Internal communication can inspire, motivate and connect workers besides keeping them updated about…

Q: Briefly discuss what measures can be taken for effective people management?

A: Management of people is one of the most important parts of any business or organization, so it’s…

Q: Compute the cycle time for Auburn Company given the following data: value add time is 12 hours and…

A: Cycle time consists of both value added time and non value added time. Given, Value added time= 12…

Q: A. Forecast sales in August using the 3-month moving average method. B. Forecast sales for the month…

A: Forecasting is the process of estimating the funture demand using the previous or historic data and…

Q: Identify and describe the major deliverables included in a Project Closure step?

A: A project possess a definite beginning and definite end. Once the project is completed, it has to be…

Q: 1a. Must show work for all competents 1b.SmartArt” (insert tab -> illustrations -> SmartArt ->…

A: Requirements of components for one unit of E. Excel model: YOu can change the value in cell D2 if…

Q: A decision maker's worst option has an expected value of $1,000, and her best option has an expected…

A: Formula:- The expected value of perfect information= Expected value with perfect information -…

Q: The Girl Scouts invited key members of Congress and executive agency officials to visit troops in…

A: The Girl Scouts invited key members of Congress and executive agency officials to visit troops in…

Q: CREATE A GANTT CHART USING THESE SCHEDULED TASK:

A: Task Start End Excavation 2/23/2022 2/23/2022 Backfill 3/7/2022 3/11/2022 Reinforcing…

Q: Explain the seven major warehousing activities.

A: Warehouse is a large empty space where raw materials or even the other manufactured goods are sored…

Q: The average weekly demand of an item is 200 units, and the standard deviation of weekly demand is…

A: Formulas used:

Q: A bakery buys flour in 25-pound bags. The bakery uses 1.215 bags a year. Ordering Cost is »1o per…

A: Economic order quantity (EOQ) is a inventory ordering technique which helps to reduce the total cost…

Q: ving is a hybrid design? cks design

A: Which of the following is a hybrid design? (1) Randomized blocks design (2) Solomon four group…

Q: In Canada, you must take 10 hours off-duty in every 24-hour period and 8 of those hours must be…

A: Hours of service is the maximum duty time of drivers in a given time period. These rules include…

Q: A price that is too low may not generate enough interest or have enough of a margin for profit. Set…

A: A price that is too low may not generate enough interest or have enough of a margin for profit. Set…

Q: project life cycle

A: A firm has to be sound at both developing new items & managing them in the face of transforming…

Q: Problem 4-11 (Algorithmic) Edwards Manufacturing Company purchases two component parts from three…

A: Given data is

Q: Discuss the many types of real-time scheduling methods available to the group for the project.

A: Real-time scheduling:- A method for setting up a schedule that uses real-time as its basis. The most…

Q: Solve the following problem using the three methods, and after solving the problem, use a method for…

A: Three methods are: NWCM LCM VAM optimal solution is found using MODI and stepping stone method.

Q: John the barber rents a very small space that has room for 2 customers only. The time John spends on…

A:

Q: What costs must be balanced and minimized through inventory control?

A: Inventory control is the process of keeping the right number of goods at right time to avoid…

I only need d)

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- 2. Provident Capital Corp. specializes in investment portfolios designed to meet the specific risk tolerances of its clients. A client contacted Provident with P2,000,000 available to invest. Provident’s investment advisor recommends a portfolio consisting of two investment funds: the Dynamic fund and the Diversified fund. The Dynamic fund has a projected annual return of 10%, and the Diversified fund has a projected annual return of 8%. The investment advisor requires that at most P1,400,000 of the client’s funds should be invested in the Dynamic fund. Provident’s services include a risk rating for each investment alternative. The Dynamic fund, which is the more risky of the two investment alternatives, has a risk rating of 6 per P40,000 invested. The Diversified fund has a risk rating of 4 per P40,000 invested. For example, if P400,000 is invested in each of the two investment funds, Provident’s risk rating for the portfolio would be 6(10) + 4(10) = 100. Finally, Provident developed…2) A buyer for a large sporting goods store chain must place orders for professional footballs with the footballmanufacturer six months prior to the time the footballs will be sold in the stores. The buyer must decidein November how many footballs to order for sale during the upcoming late summer and fall months.Assume that each football costs the chain $45. Furthermore, assume that each can be sold for a retail priceof $90. If the footballs are still on the shelves after next Christmas, they can be discounted and sold for$35 each. The probability distribution of consumer demand for these footballs (in hundreds) during theupcoming season has been assessed by the market research specialists and is presented below. Finally,assume that the sporting goods store chain must purchase the footballs in lots of 100 units. Demand Probability 4 0.30 5 0.50 6 0.20 a) Construct a decision tree…1.A clockmaker makes two types of woodenclocksto sell at various malls. It takes him three hours to assemble a pine clock, which requires two oz of varnish. It takes four hours to assemblea molave clock, which takes four oz of varnish. He has eight oz of varnish available in stock and can work 12 hours. If he makes a P100 profit on each pine clock and P120 on each molave clock, how many of each type should he make to maximize his profit?2.A biologist is developing two new strains of bacteria. Each sample of Type A bacteria produces five new viable bacteria,and each Type B bacteria produces six new viable bacteria. Altogether, at least 150 new viable bacteria must be produced. At least 10, but not more than 20,of the original sample,must be Type A,and not more than 60 of the samples must be Type B. A sample of Type A costs P500,and a sample of Type B costs P700. If both types are to be used, how many samples of each type should be used to minimize the cost?

- 2. A firm makes two products, Y and Z. Each unit of Y costs $10 and sells for $40. Each unit of Z costs $5 and sells for $25. If the firm's goal is to maximize profit, what would be the appropriate objective function? Select one: a. Maximize profit Z = $10Y + $25Z b. Maximize profit Z = 0.25Y + 0.20Z c. Maximize profit Z = $40Y + $25Z d. Maximize profit Z = $50(Y + Z) e. Maximize profit Z = $30Y + $20ZAriel holds a $10,000 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Andalusian Limited (AL) $3,500 0.80 15.00% Kulatsu Motors Co. (KMC) $2,000 1.50 12.00% Western Gas & Electric Co. (WGC) $1,500 1.20 16.00% Makissi Corp. (MC) $3,000 0.50 22.50% Suppose all stocks in Ariel’s portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Makissi Corp. Andalusian Limited Western Gas & Electric Co. Kulatsu Motors Co. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of standalone risk? Western Gas & Electric Co. Makissi Corp. Andalusian Limited Kulatsu Motors Co. If the risk-free rate is 4% and the market risk premium is 6%, what is Ariel’s…1. Suppose you are going on a weekend trip to a city that is d miles away. Develop a model that determines your round-trip gasoline costs. What assumptions or approximations are necessary to treat this model as a deterministic model? Are these assumptions or approximations acceptable to you? 2. Suppose that a manager has a choice between the following two mathematical models of a given situation: (a)a relatively simple model that is a reasonable approximation of the real situation, and (b)a thorough and complex model that is the most accurate mathematical representation of the real situation possible. Why might the model described in part (a) be preferred by the manager?

- 2. A firm makes two products X and Y and has a total production capacity of 9 tons per day.X and Y requiring the same production capacity. The same has a permanent contract to supply at least two tons of X and at least 3 tons of Y per day to another company. Each ton of X requires 20 machine hours of production time and each ton of Y requires 50 machine hours of production time. The daily maximum possible number of machine hours is 360. The entire firm's output can be sold and profit made is 80 R.O of X and 120 R.O per ton of Y. It is required to determine the production schedule for maximum profit and to calculate this profit. Formulate a LPP.1. A distillery produces two types of alcohol for filling and distributing, the regular beer and the premium beer. A batch of regular costs $375 to manufacture and a container of the Premium beer costs $420. The manufacturer wishes to establish the weekly production plan that minimizes cost. Production of these products is limited to processing, testing and material. Each batch of regular beer requires 4 hours processing whereas each batch of premium requires 2 hours of processing. Further each batch of regular requires 4 hours of testing compared to 6 hours of testing for a batch of Super. A batch of regular and a batch of Super each require 1 litre of material. Processing and testing have a maximum of 100 and 180 hours available and the total material available is 40 litres. Because of an agreement, the sales of regular beer are limited to a weekly maximum of 20 batches and to honour an agreement with a loyal distributor, at least 10 batches of premium beer must be sold each week.…Problem 3: Let L(x, y) be the statement “x loves y”, where the domain for both x and y consists of all people in the world. Use quantifiers to express each of the following statements.1. Everybody loves Jerry.2. Everybody loves somebody.3. There is somebody whom everybody loves.4. Nobody loves everybody.5. There is somebody whom Lydia does not love.6. There is somebody whom no one loves.7. There is exactly one person whom everybody loves.8. There are exactly two people whom Lynn loves.9. Everybody loves himself or herself.10. There is someone who loves no one besides himself or herself.

- A recently hired chief executive officer wants to reduce future production costs to improve the company's earnings, thereby increasingthe value of the company's stock. The plan is to invest $76,000 now and $58,000 in each of the next 6 years to improveproductivity. By how much must annual costs decrease in years 7 through 12 to recover the investment plus a return of 13% per year? The annual cost decreases by $....4 (b) An insurance company provides customers with both auto and home insurance policies. For a particular customer, Χ is the deduction on his or her auto policy and Y is the deduction on the home policy. Possible values of Χ are K100 and K250, and for Y are K0, K100 and K200. The joint probability density function for ( ) ,YΧ is given by the following table: Χ Y K100 K250 K0 0.20 0.05 K100 0.10 0.15 K200 0.20 0.30 i. Find the probability for a randomly selected policy holder having a K100 deduction on the auto insurance and a K200 deduction on the home insurance. ii. Find the probability that a randomly selected policy holder has a home deduction of at least K100. iii. Are the random variables Χ and Y independent? Explain your answer.2. A canning company produces two sizes of cans—regular and large. The cans are produced in 10,000-can lots. The cans are processed through a stamping operation and a coating operation. The company has 30 days available for both stamping and coating. A lot of regular-size cans require 2 days to stamp and 4 days to coat, whereas a lot of large cans requires 4 days to stamp and 2 days to coat. A lot of regular-size cans earn $800 profit, and a lot of large-size cans earn $900 profit. In order to fulfill its obligations under a shipping contract, the company must produce at least nine lots. The company wants to determine the number of lots to produce of each size can (and) in order to maximize profit. 8. In Problem 2, how much flour and sugar will be left unused if the optimal numbers of cakes and Danish are baked?